“The Crisis Portfolio”

A recent Globe and Mail article, “Stock markets are out of touch with reality,” an opinion piece by Gordon Pape, quotes an email from a reader:

“Although you (columnist) make some valid suggestions as to how to react to the next (market) drop, I would love to see a ‘crisis portfolio’ which one could build before the crisis strikes.

I have sold half my investments, which currently reside in daily interest accounts, in preparation for such an eventuality.

To my mind, it takes years to build solid returns but only a few weeks or even days to destroy a large part of it. Can you propose such a portfolio which would ‘anticipate’ a sudden drop – and rise quickly from the ashes.”

- Alain H.

This got my mind percolating…

Last month we completed a one-stop fund version of what I would call our “Crisis Portfolio.”

Before we go any further, I want to define what I mean by “crisis.”

You see, most of us immediately associate “crisis” with a negative outcome, and while it is true that most crisis come in a negative form, it’s not always the case.

What would happen if inflation took off due to the immense amount of money printing, and a few years out the world was faced with real estate prices that are 50% higher and stock markets that are 100% higher?

People might say: “Hey—that is no crisis—that’s just what I hope happens!”

Maybe…but then again maybe not.

- Do you think wages would keep up to that type of asset inflation?

- Considering low to zero, or even negative interest rates, do you believe you have enough money invested to generate a high enough rate of return to compensate for the higher cost of food, gas, shelter, and all the other necessities of life that would come along with that type of inflation?

- The urge to take a profit would be huge, would you have the courage to stay invested when the news grows more negative due to the impact of rapid inflation paired with sharply higher asset prices?

A “Crisis Portfolio” needs to be able to handle a “positive crisis” as well as a “negative crisis” with equal expertise. We believe ours does just that.

One of the most challenging aspects in creating our “Crisis Portfolio” was determining:

- What assets it should hold under what economic and market conditions?

- What triggers should be used to transition between asset classes?

- Under certain “crisis” conditions, will there be enough market liquidity for us to trade from one asset class to another?

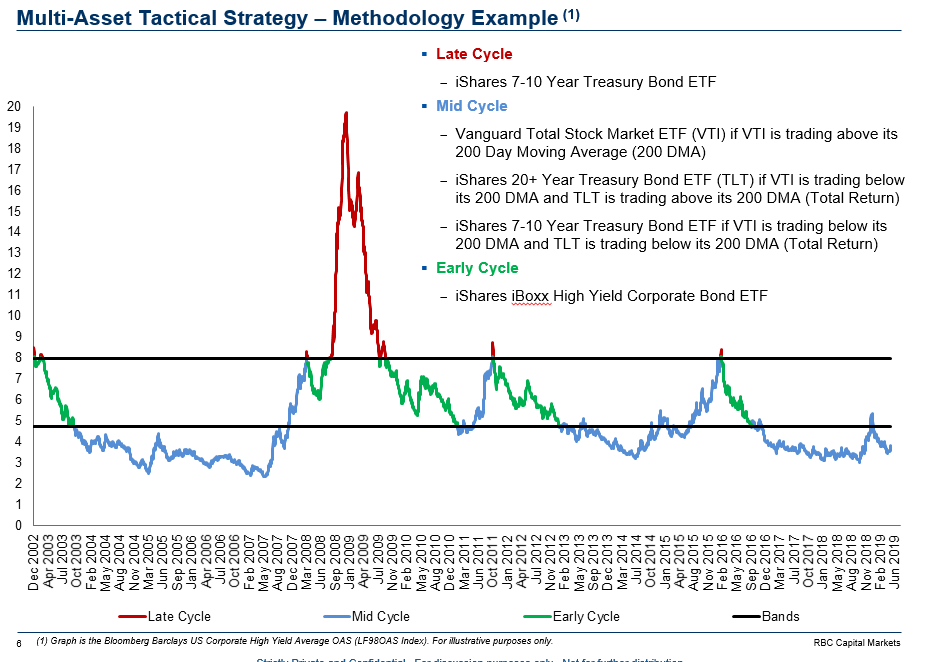

In the basic Crisis Portfolio model, we decided to go with:

- A broad index of dividend paying companies.

- The 10 year US Government Treasury Bond.

- A High Yield Bond index.

When we looked at the next 10 years we came to the same conclusion that another notable newsletter, Epsilon Theory, came to.

We believe the financial world in its present form is unstable. To maintain the status quo of rising asset prices and solvent banks it demands the “zombification” of the vast majority of everything else.

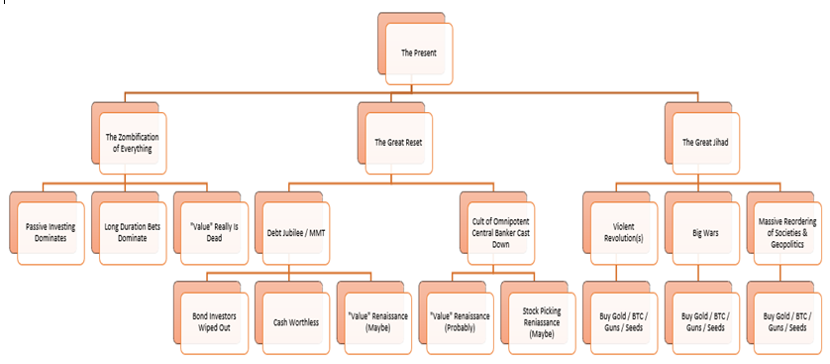

If the zombification process fails at some point the world likely reaches either a “Great Reset” or “Great Jihad.”

Below is a graphic outlining the thought process being employed.

Please don’t take the flow chart literally or linearly.

The point it is meant to make is that the central banks are playing with fire by trying to control economies and markets with unlimited debt creation. It is meant to point out that unintended consequences of manipulation radiate far beyond the tameness of the present.

Really, nobody knows what will actually happen.

Yet, the present zombification can’t go on forever, so it is worthwhile to consider what might happen in the future.

Summary:

The “Crisis Portfolio” is designed to:

- Stay invested in the “zombification” phase of markets where asset prices continue to rise versus wages and interest rates remain unnaturally low by owning a broad index of companies.

- Switch to US Treasury bonds if the stock market should begin to drop significantly.

- Decide the better value between 10 year Treasury bonds or high yield bonds in different economic and market situations.

The chart below shows you an illustration of the types of shifts the Crisis Portfolio would have triggered from one asset class to another over the past 18 years.

The past three years have taken us on a round trip of Quantitative Easing, to Quantitative Tightening and raising interest rates, right back to record amounts of Quantitative Easing again.

It is my strong recommendation to make a plan now while still in the “zombification” phase of the markets to deal with whatever the future may hold.

If you want to discuss this or any other market or economic matter on your mind, you can always give us a call, or better yet join us in our board room on either Nov. 28th at 11 a.m., or Dec. 3rd at 2 p.m., for our Coffee Break re-launch. Please RSVP as space is limited.