The Bounce Part Two

Highlighted in the graphic below is “the bounce” referred to in last weekend’s publication, Catching a Falling Knife.

BEAR market rallies are always breathtaking events, but this one was one for the ages.

The TSX bottomed on Monday last week at 11,722. In three days it bounced all the way back up to near the 14,000 target we were using in our Catch a Falling Knife communication.

The worst thing that happens in BEAR markets is that they tend to draw more money out of investors who were already too exposed to the stock market BEFORE the troubles began. Stay disciplined and keep your exposure right for you.

Let me be clear, there are three ways I choose to view the present stock market:

- If you want to buy something that pays a great yield and you plan to hold on to it no matter what happens in the market then, by all means, buy what you think helps you accomplish your long term financial goals.

- If you are moderately exposed to the stock market already and feel relatively comfortable, just be patient and stay the course.

- If you feel like you are too exposed to the stock market and you were really feeling panicked earlier in the week, give me a call and we will do some changes now that the markets have had a good bounce.

Summary:

The world stock markets have crashed. Let’s call it what it was.

They are presently in the midst of a bounce that started right on schedule. The targets I have been using in the bounce are:

TSX Comp – 14,000 and Dow Industrials – 23,000

Let’s be patient and see what comes next.

But what about the underlying economy?

No doubt, a large sized recession has started. That is not up for debate any longer...except by politicians trying to spin the data.

The question is HOW LONG WILL IT LAST?

I am getting more nervous that the recession is going to last longer than anyone thinks right now.

In part because the shock has been greater than originally expected, but largely, because social distancing and isolation protocols have not been followed as closely in North America as in other parts of the world. This in turn means, less of a return to normal life soon.

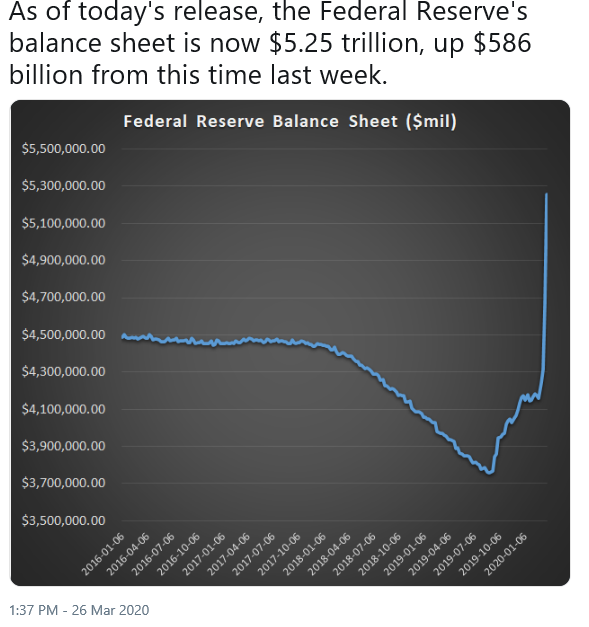

The US Federal Reserve has gone into complete insanity mode in terms of money printing. Canada is not far behind.

Below is a chart that shows how fast the US Federal Reserve has exploded higher.

The US Fed has literally bought every asset imaginable other than stocks.

But without flattening the COVID-19 infection curve, the Fed’s money is going to lose its impact on the financial markets.

Again, consider the three market views in section one, and how you feel about your personal situation. Hopefully, “the bounce” should have a little more to go to the upside.

Please feel free to contact me with your questions.

As a couple of asides,

- The Wall Street Journal pronounced a “new BULL market” since the Dow Industrial Average went up more than 20% from its low on Monday.

If we applied this logic to the 1929 BEAR market these are the BULL markets that occurred within the large total BEAR market. There were 20+% rallies starting on:

November 20, 1929, at DJIA 241

February 21, 1931, at DJIA 191

June 24th, 1931, at DJIA 152

October 8th, 1931, at DJIA 106

January 15th, 1932 at DJIA 86

The Dow Jones Industrial Average (DJIA) finally bottomed at 41 on July 8th 1932.

Something to keep in mind in a BEAR market.

- And I had to laugh out loud at the following Tweet is saw this week.

Lol, we’re a bunch of paycheck to paycheck employees,

Living in apartments owned by paycheck to paycheck landlords,

Working for paycheck to paycheck corporations.

Whose idea was this?