You Can Only Choose One: Choose Wisely

These comments have always been a fun and easy way to gather my investment thoughts and communicate them with you, since 1998.

They started as bi-monthly mail-out editions, and migrated to weekly with the advent of near universal access to email, which made them cheap and quick to publish.

The “fun and easy” does not apply to the present conditions under which I try to write.

The financial market narrative changed drastically in January 2019 from “tightening” back to “loose” monetary policy. It was a total departure from where central bank leaders had been promising to go for the three years prior.

The loose financial conditions of the past 10 years continue to allow financial repression to thrive in the world. Without mincing words, it personally, pissed me off! Not that I have any control over it.

Setting aside my personal feelings, my goal this week is to take a more balanced look at the past few years of the US Federal Reserve’s connection to financial markets.

Having a difficult time remaining objective, I will use the excerpt from Kevin Muir’s, May 7th, “Macro Tourist” publication (emphasis mine), to accomplish this goal.

(Jarome) Powell gave up on trying to balance the financial economy

When Powell first grabbed his seat at the head of the table as Fed chair, he was determined to squash what he viewed as an imminent bubble. He cranked rates and did not let up. Every FOMC press conference was met with equity selling as Powell failed to mouth the soothing words Wall Street wanted to hear. Rather, he highlighted the imbalances in the financial economy. Powell had sat through the Great Financial Crisis and was determined to not let another bubble develop under his watch.

Don’t believe me? The chart that best illustrates the dramatic change in Fed policy under Powell’s tenure is the 2-year TIPS yield.

Under Bernanke and Yellen the 2-year TIPS yield (the real yield after inflation) gyrated between 50 bps and minus 225 bps. Most of the time it was negative or close to zero.

Look closely at the red box. That’s the point when Powell got behind the wheel and steered 2-year real rates up to 200 bps.

And want to know the date of the high tick? It is one day before the infamous Christmas-eve massacre when stocks went no bid.

After that, Powell changed his tune. No longer was he the bold-new-Chairman-willing-to-slow-down-the-financial-economy-to-stop-a-bubble. Suddenly he was the scared-and-trying-stay-out-of-Trump’s-crosshairs-FOMC-leader that was advocating patience with rate hikes.

Now some will claim Powell didn’t kowtow to Trump but rather reacted to a credit market freeze. I get it. Credit seized up. No doubt. But let me ask you something. Do you think if Trump had come out, and instead of lambasting Powell, said something to the effect that the financial economy was dealing with years of distortions and that he had faith his Fed Chairman was on the right path with his attempt to reset rates higher, do you really believe Powell would have backed off? I don’t. Not. For. A. Single. Second.

But Trump didn’t do that, so we will never know.

The bottom line: The interest rate needed to balance the “real economy” is significantly lower than that which balances the “financial economy.” Powell has been forced to choose. Either stop a bubble and crush the economy. Or try to let the economy grow and potentially create another bubble in the process.

At this point we know which way he has chosen.

Back to Nick…

Have the central banks (The US Fed) chosen wisely? It is going to take time to shake out; we will see in coming years.

Last week, Kevin Muir’s piece really made me stop and think. It makes an important (non-biased) statement in the section above:

Powell has been forced to choose.

- Either stop a bubble and crush the economy.

- Or try to let the economy grow and potentially create another bubble in the process.

At this point we know which way he has chosen.

Jerome Powell and his cast of equals at the other global central banks have chosen option two and let the economy grow and potentially create another bubble in the process.

What does that mean for our investment thesis? Below are a few really basic thoughts.

- The investment themes that have performed well for the past 10 years should continue to do reasonably well. Most are expensive, but as the financial conditions they have flourished under remain the same…they continue to work.

- The risk to the downside of asset prices is significantly lower than it was in 2017-2018 when central banks were trying to “rebalance” the global economy by tightening financial conditions with raising interest rates and quantitative tightening.

- Financial market volatility will remain in “choppy” price conditions.

- Inflationary pressures will continue to be understated.

- Interest rates will remain below the level of household inflation; lower financial demographic incomes will struggle to keep up with cost of living.

- Income from safe investments, like GICs and short dated bonds, will remain low and could trend lower; hard for traditional “saver” households.

- High dividend paying investments will remain an important part of investment strategies.

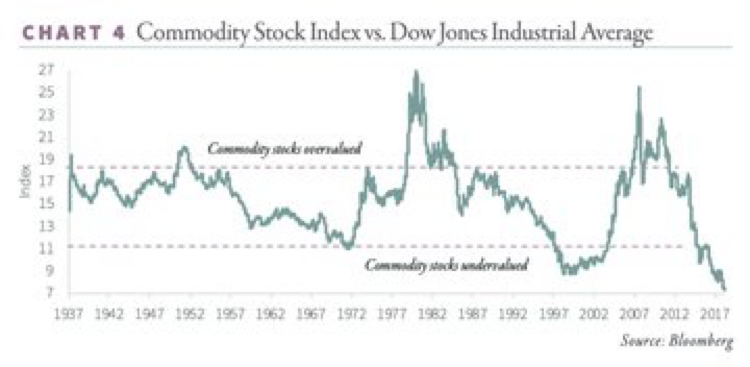

Inflation based investments may go from “being hated” to “growing in popularity” in coming years.

These are all broad themes and long term thoughts. They can all be debated and probably should be…

My invitation to you is to come in, sit down, and chat about how these themes impacts your personal household.

Rebalancing investment risks in 2019 has changed. It will be my pleasure to discuss these issues with you, and I extend this offer to include your friends or family if they want to meet. I’d love to set up a time to get to know them and give them some ideas that might help their situation.

Thank you for be patient with me and letting the time pass required to wrap one’s mind around the sudden changes of 2019.