Doxastic Commitment

You are walking along a trail in the middle of the forest and you start to get worried. Something is definitely not right. Somewhere you took a wrong turn.

Fortunately, the Trailforks app is on your smartphone and can see that the trail you are on will lead you back to another trail that will get you back to your original hike. It’s not too far in front of where you are now standing.

But ahead on the trail is an old suspension bridge made of ropes and cedar slats. It looks really old and not exactly safe.

You stand on the second slat of the bridge and bounce your weight up and down…it holds you even though you hear some serious creaking sounds.

It is a long way back if you choose to backtrack your mistake and it is late in the day. What do you decide to do?

You believe the bridge will hold you. In your mind you can rationalize it should be fine to cross. The bridge has been here for years…you are sure other people have come this way…why would the bridge choose this moment to break?

But to step out and cross the bridge, you have to go beyond believing the bridge will hold and commit to your belief that it will hold with your personal safety as the wager.

I like to say you have to move from “belief” to “trust.”

Doxastic commitment is defined as a “steadfast allegiance in action to the beliefs one holds, and is a precondition of honour. Doxastic commitment demands that we put our full soul into the game, and be willing to take whatever hurt follows.”

Is financial doxastic commitment healthy? When is it appropriate?

Should doxastic commitment be a part of how we act as investors? How about as company board members? What about politicians and central bankers?

The financial world is full of new theories and monetary experiments. The developers and administrators of these initiatives believe them to be generally beneficial.

But do the people in power really have any “skin in the game?”

In other words, if their “monetary experimental rope bridges” collapse are they, as individuals, negatively impacted?

In general, the answer is no, not significantly.

It is the poor and middle class being asked to walk across the shaky rope bridge with no lifelines. The lack of doxastic commitment on the part of leaders is a major flaw in the situation the world finds itself in right now.

Before I leave this topic let’s take it one more direction. Let me personalize this argument to my money management style.

My personal doxastic commitment was galvanized in 2005.

At that time, I committed to the belief the economy was, for lack of a better expression, a monetary Ponzi scheme. I believed that financial markets were ever more aggressively manipulated by central banks creating a greater income and wealth inequality gap, and that there was going to be a price to be paid—at some point in our future—for our leader’s collective financial arrogance.

Today, my doxastic commitment to this belief is still the same. Actually, it has intensified.

Personally, wanting to see how this all plays out is the main reason I continue to keep working...and I absolutely have put my full soul into the game, and am willing to take whatever hurt follows.

Hopefully, my investment process will prove robust enough to manage our way through such an event if there is one. The process has been built over a lifetime of research. I enjoy each day doing my work.

But before we move along, let’s challenge my doxastic commitment from a long and short term perspective.

For The Long Term

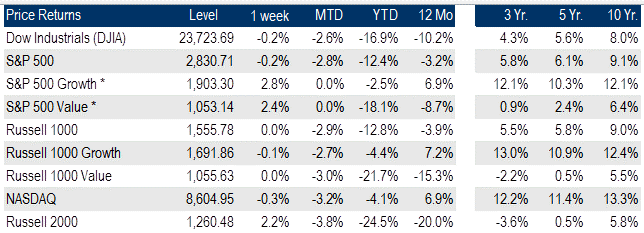

Below is a graphic of the short and long term rates of return for the US equity markets. I am focusing on the 3, 5, 10 year return columns.

Outside of the Russell 2000 index, these are the equity returns investors believe have been normal since the last financial crisis.

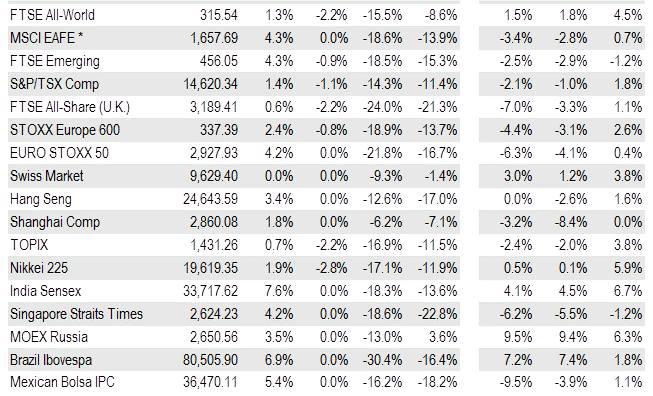

But let’s look at the rest of the world’s stock markets.

*These returns do not include dividends. **S&P/TSX Comp is Canada

The 3, 5, 10 year returns outside of the US have been pretty weak.

Remember, those rates of returns are in the environment of insane amounts of central bank manipulation via artificially low interest rates and Quantitative Easing (QE).

So maybe most of the world has already paid a significant price for the central bankers’ collective arrogance? Maybe now is a time to remove such a bias and be quite BULLISH on the future?

If one employs a scientific methodology to their market analysis this hypothesis becomes quite plausible, given the awful long term returns in stock markets outside of the US and revision to the mean theory.

For The Short Term

In many ways, the same case can be made of short term returns. Let me paint you a picture:

Stock markets are trying to recover from the fastest, steepest decline in history. They plunged well below their 200 day moving averages, and the largest monetary intervention in history was deployed.

If stocks can recover their 200 day moving averages with the wave of central bank money behind them, what is to stop stocks from totally disconnecting from the economy to move significantly higher?

My reason for sharing the long and short term view above is that, even though my doxastic commitment is BEARISH, I am completely open to higher stock prices and BELIEVE my process is robust enough to handle either outcome.

Nobody knows the future. Everyone has an opinion and belief. Let’s watch and see what happens.

If you want to discuss anything mentioned above, or have questions, please email me and I will connect with you as soon as I am able. If you want to take advantage of the reduced annual minimum for your LIF or RIF payments this year, or have any administrative items needing attention, please email Megan and she will be sure to reach out.

“The End of the Beginning of the End”

- An Invitation to my new Personal Blog

It has been a privilege to work with all of you during the past few months. Each day is filled with conversations that fill me with thoughts and perspectives.

Reflecting upon so many of our chats, I see where many of us are experiencing disconnect from our “old lives,” and are wondering what comes next?

There are feelings of insecurity and fear. In many cases anxiety is added to the mix and causing a type of social paralysis.

While writing the editorial above, I could not help feeling there was so much more to say. It feels like it is time to go deeper into many issues than a business blog allows for.

Therefore, I am starting to write a PERSONAL blog.

The title “The End of the Beginning of the End” sounds a little ominous, but it is meant to lead readers to deeper thoughts and a place of hope, trust and faith.

As a regular reader of my business blog, if you would like to give this blog a try you are welcome to reply to this message and I will include you on the list.

If it doesn’t fit your taste, just send me an unsubscribe and I will take you off the distribution list.