A European Perspective

The following is a role play.

Imagine I am your financial advisor and we are meeting in my office in Germany; I work for the investment arm of Commerzbank and we are doing your financial plan.

After spending some time talking we decide together that a portfolio of 50% bonds and fixed income, and 50% stocks would have traditionally been the right ASSET MIX to accomplish your goals within your risk tolerances.

Ah, but I said traditionally. Today, traditionally doesn’t work.

“Why can’t we do the traditional approach”, you ask?

“Let me show you”, is my reply.

In Euro, we can offer you a certificate of deposit (GIC) of 0.005%.

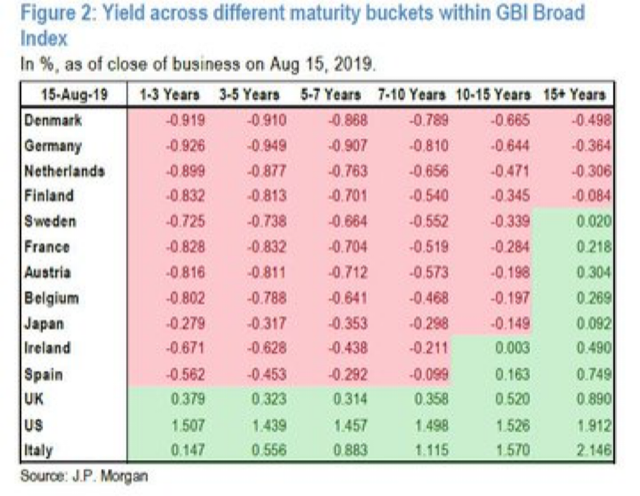

As for German Government Bonds, let me show you the (ahem, ahem) yields. Yes, those are all minus signs next to the term of investment (Germany 5Y is the 5 year German bond, and -0.882 per year is the yield).

As you can see you can’t get any positive yield on ANY German bonds today.

“Ok, Nick…why don’t we just put the fixed income money in US dollars and buy US treasury bonds?”

“Exactly what I was going to suggest…not only do we earn interest but we can capture a capital gain from a strong US currency too. If you wish to change you funds to US dollars, we can offer you a rate of 2.5% locked in for 5 years”, I boldly reply as the easiest solution.

Now we need to stop the role play here for a moment to clarify a few interrelationships that are happening at this stage of the economic cycle.

For the record, this is exactly where the world finds itself right now in August 2019.

By putting money in US Treasuries our clients are helping to drive already low US interest rates even lower by taking US Treasury supply off the table AND continuing the strength in the US dollar index by purchasing US dollars to settle the transaction.

But I believe the buying US Treasury bond solution in areas with negative interest rates comes to an end once US interest rates drop below about 0.40%.

This comes back to the idea that interest rates are not linear in their correlation to economic or financial incomes. Once certain thresholds are breached on the downside…the affect is similar to “pushing on a string.”

Back to our role play.

“As a second investment area to consider, I would look at German high dividend companies that have utility-type cash flows.

Also, real estate has really done well since our interest rates in Germany crossed over into negative territory. I would consider something more in the real estate market too.”

“Ok, that makes sense…but what happens when the whole world is mired in zero or negative interest rates,” you wisely ask.

There is the key question for all of us to ponder and the thought I want to leave you with until I write my next newsletter.

For my clients, you know my answer has been based in what I refer to as Phase 1 and Phase 2 of this present economic cycle.

Phase 1 refers to the time it takes to get to the zero bound EVERYWHERE and Phase 2 refers to what we might need to do once we arrive there.

I have attempted to discuss this with virtually every one of my clients. If I have not had this conversation with you or you would like to chat about it again, please give me a call or email.

The “Phase 1/ Phase 2” plan so far is working well. The key is that it gives us a template to know when something changes and doesn’t go according to plan. At that point, the plan can be re-evaluated.

I really can’t stress how important it is to have both a Financial Plan and a Market Plan in the present situation.

Having a solid handle on both these plans allows you to watch the silliness of a financial world where Tweets and slight changes in central banks statements are the topics of conversation each day.

In other words, you can look past the stupid news flow from each day and see the bigger picture.

In summary, nothing has changed the trajectory of the interest rate markets on their path to something near the zero bound. Plan around that reality now and know what to do if things change.

The Last Week of Summer

Megan and I hope you had some time to enjoy our relatively short Canadian summer.

The days are definitely getting shorter now and the evening chill hits the air even on hotter days.

For many of you, this is the season where you start getting your mind wrapped back into normal life again.

If what I wrote describes you, please take a few minutes to go back and read the last few weekly comments.

The first weekly comment in September will be the final Tri-Annual review letter looking out over the final four months of 2019. It will take a while to write so my goal is to publish it sometime in the first two weeks of September.