So You Want to Get Aggressive?

The beginning of January tends to encourage people to revisit their portfolio allocations and performance.

The way 2019 ended up with a face-ripping rally from the September lows after the US Federal Reserve decided to get into the money printing business again, has prompted many of you to ask me how to get more aggressive with your investments holdings?

Actually, let me rephrase that question.

What people are really asking is how do I get more aggressive with my investment holdings while the stock market is running higher, but exit those investments when the stock market turns down again?

My answer to people who ask this question comes in two parts:

- Does getting more aggressive really fit with your long term goals?

- How much of a loss are you willing to accept IF and WHEN the BULL market suffers a correction?

Let’s assume your financial plan says that you need an annualized rate of return of 3.5% to 4.5%, to accomplish your long term goals and live a happy life. Why would you choose to chase down a higher rate of return in the most expensive stock market in US history?

The chart below uses Warren Buffett’s favourite stock market valuation indicator: The total value of the US stock market relative to Gross Domestic Product (GDP) just closed above 156%.

That, my friends, is a new all-time record.

Therefore, it makes sense to decide if the concept of getting more aggressive is based in “fear of missing out” or really necessary for your long term well-being.

If your answer is still yes to wanting to take on more risk after considering the first question, then we proceed to question two.

How much of a loss are you willing to accept IF and WHEN the BULL market suffers a correction?

With financial markets as stretched valuation-wise as they are right now, I would argue the minimum amount of loss you should be willing to accept is 10% of the capital risked.

That means if you choose to add an extra $100,000 in risk you should be willing to lose $10,000.

Are you still with me? Do you still want to get more aggressive with your investments?

Great. Then let me share the good news with you.

Mathematically, the final leg of a BULL market is usually the one that goes the highest the fastest with very few corrections.

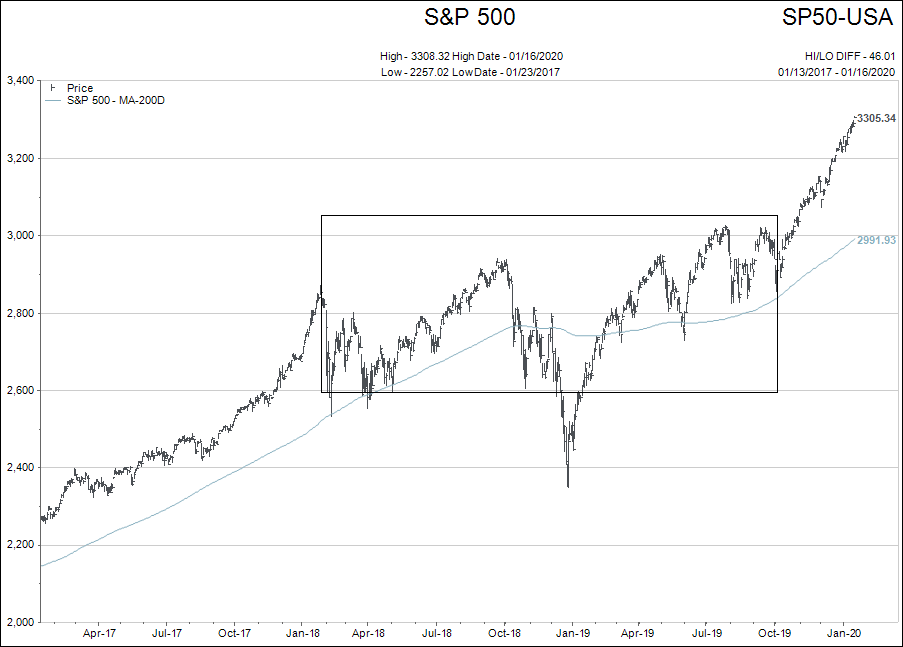

Let’s just use the S&P 500 chart as an example to see how quickly a stock market can rise.

The rectangle drawn above shows how the mighty S&P 500 has essentially traded sideways from January 2018 until October 2019.

The jury was basically still out when it came to investors know that the global central banks were no longer going to act as “the candyman” and defend rising asset prices. Then the US Federal Reserve decided to kick the money printing pumps back into gear in September 2019.

Stocks took off like a shot and have not looked back. (If you want to read about the money printing I refer you back to the Tri-Annual comment from last week).

There is nothing in the S&P 500 chart that tells me to sell, but there is nothing telling me to buy the chart either.

If my long term goals will be met and I already have a reasonable amount of exposure to stocks relative to my risk tolerance, why add more risk?

“Fear of missing out” can cost you money, a lot of money, if you don’t have a plan.

The very first weekly comment I wrote in 1999—yes, I still have a copy of that comment saved in a file—started off with Warren Buffett’s famous expression: “You never know who is swimming naked until the tide goes out.”

Warren is also famous for another expression: “A BULL market is like sex, it feels best right before it ends.”

Warren is a pretty smart guy who has seen a few BULL markets. Best to think about what he is saying in these two quotes.

Ok, you still want to try and jump on board this BULL train. Who knows it might have a lot further to run?

Then please give me a call and set up a time to meet to talk about how we can try to ensure you have good structure to your late cycle investment choices, and that they still fit into your long term financial plan.

As a post script, I am reminded of the late Bob Farrell’s, “rule number 4” for investing: “Parabolic advances usually go further than you think, but they don’t correct by going sideways.”