This Is the Hard Part

What happens in the global economy during the next six months is going to influence our longer term investment asset mix. How central bankers respond to the global economy is going to influence it a lot more!

The global economy has cooled quickly due to the relatively small increase in interest rates and the lack of new monetary fuel because of Quantitative Tightening (QT).

As stock markets plummeted to end 2018, the central banks backed away from further interest rate increases, hinted that QT could be stopped and began rounds of Quantitative Easing (QE) again.

For the record:

- The Chinese central bank instituted “quasi” Quantitative Easing again in January via $336 billion Yuan monetary infusion.

- The European central bank backed away from starting to raise interest rates from negative levels in March 2019, pushing the timing out into 2021.

- The US Federal Reserve went from looking at three interest rate increases in 2019 to zero rate increases and threatened an end to QT.

This all happened in a 60 day window of time at the end of 2018.

What did all these central banks look at and see to incite such an abrupt turn around in policy and confidence?

Below are a number of charts that likely caught central banks attention:

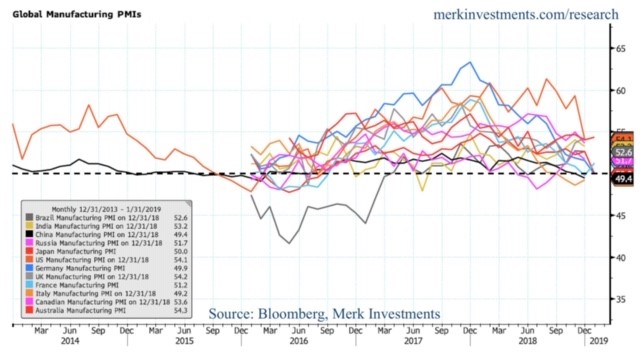

Exhibit A: Global Purchasing Managers Indexes:

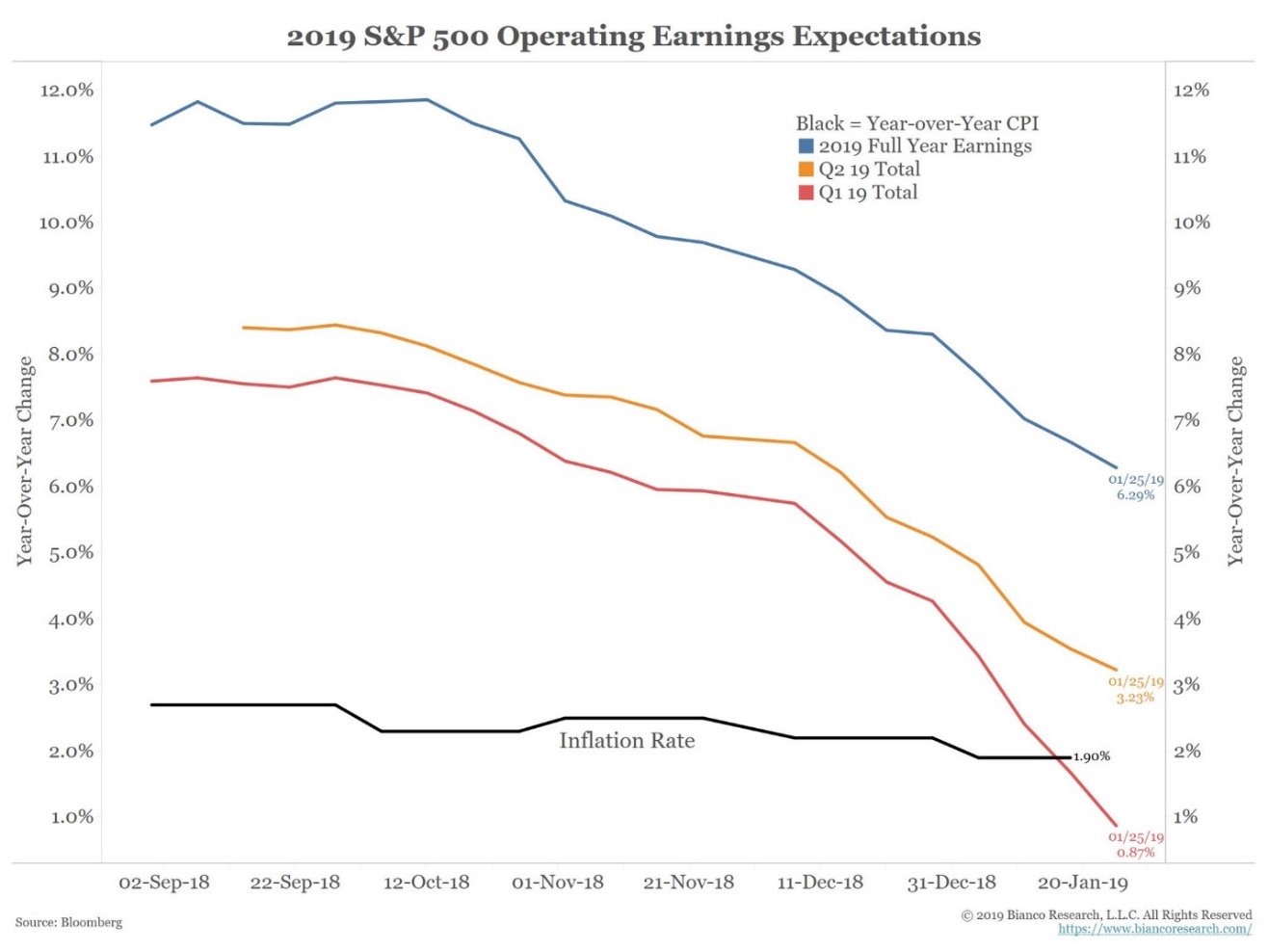

Exhibit B: US Earnings Expectations

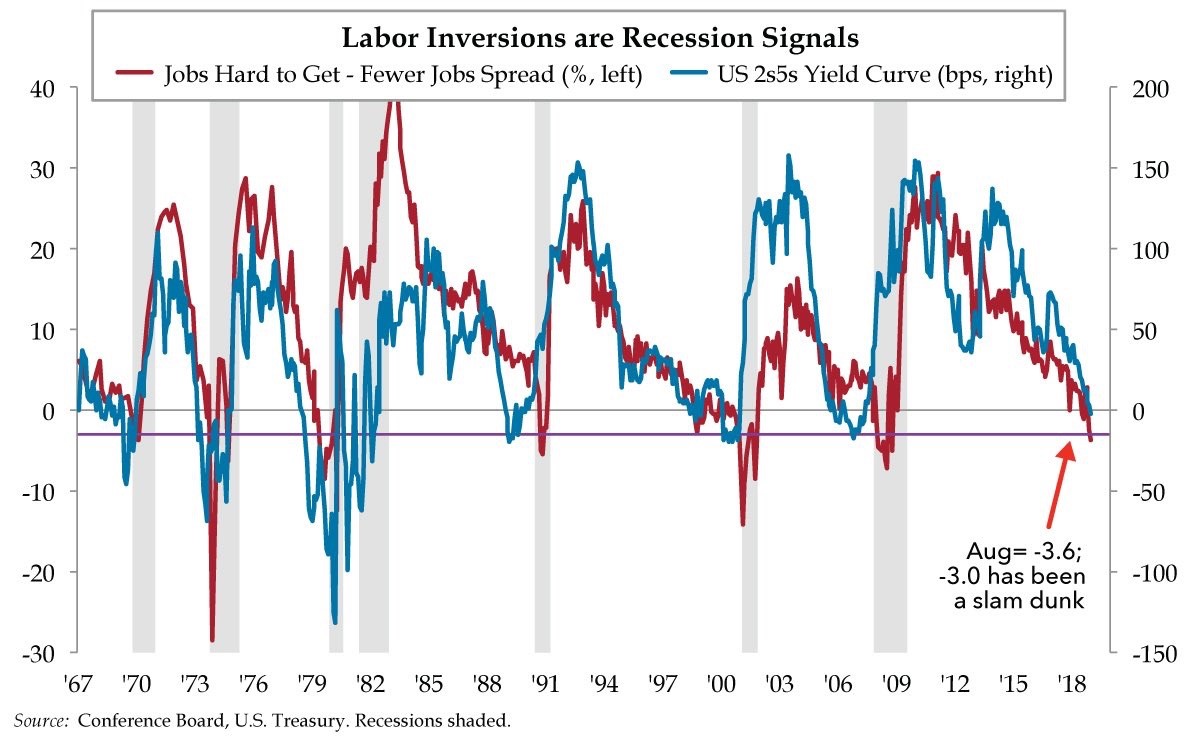

Exhibit C: End of cycle labour vs. yield curve inversion (Shadows are recessions)

Exhibit C: End of cycle labour vs. yield curve inversion (Shadows are recessions)

Exhibit D: Global Housing Markets

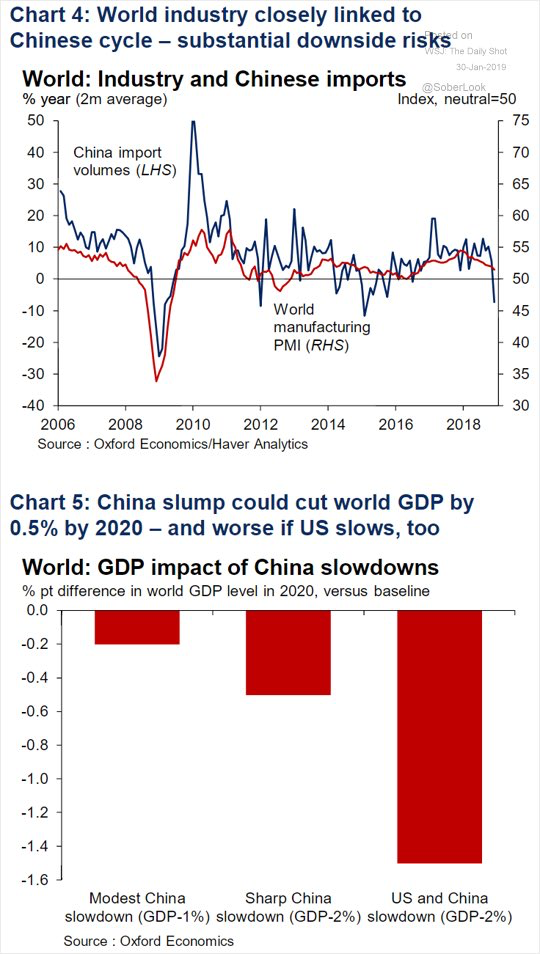

Exhibit E: Chinese Imports and GDP

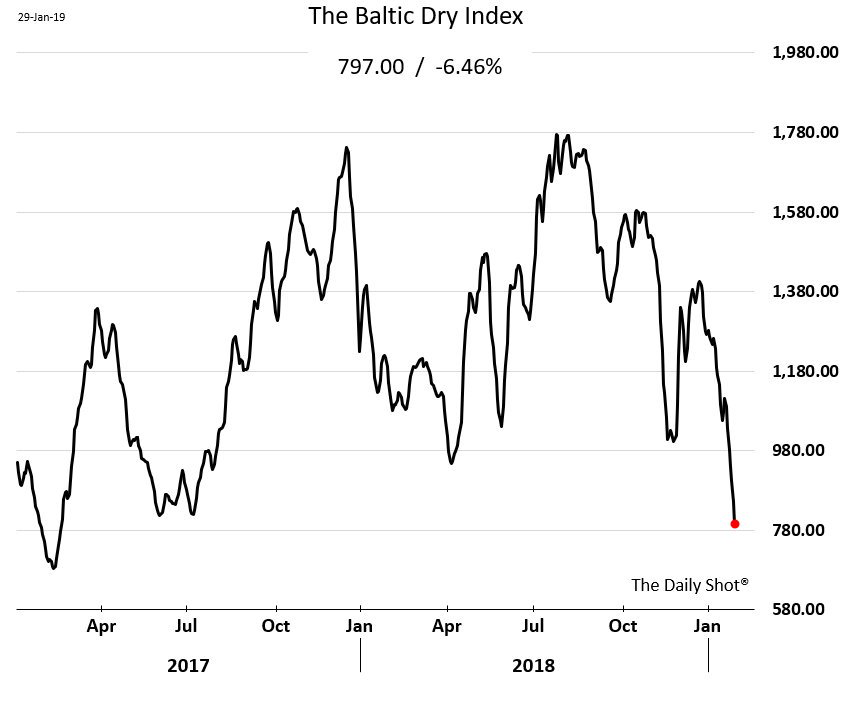

Exhibit F: Baltic Dry Index (Shipping of Dry Goods)

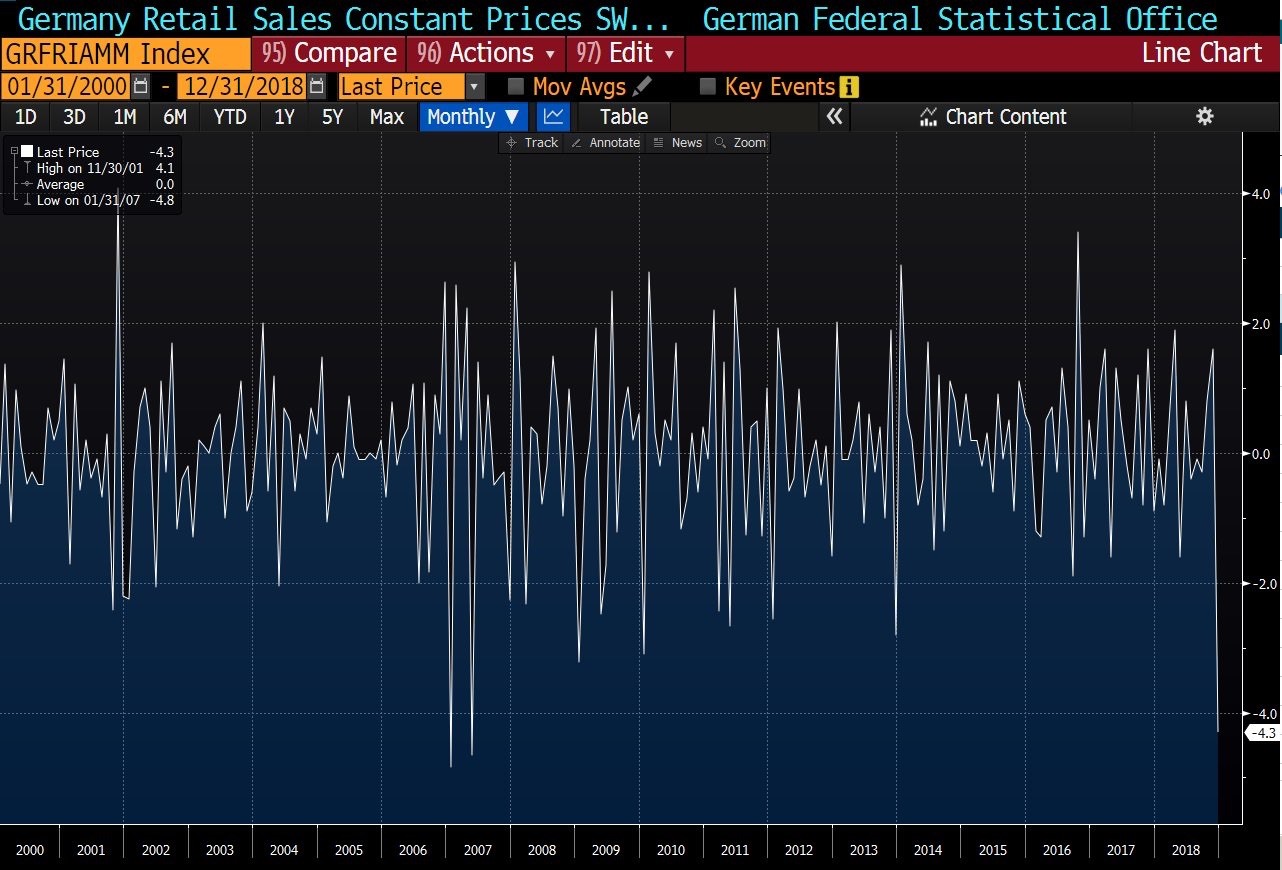

Exhibit G: German Retail Sales

It is noteworthy that Italy has actually slipped into recession at the same time.

These charts and headlines could go on and on.

What you need to understand is the stock markets interpret the global economic weakness as GOOD news.

Why?

Because it gives investors confidence that central banks will step up to the plate and print more money to support asset prices and keep the party going.

It is truly a perverse way to invest and trade, but it has been the reality of the past 10 years!

The ugly underbelly of the “bad news is good news” story is the massive growth in global indebtedness.

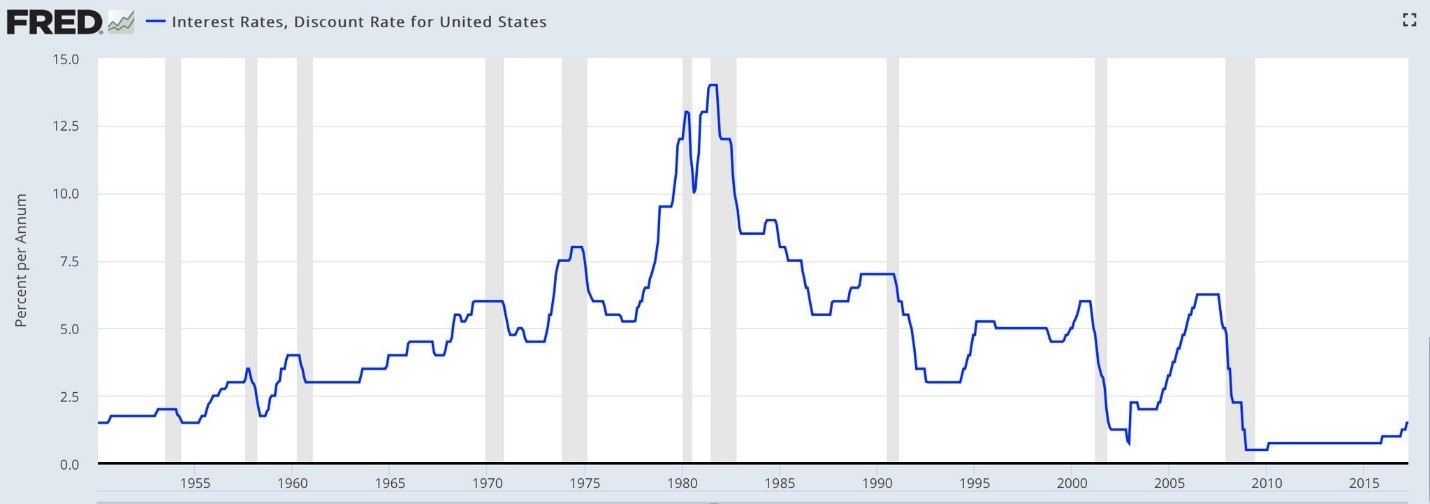

Every cycle the world goes through with central bank intervention causes there to be a lower threshold on the amount of interest rate hikes the markets can handle.

The chart below drives this problem home in graphic fashion.

In the present interest rate hiking cycle the US Fed has barely got back to the interest rate lows of the 2001 recession and the Great Depression years! And already they are calling it quits!

So let me pose a question to you.

What would you do if you were a member of the political/central banker “Team Elite” and you had backed yourself into a financial corner between the economic realities of the world, the huge and growing debt burdens, but you also had control of interest rates and money supplies?

Human nature being human nature…I guess we should not be surprised at huge debts and stagnating growth.

But how far do you think the central planners of our world are willing to go to keep the party rolling?

During the past 10 years the world has witnessed:

- The change from time tested Generally Accepted Accounting Principles (GAAP) to proforma accounting.

- The printing of money via Quantitative Easing.

- The manipulation of interest rates to NEGATIVE levels in some parts of the world.

- The purchasing of stocks and real estate directly by central banks. (Japan and Switzerland confirmed).

These are extreme measures and would have been unthinkable 20 years ago. They were supposed to be “temporary”…”emergency” measures.

And now…10 years later....

The central bankers know they are running out of ammunition to fight the next recession. They tried but can’t raise interest rates enough to get back to “normal” levels.

Central bankers know they will never pay back all the money they owe by collecting taxes, and they know the world is financially distorted with the elderly savers, middle class families, and young wage earners suffering the most while the wealthy have benefited.

They know they need a brand new plan that somehow draws those who have suffered back into believing “Team Elite” actually cares about them.

Academic think-tanks are already working on the newest and brightest narrative to infiltrate the media with and “nudge” your behaviour to a new more “confident” level.

Next week we will explore this idea and how it might impact the world going forward.

As a little teaser, its acronym is MMT.