Charts…and Thoughts

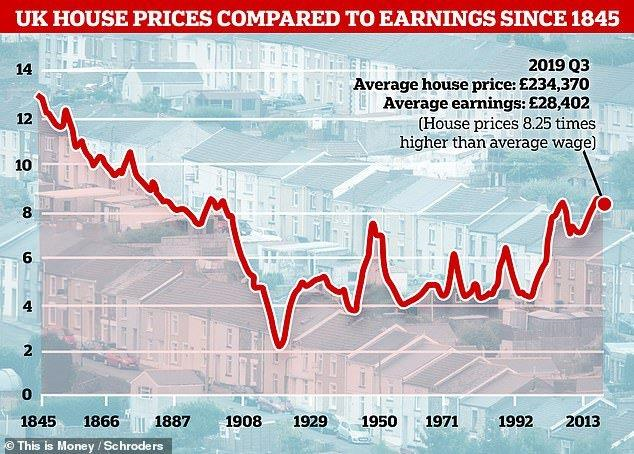

This week, I decided to spend some time thinking about the very long term. There are a lot of interesting trends shown in the chart of UK house prices relative to wages for the past 170 years.

Let me share a few of the thoughts I had:

- The downtrend from 1845 to 1914, happened as quality housing became available to more families and wages were rising.

- The jump in unaffordability right after WWII in the late-1940s came on the heels of lower interest rates and a huge demand surge from returning veterans.

- The ramp up in housing that started in the 1990s, was the last gasp of labour unions lost wage-gaining strength, and coincides with the acceleration of the hollowing out of the middle class.

You might be able to think of some more themes, so I encourage you to email me your thoughts.

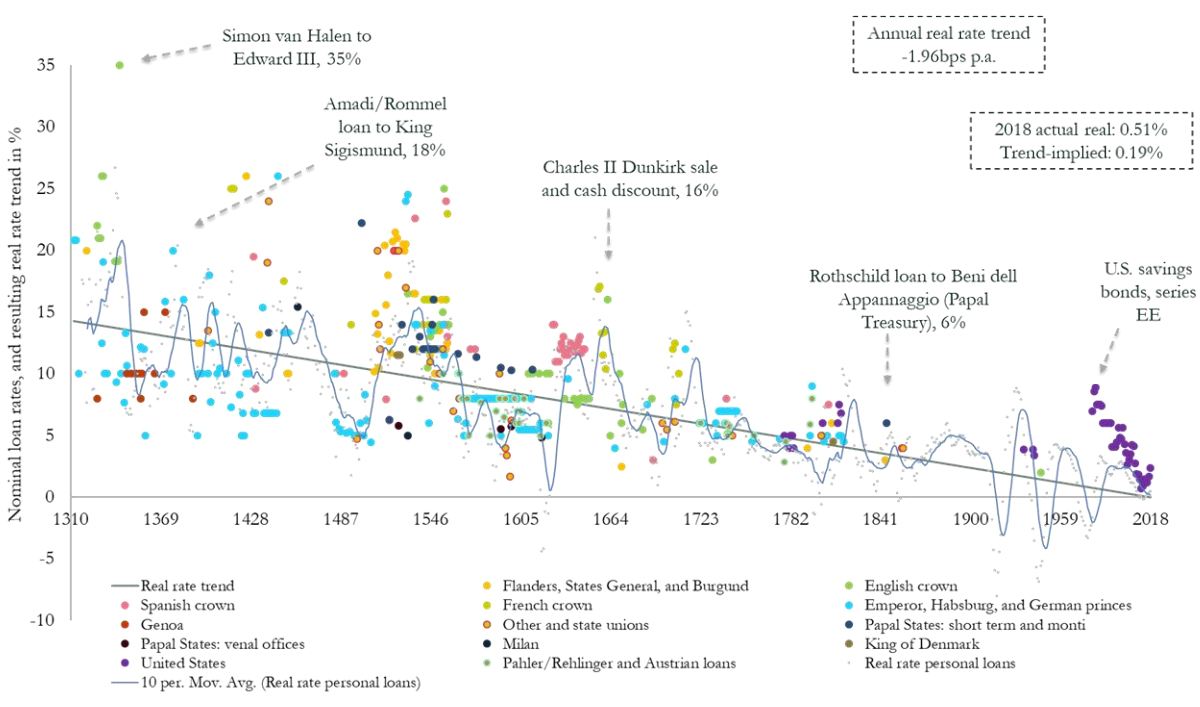

Moving on, the next chart is for an even longer period dating back to 1310.

The “real interest rate” trend shown by the gray line that oscillates uses interest rates charged on loans as its base. Isn’t it interesting how the trend of decline has been in place for a very long time?

The following chart shows how large the budget deficit in China has been since the Great Recession in 2009; the incredible rate of decline is clear and it’s not slowing.

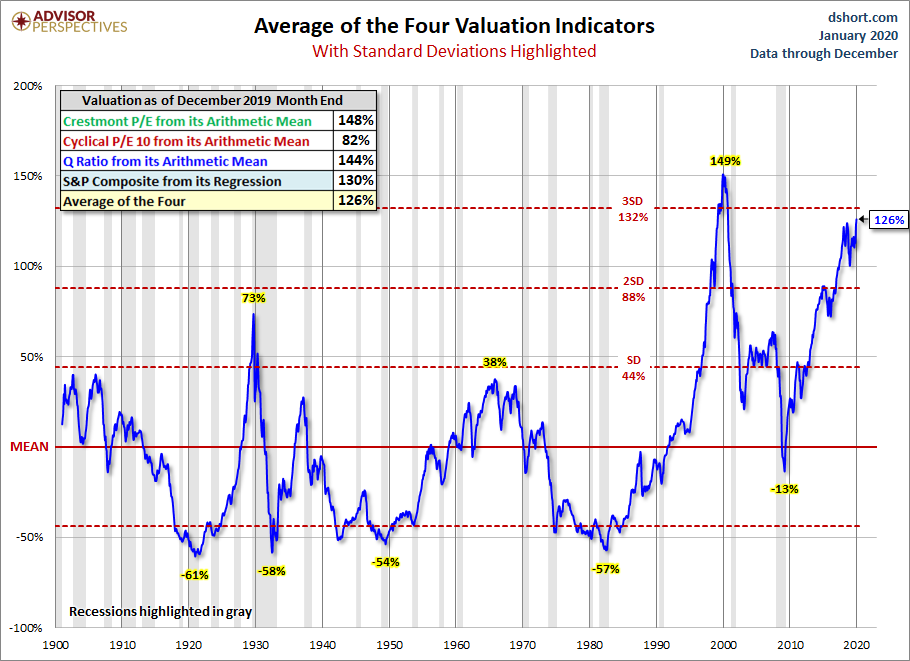

This next chart takes another snapshot of “US stock market valuation.”

What cracks me up is when I hear people say: “Well the market is not as expensive as in the technology bubble of 1999/2000.”

Somehow in the back of my mind I hear the market respond: “Hold my beer!”

To go along side of the chart above, let me show the record of earnings and sales growth in the US so far through the first quarter of earnings being announced (current through Thursday, Feb. 6th).

Not exactly rip-your-face-off type growth, but the stock market doesn’t care.

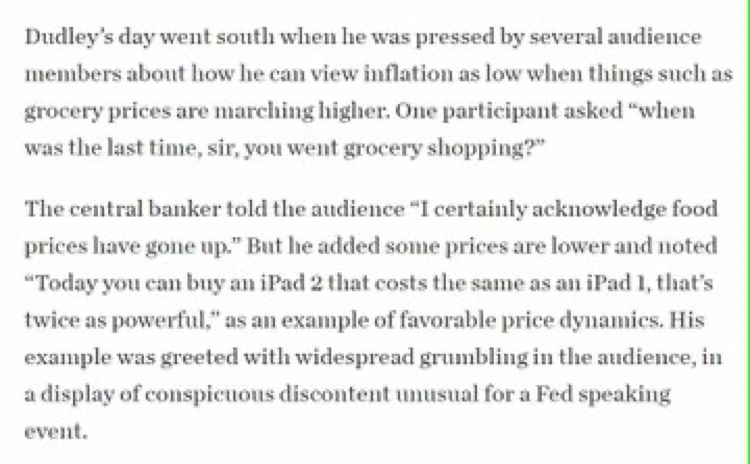

And finally, I really thought that the following excerpt from American Fed member Bill Dudley said so much in the era of central bank dominance of financial conditions.

I guess we could add: “Let them eat iPads!”

Have a great week.