No Stimulus Deal?

Any pre-election BULLISH sentiment I had was based on a US stimulus package being agreed upon before the election.

If we are to believe the Trump announcement on October 6th, the stimulus deal is now off the table until after the election.

I’m not putting much faith in anything coming out of Washington at this moment. Hold steady for now.

Simple fact: The US needs a stimulus package.

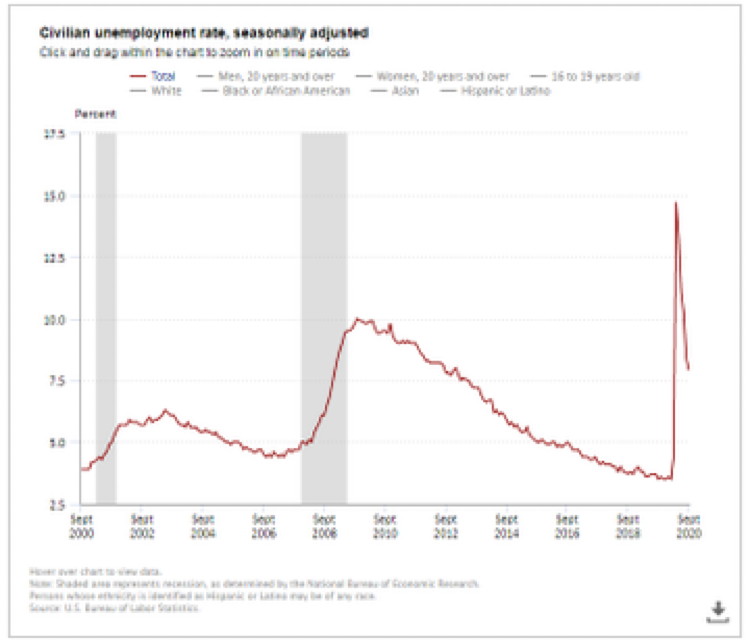

The chart above shows how dire the jobs market is in the US. There has been a large recovery from when the economy was shut down in March 2020, but the US is barely below the worst levels of the 2008 recession now.

It is important to remember that many of these job losses are now being deemed permanent rather than temporary. Mortgages in forbearance are rising ever day that stimulus cheques are delayed.

I promised myself to keep this short. Therefore, let me jump right to the conclusions I want to draw.

- Stimulus is coming, no matter who wins the US election. It has to!

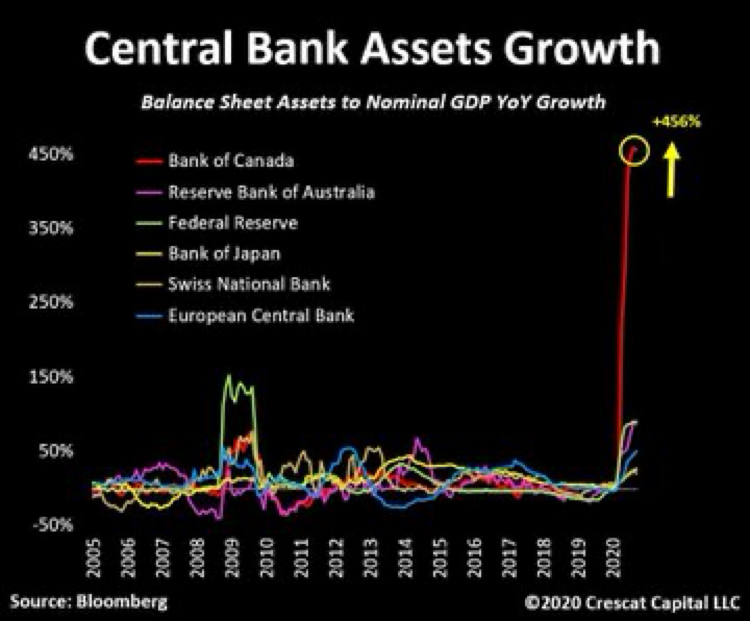

Canada is leading the world in printing money. Therefore, watch the Canadian dollar relative to other currencies. Our country does not have a reserve currency status so it might get interesting.

- Gold needs to climb back above $1,900 US and stay there to be a confident hold. $1,925 would be even better.

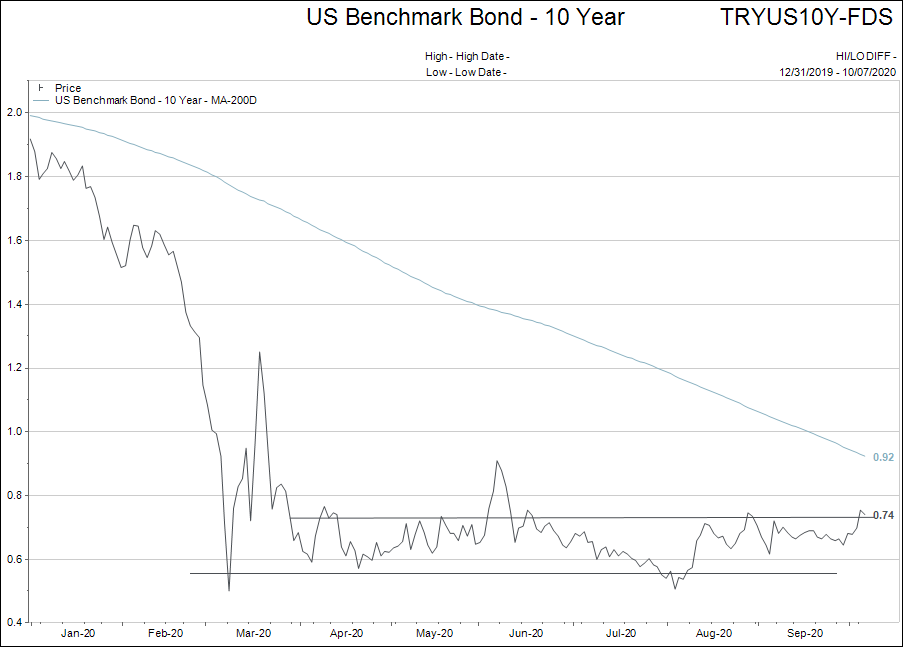

- Interest rates are starting to show a pulse. If the yield curve steepens with longer term interest rates going higher, banks look better! The yield on the US 10 year Treasury bond is shown below.

- Companies that are correlated to COVID pandemic growth globally are, once again, trending well after some weakness in the summer.

- There are a couple technology company names emerging to be considered in the high risk parts of portfolios. Please contact me for company names and details.

As always, please feel free to email me with questions or call.