Came across this gem from a 1982, Nanaimo Free Press article the other week. It got me rolling on a train of thought that lends itself well to where we find ourselves as investors in the world at present, so indulge me for a moment.

That’s me at 18-years-old. I was having the time of my life playing junior hockey; my tribe and I were invincible, immortal even. Time was infinitely abundant and at our command. The world was ours to possess and that was never going to change, or so we thought…

During the last 10 days of August, I made a point to catch up on as many mid-year financial market forecasts as I could find.

The forecasts generally concluded that:

- Markets are still well balanced and traditional portfolio weightings are going to continue to offer satisfactory rates of return to long term investors, and

- Something “broke” in the financial markets in the past 20 months. The correct path for investing is unlikely to follow the same script as the past 40 years, while interest rates declined and debt levels grew.

The extraordinary thing about these reports is that they basically used the same data points and economic yardsticks to come up with very different conclusions.

Analysts on both sides agree that the global economy is slowing, there are competitive currency devaluations, and trade wars exist.

BULLISH reports feel that markets can just continue to ignore these challenges and find higher valuations based on cheap money, while BEARISH reports conclude that cheap money and low interest rates have “run out of runway” to support valuations.

My position is that both the BULLISH and the BEARISH perspectives are correct. The art of the deal will be deciding when to make the flip.

The BULLS are right in that financial assets can continue to perform as long as interest rates still have room to decline.

The BEARS are right in that, once interest rates bottom, financial assets will have little ability to move higher and the “Great Reset” will begin.

Our strategic position therefore, is to continue to watch how interest rates trend for our signal as to when to get more defensive.

Nothing had changed in the real world, but just two years after that newspaper picture was taken my world changed dramatically.

There was no professional hockey career waiting for me at the end of my junior hockey career.

Nobody walked up and offered me a high paying job to make the rest of my life an “easy street,” either. Right on schedule real life smacked me square on the jaw.

A couple of dear friends were lost to car accidents and drugs, so I knew I was neither invincible nor immortal.

In retrospect, the silver lining of the story is that I have learned to be grateful for the challenges I had to overcome. Anything worth having tasted much sweeter when it came through blood, sweat and tears. Looking back now, those struggles ended up being the best parts!

Executive Summary:

- The “Great Mistake:” Central banks letting Quantitative Easing (QE) run for more than a year back in 2010.

- Ten Years Later—the slow pace of raising interest rates continued—central banks never took back the “great mistake” for fear of stalling asset price increases, but in the final quarter of 2018 stocks declined anyway. Real estate stalled too.

- The Panic of 2019—no it wasn’t investors who panicked, it was the central banks—the Bank of Japan, European Central Bank, and the US Federal Reserve all pivoted from tightening monetary conditions back to loosening them.

- The “Great Mistake II:” After offering an outlook stating they will not raise interest rates for the rest of 2019, panicked central banks panicked further, and started to CUT interest rates again.

- The “Hotel California Economy”—the pathways to interest rate normalization are nowhere to be seen—investors around the world scramble to try and lock in yield on investments. As the old Eagles song hauntingly informed us ‘You can check out anytime you like, but you can never leave’ the highly indebted, low interest rate world.

Rational:

The financial markets remained on a steady course since my last Triannual Outlook letter posted April 15th, 2019.

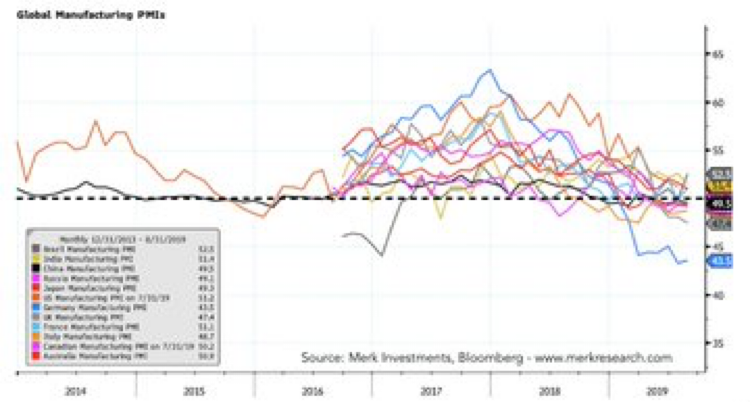

During the past four months the slowing of the global economy continued, but the rate of decline became less severe, as illustrated by the Global Manufacturing Purchasing Managers Indexes PMI below.

Stock markets churned sideways with lots of volatility.

The three most interesting characteristics of the past four months for me, have been:

- The incredible drop in interest rates around the world,

- The “flattening” of global yield curves, even where interest rates are negative, and

- The relentless move higher in the US dollar index.

Let me be absolutely clear: None of the conditions above signal a healthy economy in coming quarters.

Ironically, none of these conditions make me BEARISH of stock markets as I write this letter. That day is coming, but it is not yet to be.

Why not BEARISH of stocks?

This has been the most difficult part of the investment strategy to take a stand on. If the global economy is slowing, should we not be BEARISH of stocks?

Let’s look at the past nine months to answer this question.

Earnings for the S&P 500 have reflected the slowing economy. The rate of earnings growth was negative for a short time but has hovered right around zero percent growth for most of 2019.

Yet, the market leading US companies have seen stock prices rise from the beginning of the year. Granted, they’re up from a low starting point after the dramatic December selloff, but they are still higher nonetheless.

The increase in stock prices has been entirely based on Price-to-Earnings (P/E) multiple expansion, not stronger earnings.

Why would P/E multiples expand?

- Lower interest rates support higher P/E multiples.

- Faith in the Central Banks pulling yet another genie from the bottle.

My forecast for the rest of 2019, is that we will witness both lower interest rates across the globe AND the re-initiation of some form of Quantitative Easing in Europe, and likely the US.

As long as there is room to lower interest rates, or more central bank stimulus is announced, I am not BEARISH of stocks. It is entirely likely that stock prices make new highs in the face of the oncoming recession.

As always, we will use our 200-day moving average discipline to define our level of stock market exposure in the coming four months.

Inflation

We will not spend a lot of time on the inflation story.

It is my strong opinion the inflation is much higher for all of us living in the real world where food, gas and housing are required, than what the economists tell us we are experiencing.

However, with that said, for the purpose of investment strategy we will stick to the Wall Street version of inflation.

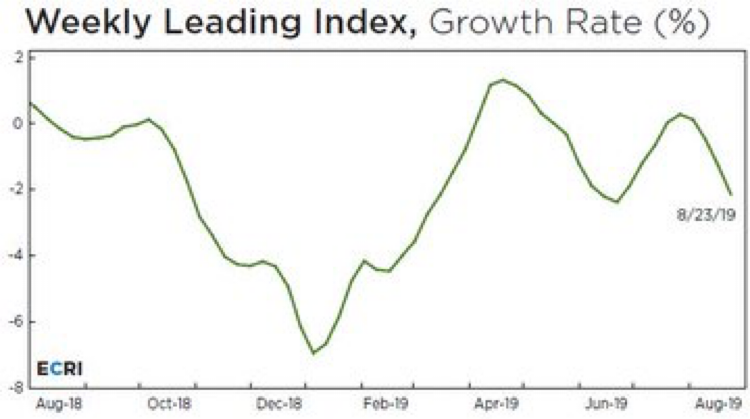

Below is a chart of the Future Inflation Gauge created by Lakshman Achuthan of ECRI.

Of course, Europe and Japan have seen even weaker inflation figures, but the ECRI chart shows where “official” inflation figures have barely been able to recover to zero per cent growth for most of the past year.

With future inflation growth remaining muted, investors can look out into the global bond markets to get a reading on interest rates. If interest rates continue to decline it means bond investors don’t see any real inflation on the horizon. So let’s look at what bond markets are telling us.

Government Bonds: How low can the go?

“After the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers cash to holding debt which yield so low a rate of interest. In this event the monetary authority would have lost effective control over the rate of interest.” –John Maynard Keynes’s 1936, description of a “liquidity trap.”

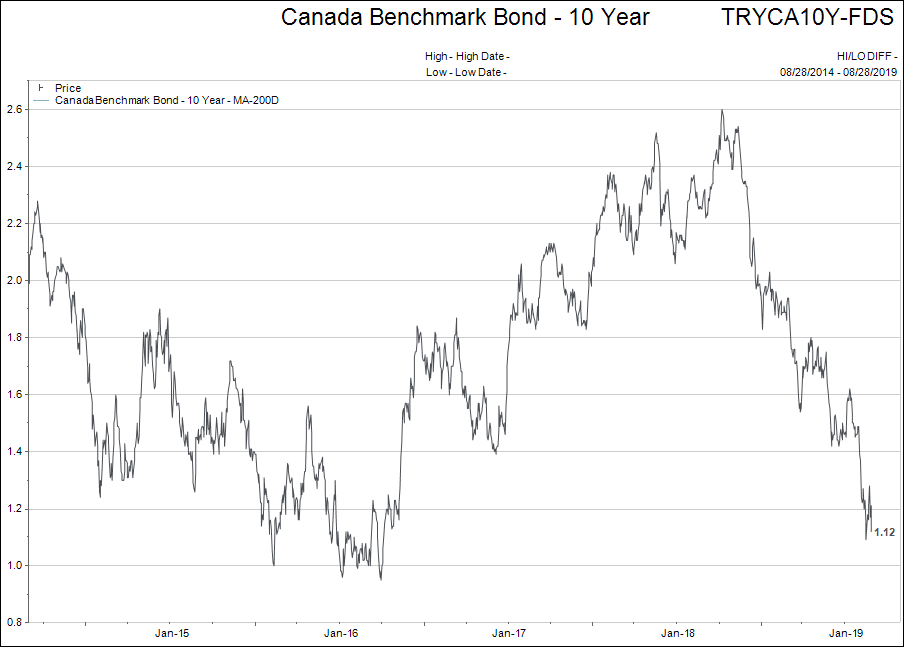

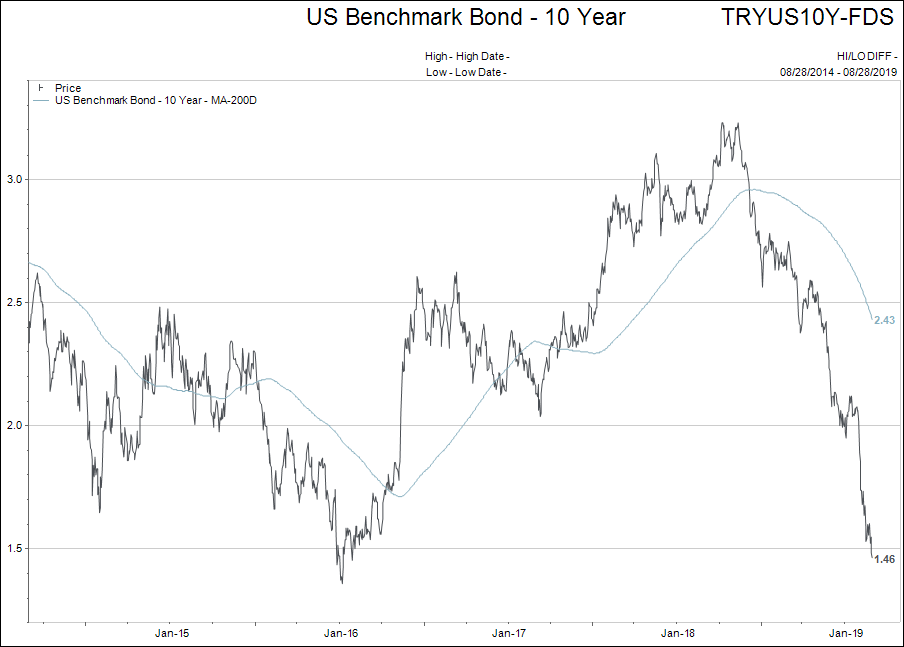

Let’s begin with a look at 10-year bond yields in both Canada and the US.

Interest rates are the most important part of the financial landscape to keep an eye on in 2019, for three reasons:

- The absolute decline is breathtaking.

- The inversions (short-term interest rates being higher than long-term interest rates) are plentiful and growing in number around the world.

- The cumulative value of negative interest yielding bonds keeps ramping higher around the world reaching $18 trillion US. If you want to see chart of where the negative interest rates bonds exist around the world please click here to view.

The first point is obvious when one looks at the chart above; the third point has been the focus of many of my weekly comments in the past few months, so let’s delve into the details of the second point.

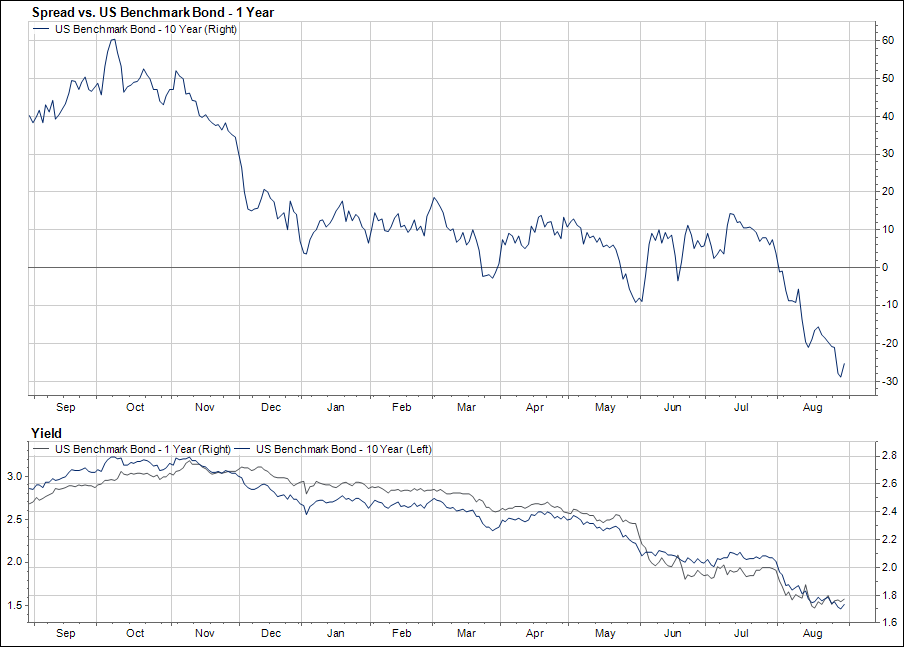

The chart below shows the “spread” or difference between the US 10-year Treasury bond and the 1-year Treasury bond.

Once the spread goes below zero the yield curve is said to be “inverted.”

It seems to me that interest rates will continue to be the dominant story for the last trimester of 2019.

The question I keep asking myself is what do investors do to create income when the entire world is near the zero bound in interest rates?

For individual investors, the answer for quite some time has been to put more money at risk in stocks and real estate.

Maybe asset prices will continue higher and this solution will continue to be valid, who knows? But the stock markets around the world have really made no headway higher since the beginning of 2018.

This is true even with the sharp decline in interest rates which was supposed to ALWAYS push these prices higher.

***Used as reference only and does not constitute a recommendation***

Note the peak in the Vanguard Total Stock Market ETF (VTI) in early January 2018.

In the coming trimester it will be interesting to see if lower interest rates continue to take hold. And, if lower interest rates continue, will the VTI breakout to the upside or the downside of the “wedge” I drew on the chart above?

It has been my premise that lower interest rates no longer act as an elixir for asset prices to move higher. The global central banks are now “pushing on a string” when it comes to lower interest rates, in that they have virtually no impact on the economy anymore.

One of the ways I like to measure the “health” of the interest rate driven move higher in stock prices, is to watch the relative performance of the Canadian bank stock index versus the Canadian utility stock index.

***Used as reference only and does not constitute a recommendation***

When “all is well in the world” the bank index outperforms the utilities index or they move in the same direction.

If trouble is brewing though, the bank index tends to significantly underperform the utilities index. This is exactly what we have seen in the last two months as interest rates fell and yield curves inverted.

Hopefully, if the world slips into recession it will be a mild one thanks to the low interest rates. However, the flip side of that coin is that the time it takes to get out of recession will likely be quite long thanks to the inability to cut interest rates from already low levels.

In summary, let’s be patient holding our interest sensitive investments. Until interest rates have a reason to stop falling, or someday reverse higher, these types of investments should hold their own against other asset classes.

Please click here to continue to Part 2.