I do have an investment narrative.

Quite a few weeks—okay, more like months—back, Nick talked to me about developing my own investment narrative. It seemed daunting, mainly because coming from strictly an admin standpoint, I’d never put much weight in having one, and I’ll admit to dragging my feet on putting it down on paper.

There have been many changes for me over the last couple of years since joining Nick here at RBC DS. The biggest of which was completing my licensing and registration requirements to become an Associate and leaving my part-time serving gig at Astera’s Greek Taverna on New Years’ Eve. It’s been a strange adjustment to go from a 60+ hour, variable work week, to a set 37.5 hour office schedule.

As I was editing Nick’s comment for this week, it struck me.

I do have an investment narrative.

Its foundation were set back when I completed my Bachelors of Arts degree in Global Studies, which focused on international relations and political economics, and conversations with Nick over the years have helped bring it clearly into focus.

For me, you cannot separate the markets and governments. Their relationship has been incestuous from the beginning, and are increasingly perverted as central bankers work to keep macroeconomics moving in an upward trajectory; marginalized people be damned.

Discussed in my previous posts, I fall into the millennial generation…just, so as comedian, Iliza Shlesinger would say, I’m an elder-millennial.

It’s a unique position to view the current state of world markets and globalization.

Growing up, I remember our first black-screened computer monitor with flashing orange text, my family’s first brick of a cellphone, and all the neighbourhood kids running home when the streetlights came on.

The first news broadcast I clearly remember was from when I was 6-years-old. It was the CBCs coverage of the fall of the Berlin Wall, in 1989, after Western corporations had made cracks in the Iron Curtain with pizza and soda pop, and the Soviets started loosening their communist grip.

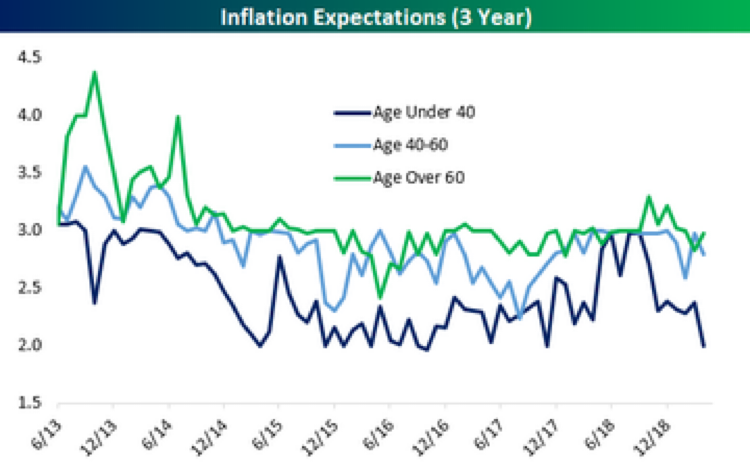

Millennials get blamed for all that is wrong with the world. Like the chart below that Nick came across and shared with me:

It claims that my generation is responsible for a drop in inflation, but in reality everything from bread to a Mercedes Benz cost more this year, than last. Could it be that people in this demographic simply cannot afford, and are unwilling to take on, huge mortgages for overpriced real estate and car loans? How dare we try to live within our means.

Market trends and stock prices used to move and shift based on fundamentals and news, and as investors have grown comfortable with Central Bank meddling and have the belief that they act with our best interests in mind, the fundamentals get murky.

The policies the Central Banks have been pursuing for the last decade are quietly fueling inflation and pushing the average investor and savers out on the risk ledge, as traditionally more secure investment options (ie. GIC’s and Bonds) can no longer keep up with income needs.

The last ten years have hollowed out the so called middle-class and concentrated real wealth in the hands of the global elites. In doing so, there has been growing discontent amongst the everyday people, driving support to either end of the political spectrum as the average worker is starting to lose the sense of human security the middle class had once provided.

People across generations and demographics are frustrated with the status quo, and we find ourselves in the midst of an epoch shift; economically and politically.

Economically, we’re seeing a growth in impact investment strategies and businesses are moving towards more sustainable business models around the globe.

Politically, we’re seeing growing momentum coming out of the Green camp. Look at the recent elections in PEI, where for the first-time the Greens now form the official opposition, or closer to home, with Green MP elect Paul Manly taking the seat in the recent by-election.

Should make for an interesting campaign leading up to the federal election in the fall, and choppy market fluctuations as we get there.

Nick and I want to hear from you. We want to know your thoughts and observations and are setting up a quarterly coffee break as a forum to discuss current market and world events. These casual get-togethers are not restricted to clients, so bring a friend or two. We’re aiming to engage in a meaningful discourse and empower people to make the right investment decisions for themselves. More details on this, and other goings on, will be shared on our Upcoming Events page on the website.

If you haven’t already done so, please send me your RSVP for this Friday’s Client, Family and Friends BBQ at Bowen Park. We’re looking forward to seeing as many of you as can make it.