“Closer to the Heart”

The goal of this weekly comment is to rise above political biases and speak to the overall wish that “we can be better.” I refer to both the collective and individual we in this essay.

Existence in 2020, has become fraught with politically correct memes or cartoons, which ignore the brick-by-brick dismantling of the fabrics our society was based upon.

The US Presidential “debate” only focused our attention upon how far the meme has drifted.

As Geddy Lee and “Rush” proclaimed in the song Closer to the Heart:

And the men who hold high places

Must be the ones who start

To mold a new reality

Closer to the heart

Closer to the heartThe blacksmith and the artist

Reflect it in their art

They forge their creativity

Closer to the heart

Yes, closer to the heartPhilosophers and plowmen

Each must know his part

To sow a new mentality

Closer to the heart

You see, we can’t just look at Trump and Biden and say how did this freaking happen?

We all bear some of the responsibility for the place the world finds itself.

Some ask, how do we ever get back to a place where the Constitution is respected and adhered to?

The answer to that question is not found looking outwardly. “Each must know his part, to sow a new mentality, closer to the heart.”

There is an old expression that says you can’t hang the pictures on the wall until the foundation is built.

Friends, we have spent nearly 60 years ripping down the institutions that represented the foundations of our society. Common decency and caring for our neighbours will never be replaced by political correctness and oppressive oversight.

I know, it is easy to say that the US have brought it upon themselves, but this is where I’m going to make my point. Just staring into the abyss of where we find ourselves won’t change our future.

We have to own our present day condition both collectively and individually.

Somehow we need to rebuild. Somehow we need to stop looking at everyone else and ask, what I can do to be part of the solution. At some point, we have to rebuild the foundation of the fabric of our society.

I don’t know the right path, but what I do know is that the US Presidential Debate should serve as a marker on history’s road to show that the pathway back to respect, dignity and liberty is long and challenging.

Maybe it can be fixed, or maybe it all has to be burned to the ground; change will come one way or the other.

Individually, we can think about how to try and add a positive vibe to the lives of those we come into contact with. At the same time, let’s try not to spout negativity via our words or social media.

The debate was deeply troubling in context of the offices those two men hold and the responsibilities that come with those positions. That evening was not representative of a future I relish.

Thank you for reading. I mean no political slant to the comment in my words above. The issues I am driving at are way beyond the scope of politics.

My hope is for a better place and world.

As to the financial markets and considering what the US election might mean to them I want to make a guess about what possibly lies ahead.

My base case around the election has been that it is going to be too close to call. I felt that the mail in ballot would take some time to sort out and that financial markets might get a little jittery going into the final stretch to November 3rd.

I have also been acutely aware of the Federal Reserve printing less money in the past month as well as the issues stopping another stimulus package from being sent out in the US.

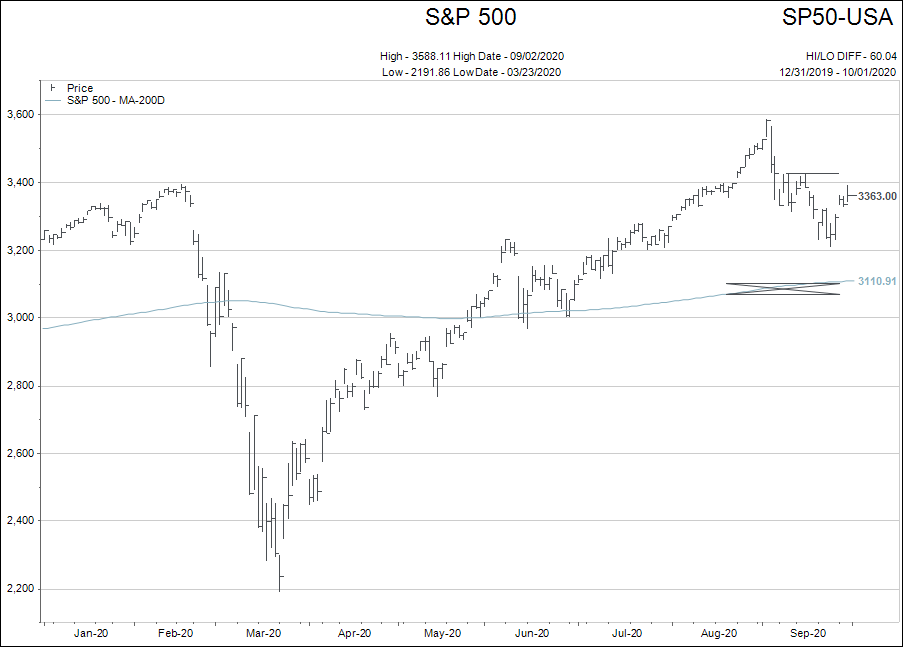

The US financial markets have taken notice of these concerns and, in September, broke their trend from the March 23rd bottom earlier this year.

But this week there has again been a shift in sentiment that we need to identify and discuss.

- The Fed is getting back to printing money.

- The stimulus package MIGHT get done before the election.

- Trump’s odds of winning the election are declining. The odds that Joe Biden might be a clear winner on election night are growing.

The financial markets love the first two changes. I’m not sure they know what to make of a clear Biden victory yet?

This brings me to a different set of investment exposures that “traders” should take AND a new problem that long term investors need to consider.

Let me broaden this out briefly by pulling out my crystal ball:

The Fed will continue to feed the “blood-sucking leech" stock and bond markets to keep them intact leading up to November 3rd. I believe the stimulus package will sound like it is “close” to being done but not become a reality before the election. The Pavlovian dog will continue to salivate over the word “close”, just like it has done with the “vaccine” and “China trade deals” over the past two years.

And I now believe Joe Biden will win the election but it won’t be a clear victory. Most importantly, I don’t believe Trump will accept the results of the election and that he will claim the vote fraudulent or employ a legal challenge of the results.

This is how my views of financial markets change with these thoughts:

- Buy gold over $1,900 US and use a stop loss of $1,850 for the positions.

- Hold stocks that pay dividends with our usual stop losses in place. Long term investors, be ready to act on these stop losses.

- Watch bond markets and, specifically, US Treasury bond rates vs. US High Yield interest rate spreads.

- Watch the US dollar relative to other currencies and gold.

My fear is that a Democrat/Biden win unleashes the inner-Trump we all saw on display during the debate. That could be a hugely disrupting force on financial markets.

For long term investors, at least consider what such an outcome would mean to your portfolio.

In summary, elections usually only have short term impacts on financial markets. This election is shaping up to impact our lives long beyond election night. It is important to identify this shift in sentiment and consider how comfortable you are with the risks of a sloppy US election result.

Please email me if you'd like a call to discuss your portfolio.