Back to Your Goals

The European Central Bank (ECB) and the US Federal Reserve (Fed) both concluded meetings in the past two weeks that can be summarized as “turning a blind eye to consequences” at the minimum, and “willfully destructive,” if you are so inclined to see them that way.

The most troubling themes I see from both meetings are:

- The continued push to lower interest rates and inject more money into the financial system when the results of these policies have been mixed at best economically; good for assets, not so great for economy.

- The continued denial that central bank policy is exacerbating INCOME and WEALTH inequality.

Therefore, it is time to accept that central bank policy is not going to change until something happens to make it change. In other words, they are going to keep pumping the adrenalin in the patient until it snaps to attention or dies.

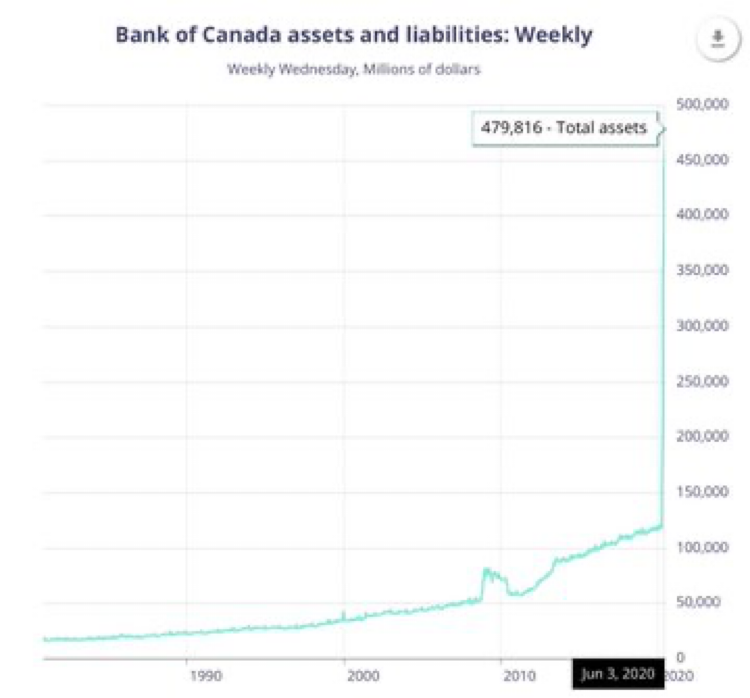

As a quick side note, a client asked me last week for a graphic of Canada and what our central bank has been doing in terms of printing money.

I don’t focus much on Canada because in global monetary terms, we are rather insignificant, but it is worth seeing that the Bank of Canada is an equal debt offender when compared to other central banks.

How is that for impressive money printing! And now, with another two months of CERB going out, the line just keeps going higher.

Anyway, back to the point above. If these central banks are hell bent on trying to print their way out of our troubles, what does that mean for you and I as investors?

Simply, it means:

- There are going to be fewer places to make a return on your money.

- Risk assets will be more volatile, but should remain bid.

- Investors will need to be more risk conscious going forward.

Let’s create an example of a retired couple to help illustrate the process of applying the three realities above.

The couple is in their late 60s and are relatively risk adverse. They have modest income needs from their savings…2.5% off of the capital would be sufficient. They are concerned about the volatility of the times.

Capital to invest: $800,000 ($400,000 in RRSP, $200,000 TFSA and $200,000 in savings).

Income required: $20,000 per year.

Total income: $65,000

From an advisory perspective, my primary goal would be to create enough cash flow to satisfy the “required income goal” within risk parameters acceptable to the clients.

If we focus on some high dividend paying companies in these accounts only half the money is needed to derive the required income. The balance of the portfolio can be invested as conservatively or aggressively as they clients choose.

This is pretty easy planning.

What if we change the client’s income need off of their savings was $40,000 or 5% of the principle? How could we accomplish both the income requirement AND the acceptable risk goals at the same time?

Tougher situation, right?

Now the balance between satisfying the income need requires virtually all the money to be invested in stocks given the sub-two percent returns on guaranteed investments.

How comfortable would the conservative couple be with a portfolio full of stocks? (Or a pile of junk bonds which are just as risky?)

The next point is absolutely key to consider if your income requirement is more than 4% return on your investable savings.

Clients with these types of higher income needs are going to be forced to make a choice:

- Carry high exposures to stock markets and live with the volatility.

- Draw down their principle while holding safer, low interest baring investments.

I can see the next few years featuring GICs with less than 1% interest rates and investment quality bonds paying less than 0.50% per year.

The good news, this should keep a bid under risk assets.

The bad news, there will likely be more days like Thursday last week where the stock market fell 7% in one day.

It is important to think about this choice BEFORE a surprise bout with volatility hits your portfolio.

If you went through the March decline and you were losing sleep at night and just plain scared, we should talk about adjusting your portfolio now.

The recovery in stocks has been solid and is starting to show signs of flattening.

Don’t hesitate to touch base to discuss. Best to send me an email and we will organize a time to chat.