Reality Check

This week’s post is going to include a few charts that seem out of sorts with historical norms. The objective is to share with you some perspective and question whether a revision to the mean is in our future.

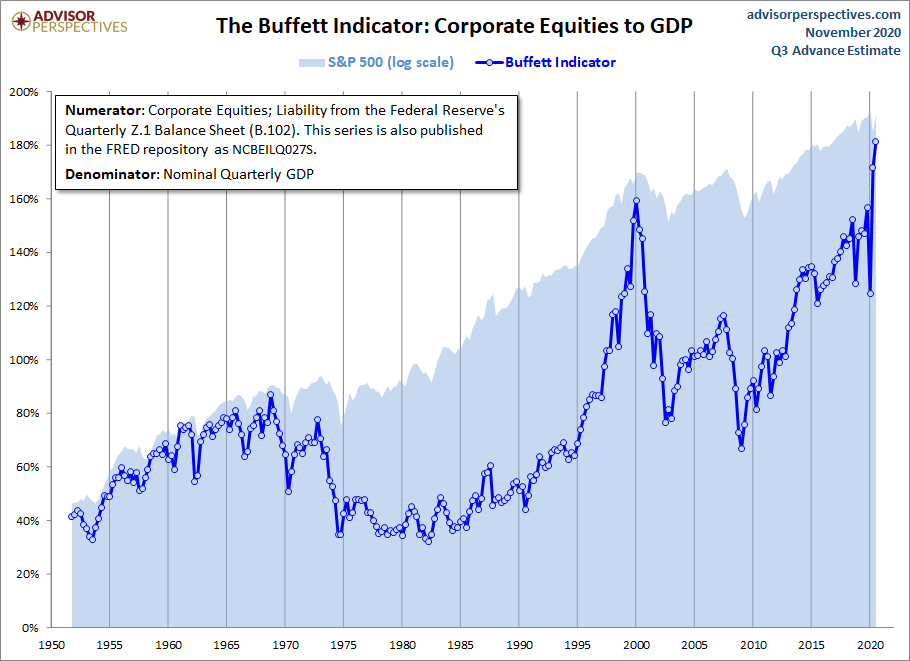

The first chart is nicknamed the Buffett Indicator as it has been described by Warren Buffett as being the first relationship he considers when making long term asset allocations to stocks.

The chart simply correlates the value of the entire stock market relative to Gross Domestic Product (GDP) in America.

Notice the spike in 2000, relative to the spike in 2007/2008. The bubble in 2000, was technology stocks and the bubble in 2007/2008, was real estate and mortgage debt.

What is defining about 2020, is that the bubble is in government debt which has led to “the everything bubble,” where all assets are expensive.

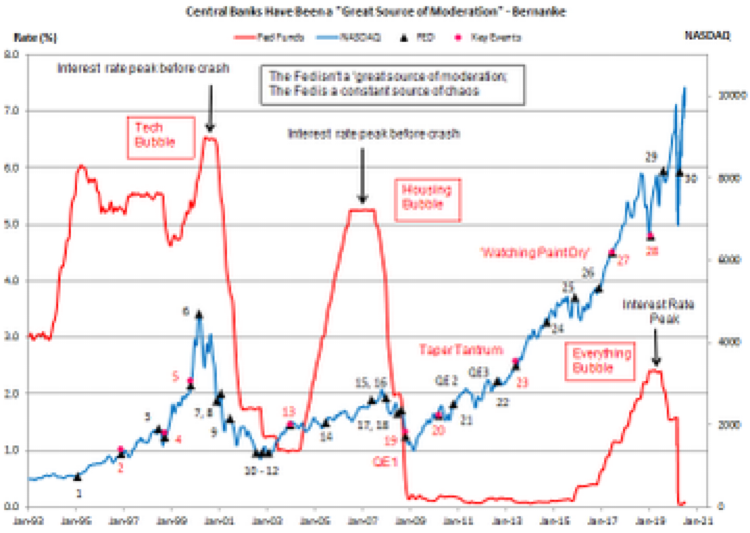

The next chart is a little busy, but I want to focus on the red and blue lines. The red shows the Fed funds rate and the blue is the NASDAQ Comp index.

I love how the chart exposes the FED as riding to the rescue to save each bursting bubble by slashing down interest rates (Fed Funds rate).

Because the absolute levels of debt continue to grow exponentially, the interest rate cycle never climbs back to the subsequent peak.

The present cycle see the Fed unable to raise interest rates period. Can you see the Fed having a pathway to raise interest rates?

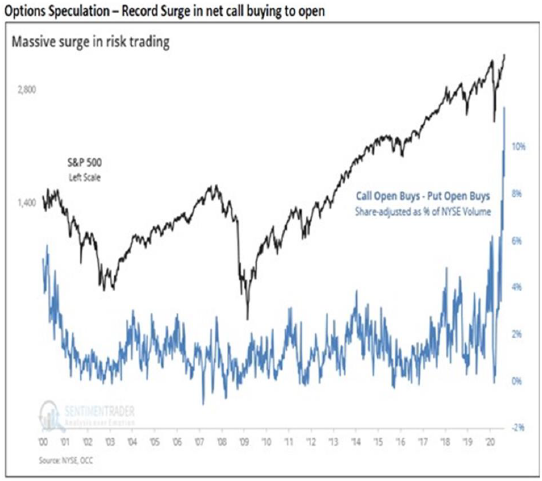

All of this “financial support” by central banks has led to a significant level of speculation by investors.

The next chart shows the record surge in options buying that has taken place in 2020. Increased leverage and speculation in the markets definitely increases the risks of more violent moves UP and DOWN in financial markets.

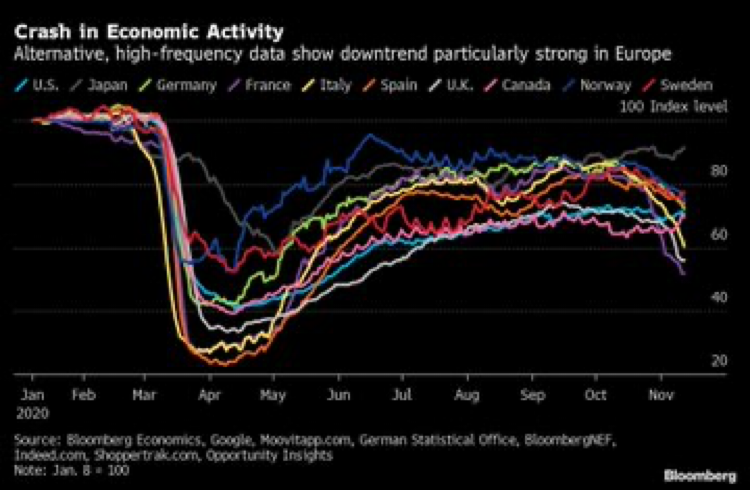

The next chart shows how global economic activity has started to turn down again due to the second wave of COVID, and the caution it has added to consumer and company behaviour.

How the governments of the world employ their lockdown strategies in coming months running out to Christmas and the holiday season, will impact the trajectory of economic activity in the short term.

The weekly leading index shown below is has fully recovered from the March 2020 lows. This definitely helps the economy stay resilient in the face of further government actions.

To conclude the chart section of the editorial, the next chart shows global oil production. Notice the “Demand Trend Line” and how it began to outstrip production in 2019.

With oil now only 2% of the market capitalization of the S&P 500, there is value in this sector for those with long term time horizons.

A Little Ditty About Jack and Diane: epilogue

Two weeks ago we took a stroll through 40 years of financial history via the life experiences of Jack and Diane. They were a fictitious working class couple that tried to make their way through life during the era of financialization.

The following paragraph is where we left off in their story:

Diane’s father passed away in 2015, so Jack and Diane moved back in with Diane’s mother to take care of her.

Jack was tired of the steel mill, but he had to keep going back. As a matter of fact, if his body would hold out and if the steel mill would let him…he would never leave.

But that wasn’t going to happen. The mill had mandatory retirement dates.

…Jack and Diane’s son, David, had moved away to California and been working with a technology company that he received shares in. David had bought himself a place in San Jose about 12 years earlier…just a studio. But he sold it after the real estate crash in 2009, and since his job income was growing quickly, bought a nice house in the suburbs via short sale. It was now worth nearly $2,000,000. David’s company was going to go public and David would end up with about $8,000,000 after tax.

David called his mom and dad and invited them out to San Jose for a visit and a break from reality.

When they got there he gave them a cheque of $1,000,000…

It was a happy ending. And now for the rest of the story:

Jack and Diane were floored. They knew David was doing well for himself but they had no idea how well.

David hugged his parents and thanked them for the sacrifices they made to help him go to school and give him a chance to live out the American dream.

Jack and Diane got home. They needed a plan to be prudent stewards of their good fortune. They needed some help…

They went to their local bank and met with their long-time friend who was overjoyed for her friend’s turn of fate. They actually cried together in her office.

She recommended they purchase a small but nice home with around $250,000 of the windfall and invest the balance conservatively. She suggested half the money go into certificates of deposit (GICs) and half into their banks proprietary financial fund products.

Jack and Diane wondered how much income they could expect to receive from their investments? It was decided that 5% of the principle was a good guideline to start drawing money out.

Diane grabbed her phone off the desk and multiplied $750,000 by .05 to get $37,500 of income per year. She smiled and Jack and said they were going to be ok when all their sources of income were considered.

Jack decided to retire. He could do a bit of work on the side still…at his pace and choice. He really was tired.

It was all working so well until 2020 came along. Their certificates of deposit were getting lower rates of return as they came up for renewal but up until 2020, the fund portion of the portfolio was compensating for the lower CD returns.

In March 2020, everything crashed.

Jack and Diane were scared. They called their advisor and she said for them to just hang in there. But they decided they could not stand the fear of losing their money and possibly ending up back where they would have to go to work again. The compromise was to sell half of the funds.

“We are going to be fine Diane,” Jack said to her as the world was being rampaged by the pandemic. Our first priority is to take care of your mother and Carla and her family. David will be fine. Even if we make nothing on our money it will last another 20 years.

The stock market recovered through the summer of 2020 and made a new high in the fall. The United States were completely turned upside down, both politically, and from the fallout of the pandemic. Even so, Jack and Diane were confident they were going to make it.

By November 2020, their world felt like an episode of the Twilight Zone.

The pandemic that had caused the world to “lockdown” seven months earlier was ravaging throughout the United States…and it seemed nobody cared. It wasn’t just the US…it was like this everywhere.

Interest rates on their CDs paid nothing but prices for everything they needed to buy to live were rising faster than they had ever seen. The government kept talking about how inflation was too low…the government clearly didn’t get their data from Jack and Diane’s house.

The stock market kept going higher but why? Even the pundits were running out of stories to justify the relentless rise in asset prices. There was nothing to reference what was happening to any other time in their lives…it all felt dystopic.

David called and said he was planning to come home for Christmas. He hadn’t been home for a couple of years. He was missing his family. “The culture in California had changed,” he said. “There is no substance to anything. I need to get back to my roots…our roots. See you in a few weeks.”

Even though the world made no sense Jack and Diane felt a warm sense of purpose. They knew the world was spiraling out of control. They also knew that nothing they did was going to change any of that. But they were excited to think of their family gathered together in the midst of the turmoil.

They realized that nothing could ever change the fact that they all loved and cared for each other…supported each other, and looked out for one another. And because of that…they were going to be fine.

Since we started our “little ditty about Jack and Diane,” referencing the John Cougar Mellencamp song, it makes sense we should end their story the same way.

On one hand their lives really do represent, “two American kids who did the best they can.”

As we sign off from their story I can hear Jack and Diane singing an ode to 80s rock god* Jon Bon Jovi:

“We’ve gotta hold on to what we got, it doesn’t make a difference if we make it or not, we’ve got each other and that’s a lot for love, we’ll give it a shot.”

Best of luck, Jack and Diane!

* Megan may have taken some editorial liberties here