Ouroboros

The image below is the Ouroboros. I will share the significance of this symbol at the end of this letter.

This is a letter I need to write, but is also one that I have avoided writing. Letters during the last three months have danced around what I am going to share about today (megaphone formation, “melt up” in stocks, perpetually low interest rates), but it is time to be specific…

What changed my mind as to writing this comment now?

Two things:

- A podcast I listened to featuring Chris Cole of Artemis Capital.

- The most recent options market data and how is appears to be going parabolic in total market activity.

The podcast is quite long (1.5 hours) and technical in nature so I am going to break it down. In simplifying, I am going to leave out steps of how the financial conditions of today were created, which, may unfortunately, leave the reader thinking that I have jumped to my own conclusions. Hence, my hesitation to try and write about this topic.

So let’s set a ground rules to this comment.

The bullet points below do not have a logical flow of how each step progressed, so if you want to understand better about “how”, please email me and I will send you the Podcast. For those willing to just take this as “food for thought,” I will continue.

Let’s begin with a couple of headline from on November 25, 2020:

From RBC Morning Notes - One of our (Dominion Securities) mild concerns heading into 2021 is whether the current central bank support is going to be strong enough to keep financial markets happy

From Bloomberg -- China stocks fell by the most this month on concern that liquidity conditions in the financial system are not strong enough to support recent gains.

How can these possibly be true? Interest rates and central bank sponsored liquidity are at all-time lows and highs respectively.

Is the correct conclusion to such a statements that the world needs lower interest rates and higher central bank liquidity to keep it asset prices afloat?

The answer is actually yes…

Let’s look at a simplified reason as to why this is true.

- Volatility is the base unit of financial markets. Markets require “fiat money” (dollars, Euro etc.) to operate as exchanges, but volatility sets asset valuations moment by moment.

- Liquidity of markets is the life blood of volatility. When liquidity dries up, asset prices dislocate to the downside. When liquidity is over abundant, asset prices dislocate to the upside; think of an elastic band hitched to a single point being stretched in either direction.

One only has to look at the trading year of 2020, to understand this concept. In March 2020, liquidity was crushed. Immediately, asset prices got crushed in what was the fastest 35% decline in stock markets in history.

Nearly $20 trillion of newly printed central bank liquidity reversed the volatility feedback loop in the other direction. Asset prices are still in the process of assimilating the insane amounts of liquidity created, and continue to rise to ever more ridiculous valuations.

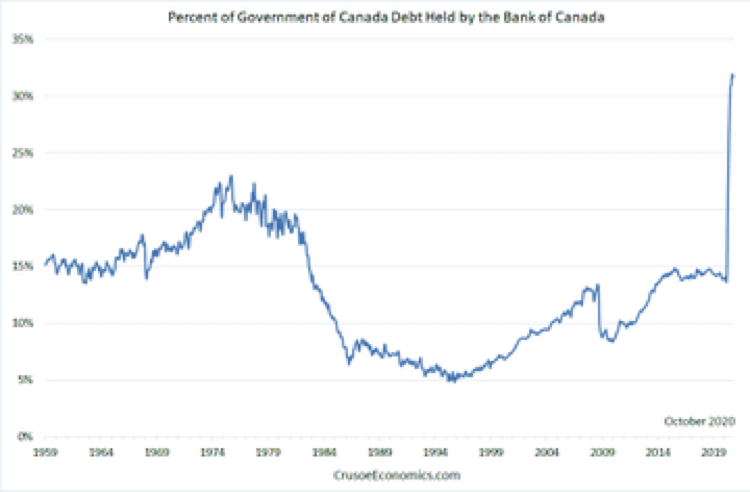

Below is a chart of the percentage of Canada’s debt that is owned by the Bank of Canada. The Bank of Canada is printing so much money that is has to become buyer of last resort in order to hold down the interest rates.

- Liquidity coupled with near zero interest rates, create an environment where there are no logical valuation metrics to use for asset prices.

Imagination is all you need to see “value,” and “price momentum” becomes an alter to be worshiped at.

Tesla shares are as easily valued at $10.00 per share as they are $1000 per share. Bitcoins are the same…what’s the difference between $100 Bitcoin and $100,000 Bitcoin? Gold bullion…no different either.

So here is the key question: Does liquidity trump all else to create ever increasing asset prices? In other words, if central banks can just keep printing money the financial world will live happily ever after?

The answer to this question is most likely a no, although the world has never done this before so nobody knows for sure.

We only have to look back to August 2000, or more recently March 2020, to see examples of what was “adequate liquidity” being deemed too “inadequate,” and asset prices quickly revaluing lower in response.

So let’s look at what changes the adequate liquidity narrative to inadequate, rather than how.

- A change in perceptions about liquidity. This is what the Bloomberg headline is referring to, and can be a real change in liquidity or a “narrative” change in liquidity.

- A sudden increase in interest rates.

- A change in central bank policy direction.

Any of the above changes will be easy to measure in terms of an increase in volatility.

Nick, why are you sharing this information with me? How does this impact my personal situation?

Glad you asked…remember, the assumption to this editorial is that volatility is the base unit of financial markets.

Therefore, investments are either LONG volatility or SHORT volatility. This is using “long and short” in the investment context meaning you either profit from high levels of central bank sponsored liquidity or you make next to no rate of return or lose from it (in the case of a short seller of risk assets).

******Almost every asset class in the world today is SHORT volatility meaning they profit from central bank sponsored low interest rates and rising asset prices.*****

Real estate, stocks, private equity, and bonds clearly benefit from liquid markets and abundant money. This is where the vast majority of stored wealth is concentrated in 2020.

Think again about what happened in early March 2020. ALL of these investment classes lost value for a short period of time at the same time.

COVID was the catalyst to a change in the perception of adequate liquidity being available.

Everybody wanted out at the same time.

There were not enough buyers to meet the selling demand. ALL assets fell as the need to get liquid trumped the desire to hang on for the long term.

Since the US election in early November, it has been the opposite. Stocks go up endlessly every day. There are too many buyers and not enough sellers. Excess liquidity creates the conditions for a near endless stream of money to be available to keep buying.

Now think about your personal investment holdings. Your home, investment real estate, stocks, GICs, bonds…again, all short volatility. If you think you own something that is long volatility I’d like to hear about it.

Personally, that is one of the reasons as to why I am developing our farm property. It is not a perfect LONG volatility investment, but it’s not bad either.

It is not your fault that you are almost purely short volatility other than cash that you hold. You were boxed into these choices systematically. My goal is just to pull the curtain back for you to see that even though you think your portfolio is diversified…it is not.

One quick detour here is needed before we finish up this editorial.

Liquidity does not create solvency.

When we look at all of the negative yielding bonds, zombie corporate balance sheets, government debts and deficits etc., it is clear that these problems are growing, not shrinking. Actually they are being enabled by the liquidity creation.

This is where we come to the Ouroboros image at the beginning of the editorial.

As the liquidity levels are ramped up ever higher to suppress volatility the net impact is not all positive. Interest rates are suppressed, stock prices go higher, real estate values rise. You know, all the stuff that is happening today.

But beneath the surface the financial health of governments, corporations, and individuals are left in more precarious conditions that require the short volatility favourable conditions to be left in place.

The graphic below is a testament to the rot in the foundation of the central bank sponsored world.

There is no way that graphic could be true in an organic growth environment with market driven interest rates and no central bank sponsorship.

No wonder politicians are falling all over themselves to throw money at the poor and the middle class.

Nassim Taleb refers to this condition as fragility and speaks to it in-depth in his book Antifragile.

Think of fragility as a child who has a parent that never let them experience life and make their own mistakes, who one day chooses to leave home. The real world comes as a complete shock to this child and she/he will likely not be able to cope. They are fragile.

Compare that to a child who grew up in a home where they were basically left to their own devices. That child will likely tackle the world and its challenges head on, if they live long enough to get to tackle the world. Why? Because they already learned the world is a harsh place. This child would be considered anti-fragile or robust.

This fragility process applies to diseases, therapies, legal systems, almost everything.

The past 40 years of financial history have seen a steady increase in asset prices where any “speed bumps” along the way were quickly suppressed by monstrous levels of liquidity applied to remedy the problems.

But the underlying structural decay remains unhindered. Hence, the financial markets are in a state of fragility. They require very low interest rates and artificial liquidity injections to stay where they are.

Friends, nobody knows how or when the liquidity matrix that supports the present financial markets will decide that there is not enough liquidity once and again, and the long volatility investments will benefit while short volatility suffers. NOBODY KNOWS…

We look at our portfolios and we smile when the valuation is better than last month. Other times we look at our statements and wonder why the valuation is lower than last month.

But most of us never really imagine that we are stuck in a world where we are forced to be short volatility in all of our holdings AND we require the central banks to support insane liquidity narratives so our assets hold their values.

This is why investors must have a strategy to choose a place to sell some of their assets and not get too aggressive in their investment choices or utilizing too much debt.

Liquidity is a fickle thing. One never knows when it will be deemed that liquidity is lacking and markets will move sharply lower.

Feel free to email if you have any questions or want to chat. This is complicated stuff, I will answer what I can and tell you that I don’t know if you ask a question I am unsure of.