End of year admin

With 2019 quickly coming to a close, I (Megan) am hijacking the beginning of this week's comment to bring you a couple important administrative reminders.

This will be brief and relatively painless...unless I'm waiting on documents to be returned. If that's the case, I make you no promises and no guarantees to your safety. I kid of course, but seriously, I need those forms back.

Please keep the following in mind before holiday festivities fill your calendars:

- Have you made your RSP, TFSA and RESP contributions for 2019?

- Do you need to take an extra RIF payment?

- Has your accountant or tax preparer recommended selling something to realize a loss to off-set some gains?

- Do you need any corporate year end reports?

- The deadline for initiating charitable donations is December 13th, and they will be completed on a "best-efforts" basis, and last but not least,

- If you want to have your accountant added as an "Interested Party" on your accounts, so that they will automatically receive your statements and tax package, I'll need an autograph from you by December 18th. If that's overkill and you just want to authorize me to be able to provide them information upon request, give me a quick call at 250-729-3226, so I can add that note to your profile.

If you have any questions or need to have a request completed before we usher in 2020, please email me sooner rather than later.

Now, without further delay, I'll return you to your regularly scheduled program. Please stand by.

.

.

.

Understanding the building blocks of the stock market rally

If only there were signs…

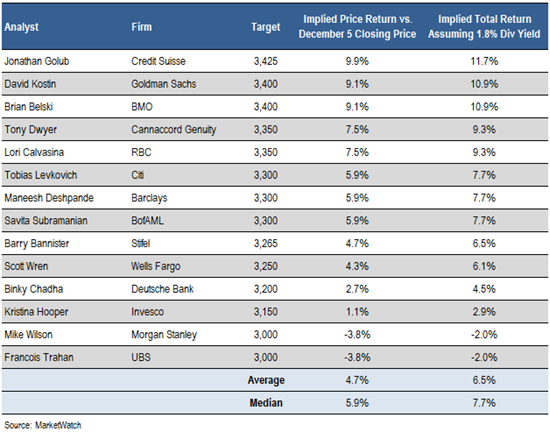

As we approach the end of the year, the ritual of market projections begins. From what I have seen so far the 2020 themes are fairly consistent:

- No projections for less than 3000 on the S&P 500 (see table below),

- Global growth to accelerate slightly from 2019,

- Earnings for the S&P 500 are looking at about 8% growth after a year of no growth in 2019, and

- Central banks are projected to continue cutting interest rates and supporting asset prices with Quantitative Easing (QE) and Zero Interest Rate policy (ZIRP).

For investors, the last point is likely the most important to continue to stimulate asset prices higher.

Traditionally, the final year in the US presidential cycle is a positive year for stock markets, so that helps with the BULLISH forecasts as well.

Let’s quickly recap the past 15 months in the stock market.

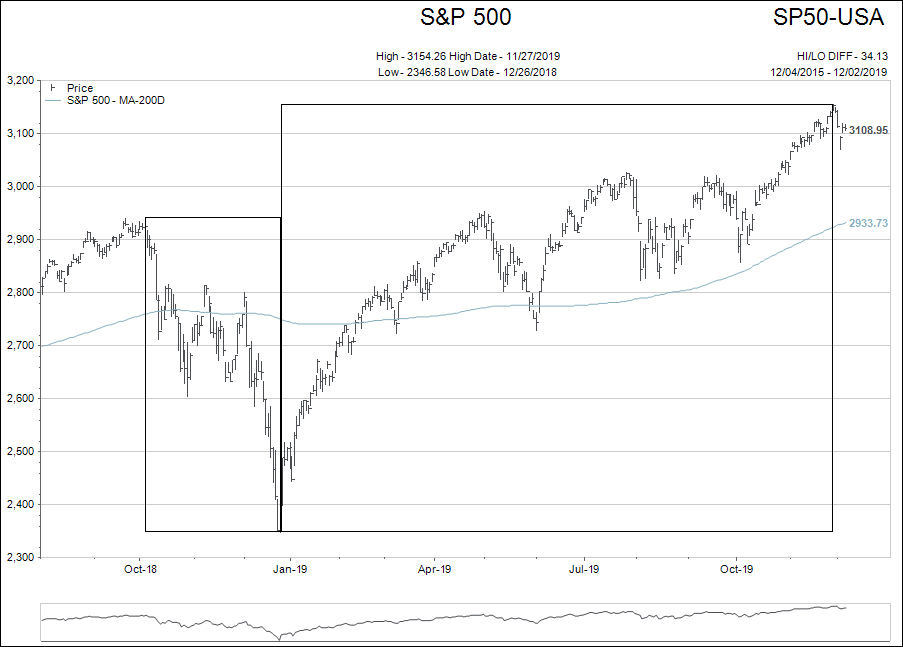

The chart below shows the S&P 500 from August 2018 to the present.

The smaller box on the left hand side of the chart shows the 22% decline in stocks, which took place over 10 weeks as the economic numbers weakened and the US Federal Reserve was still vowing to raise interest rates to normalize the economy.

The large rectangle shows the 33% rally in the stock market during the time that the economic numbers kept on weakening but the global central banks returned to the position of “market enablers via QE and ZIRP.”

The hill I am willing to die on, is the US Federal Reserve “pivot” on interest rate policy on December 24th, 2018, from a bias to raise rates to holding interest rates steady was historically significant.

Before that pivot there was a level of belief that monetary policy had a “central bank driven” pathway back to normalization. The chances of normalization via central bank policy went to zero in 2019.

You think that is an extreme statement?

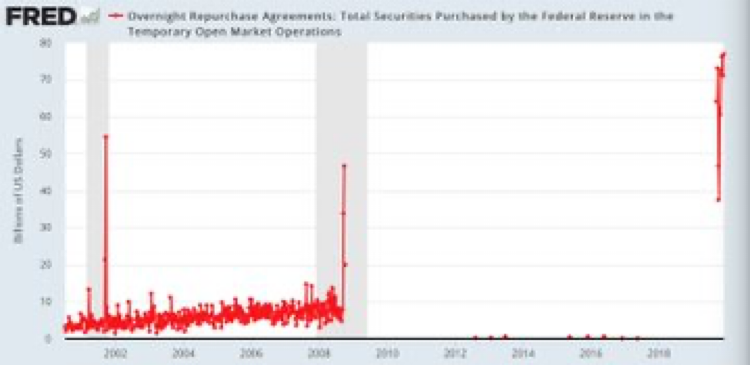

Below is a chart of overnight central bank repo operation in the US since 2000.

The spikes in the red line show amounts of overnight repos in billions of US dollars. The first two short term spikes occurred in deep recessions; now the US Fed is running extreme policy on a daily basis and has been since September 7th, of this year.

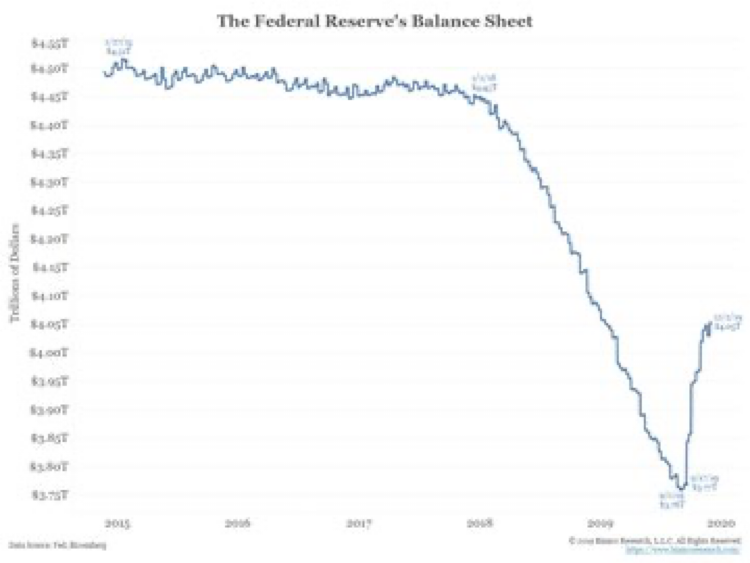

The next chart shows the Federal Reserve’s balance sheet.

Quantitative Tightening (QT) was well entrenched up until the beginning of 2019. However, as of September 2019, the US Fed’s balance sheet is expanding at the fastest rate EVER in history, even though they don’t call it QE…a rose by any other name…

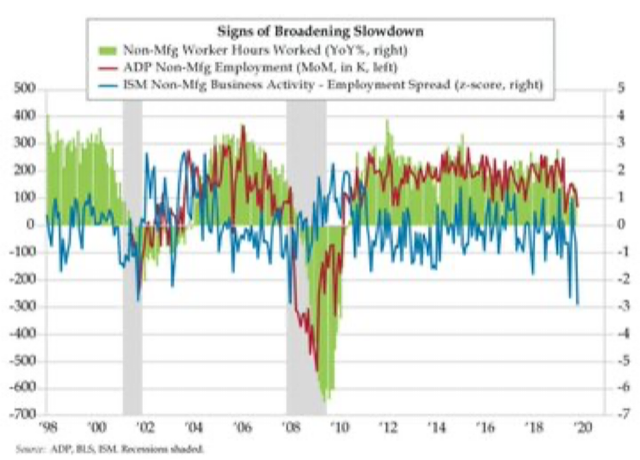

What does all this mean?

Please understand, stock prices, housing prices, bond prices—virtually “everything prices”—went higher in 2019. It was not because of great earnings or a strong economy or anything like that.

It was because the global central banks decided to print lots and lots of money.

That means investors need to remain BULLISH on markets. But it also introduces a tremendous amount of risk into the equation if something in this fabricated monetary ecosystem goes wrong.

Please don’t get complacent; it's important to stay engaged in the process and don't hesitate to reach out with any questions, comments or concerns.

Have a great week.