Bullet Note Weekly

For all that has gone on in the world the past two weeks, my phone has been relatively quiet; not on Monday though!

Truth be told, I was thankful because recovering from hand surgery made me left-handed for the week, and it was tricky doing everything I usually do.

The hand feels much better now. Once the scar tissue debrides itself, things should be back to about 85% of normal. Thank you for all the notes and well wishes, they’ve been much appreciated!

The US Election:

This story is more than covered each day by the media, so my only comment is that the outcome of the election had little to do with how financial market behaved. Historically, “gridlock” is just fine for financial markets. I think that is doubly true today when both sides have relatively extreme agendas.

From here, the election news will be a net negative for markets if the Biden win results are contested and uncertainty in terms of civil unrest rises up.

Broad Stock Market Indexes (Canada and US):

Interesting to me, when looking at the stock markets, is that they really didn’t seem to care who won the US election. All the analysis going into the election was that a “clear winner” would be good for markets and a “contested Presidential race” would be bad.

So much for that line of reasoning.

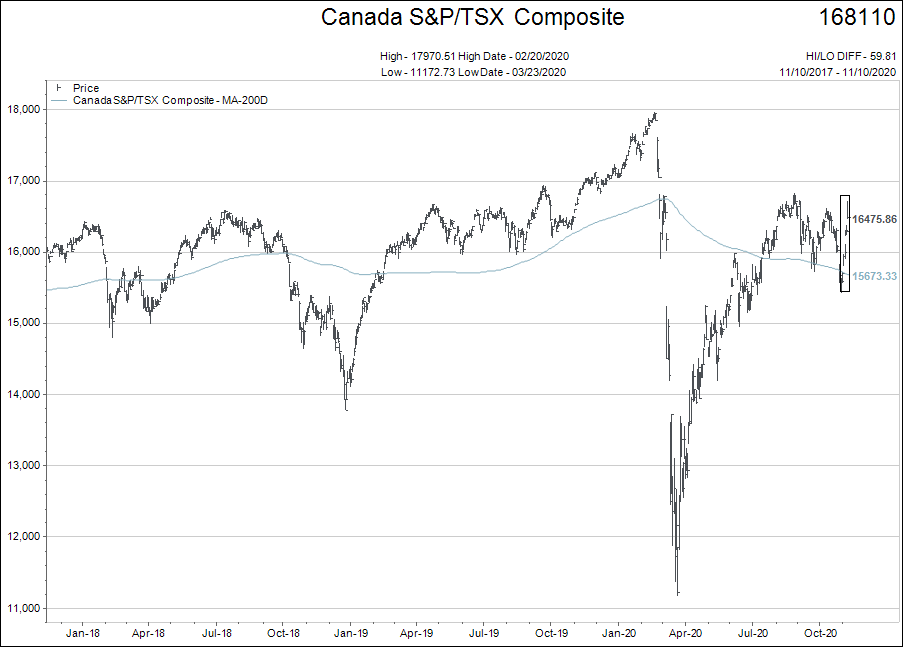

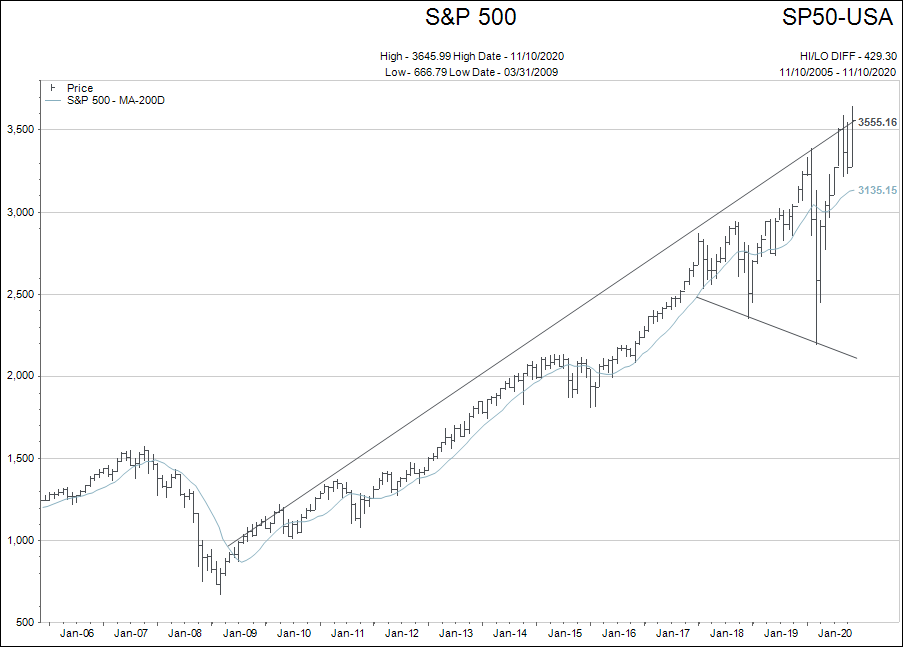

Stock markets have rebounded sharply from their sell offs that bottomed a week ago, two days before the election. New highs in price of the US markets, but still quite a bit more to go for Canada and most global stock markets.

Internal Change in the Stock Market:

This is where I think things start to get interesting, especially for my clients and long term type investors.

The huge rally in US stocks relative to other global stock markets (not including Taiwan), has been the relative outperformance of the technology sector versus more value oriented sectors.

We refer to this as the “value vs. growth” debate.

In the email post-election note, sent out Wednesday this week, the following chart was included. Let’s take a closer look at what it is telling us.

Prior to the 2008/2009 recession and stock market meltdown, “information technology stocks,” or growth were trading with a P/E multiple of about 17 times earnings and value was trading with a P/E of about 11 times.

In the crash, value P/E ratios went up and growth P/E ratios fell to meet in the 10 times area of the chart.

All this means is that growth stocks fell significantly more than value stocks in the crash.

In 2020, the P/E ratio gap is the largest in history.

Bottom line: All I am suggesting at this time, is that the gap is going to narrow in coming years, and the outperformance of growth is going to become an underperformance. It has started already, but it is hard to see when viewing the stock indexes because of the way large capitalized technology stocks dominate their performance.

Most portfolios are over exposed to growth stocks right now. Something to think about in coming months if you are a passive investor.

Final Thoughts for the Week:

Try as I may, I cannot get the image of the “Megaphone Market” out of my mind.

This is where the world of near zero interest rates allows price changes that were unimaginable in the past to happen…nearly every day!

Zero interest rates make even the most outrageous valuations possible to spin a narrative as to why they make sense.

Most of you are likely more familiar with real estate investing in terms of understanding “value” over stocks. Think about how high real estate prices that net return less than 1% on capital costs can be seen as “reasonable,” when a government bond only pays 0.50%.

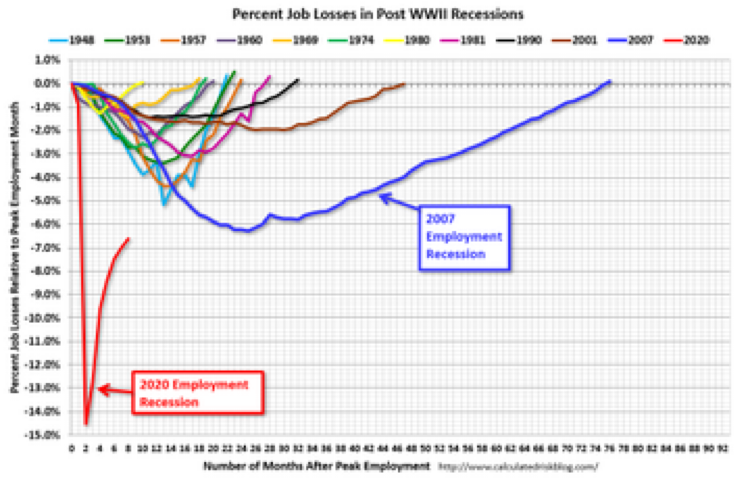

If GICs paid 4%, who would buy a rental home or commercial building that nets only 1% at present day prices with the way the jobs market is?

That’s what happens in the stock market too.

The Megaphone Market is still a thing. The trend is still valid.

The economy is recovering, but the second COVID wave is taking its toll.

The chart below shows just how severe the COVID downturn was in the jobs market and, even in recovery, the jobs market is well behind the worst recessions in the past 100 years.

Back in February 2020, I felt the top had been seen for the US stock market for the year. After the huge COVID vaccine news driven move higher in stocks on Monday, Nov. 9th, I believe it is entirely possible the peak may have been seen for 2020 in the US. Note: the February 2020 high is still valid for Canada’s TSX.

The Biden win and the vaccine creation takes the two “good news” stories the stock market were salivating over off the table. Earnings recovery is the next good news story to be played out, and it will be easy to beat earnings in the second quarter of 2021 for all companies. But until then, the bar is set pretty high for most companies considering the economy of the fourth quarter of 2019, compared to the coming quarter.

Nobody knows what comes next. Keep an open mind and invest with an asset mix that you don’t mind living through a significant amount of price volatility with.

That is the best advice I can offer. Please email me your feedback or questions, and enjoy the rest of your week.