Your Participation Requested

Below we will review the charts of numerous financial markets, but first I would be interested in your thoughts on a couple of issues.

Truthfully, what I’m hoping to find out is if your thoughts have changed on either of the two issues below.

President Donald Trump:

It doesn’t matter if you are for or against Trump. If your feelings have not changed you don’t need to respond.

But if you have changed your view of his Presidency, or of him personally, I would appreciate if you would write a few sentences about what has changed for you.

I will not use any names, but I would like to make some of the responses public in one of my letters.

COVID-19 lockdown:

The second topic I am interested in hearing your thoughts about is the lockdown.

Here again, if your view has not changed as per what our leaders did in response to the COVID-19 pandemic, you don’t need to respond.

I would love to hear from those of you that feel differently now than you did six-weeks ago about the government response. Again, no names will be published, but I would like to use some of the replies.

Please click here to provide your input.

Updates from Different Financial Markets

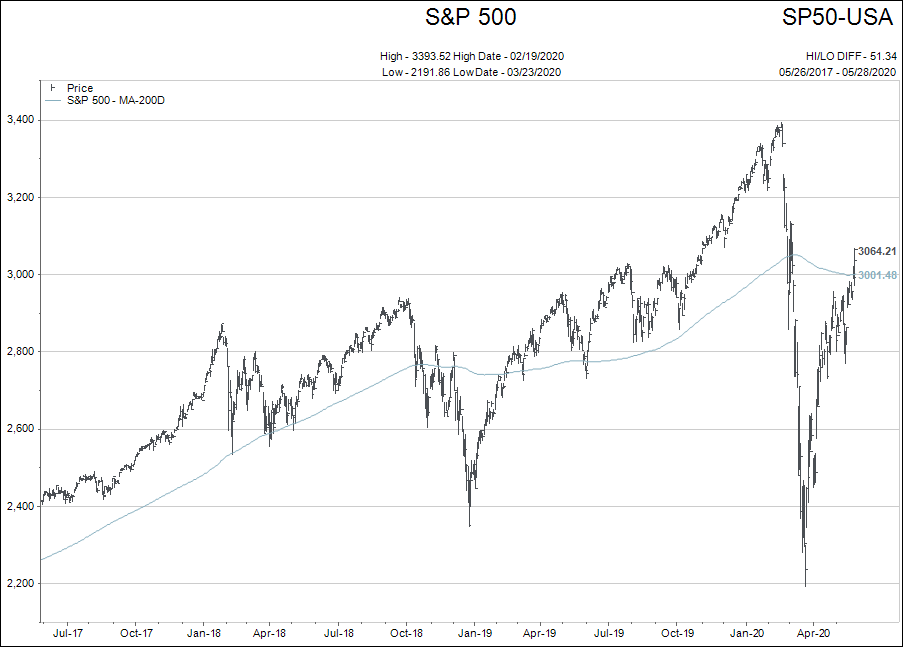

Stock markets have traded out of their ranges and are now eyeing their old all-time high levels.

With the US index back above its 200 day moving average, traders can use whatever system they are comfortable with to create a healthy stop-loss on their long positions if they are concerned about another downturn (Blue line is 200 day MA).

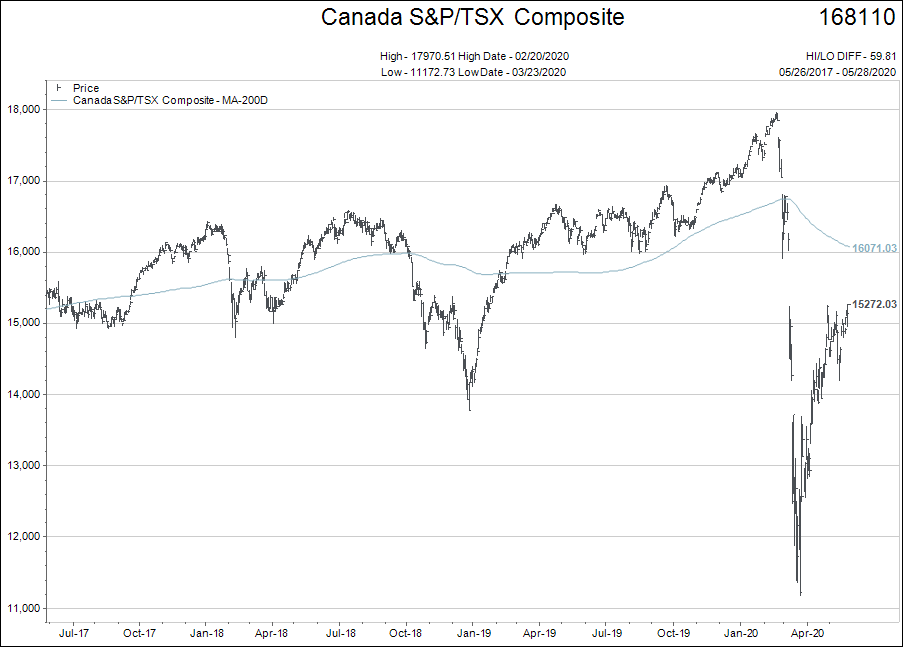

Canada still has some work to go to get back to the 200 day moving average, but with the Canadian banks having an excellent week price-wise, the chances of getting back to the moving average is improving.

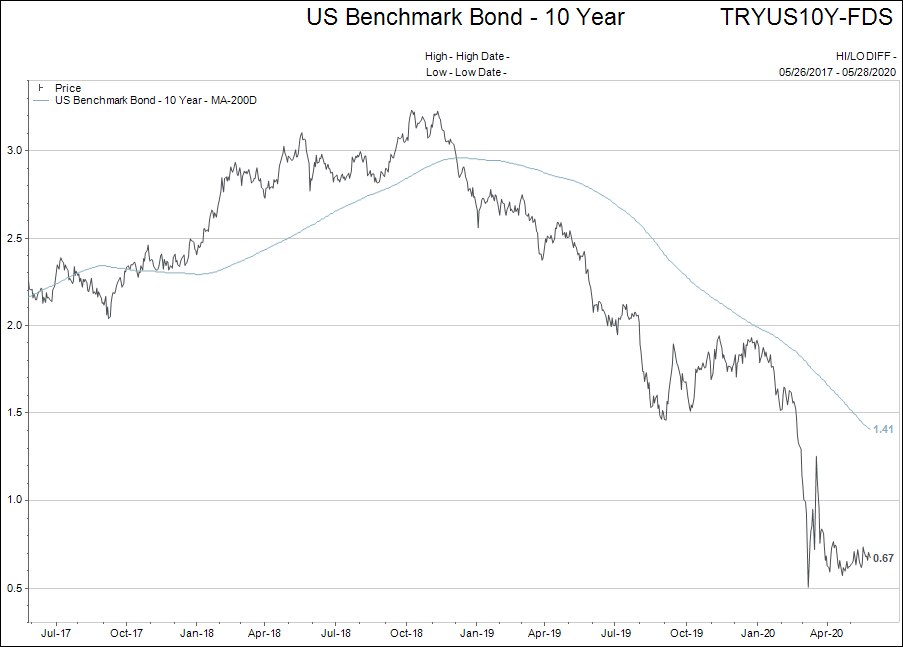

Next let’s look at 10 year interest rates in both Canada and the US.

Next let’s look at 10 year interest rates in both Canada and the US.

Honestly, when I look at those two charts relative to the bounce back in stock markets I kind of shake my head.

The 10 year interest rates remind of the EKG of a recently deceased. There is no pulse left!

Yet stock markets have rallied like the world will be back to normal in a few months’ time.

I’m not judging anything right now in the wacky financial world we live in…but it is very strange how these two markets have behaved so differently.

Let’s add one chart for a little colour on why this might be happening.

The blue line is the Industrial Production Index in the US. It is a decent barometer of economic activity. The red line is M2 money supply.

I used a long term chart so you could see how the amplitude of both lines get more extreme in each subsequent recession (grey bars = recession) since the central banks have taken over the world.

Money supply is not the only reason for the divergence between bond and stock markets…but it is certainly a big reason.

The result when stocks rally BEFORE the economy recovers? The valuation metrics get to crazy expensive levels. (Price Earnings Ratio - P/E - shown below).

On another note, high yield debt (junk bonds) have been one of the areas that the US Federal Reserve has supported by buying up bonds for their balance sheet.

Since the Fed announcement, the yield spread over government treasuries has declined substantially (11% down to 6.8%).

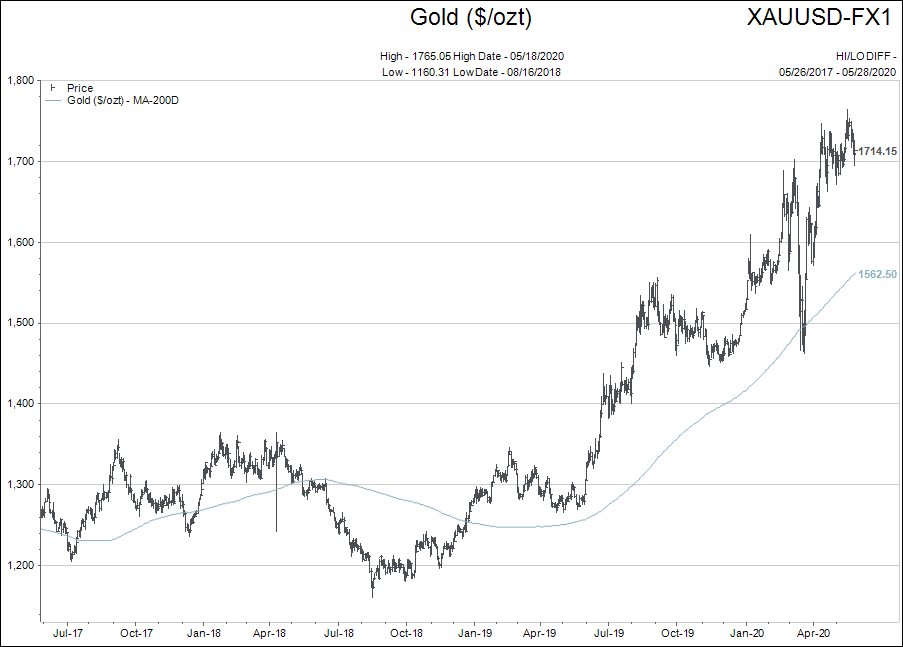

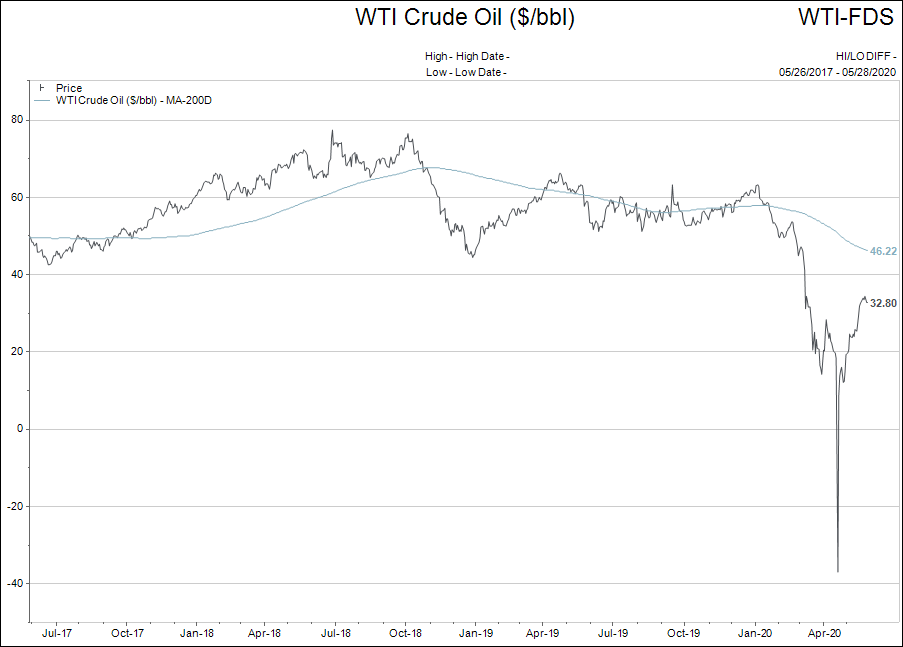

Let’s next look at Gold and Oil.

Oil has made a nice recovery and gold is still holding its uptrend, but looks vulnerable to a correction.

In summary, a solid week for the stock markets, especially with the banks participating in the rally. As the chart showing the rise in P/E ratios alludes to…the financial markets have run way in front of the economic recovery.

At a P/E ratio of 24.4, I have little interest in buying stocks. There is no reason to be a seller either.

Have a great week and, if you are comfortable doing so, please write a few lines about the two questions I opened the blog with if you have some thoughts.