It Makes Me Happy, So I Will

Entitled.

Often times, social media loves to use the term in reference to younger generations, but we as Canadians and Americans all live pretty darn entitled lives.

What I don’t understand is exactly where we decided to take the fork in the road that leads to an entitled mindset? Some might argue we are only following the example of our leaders. Who knows?

The fact remains that we have become a continent of entitled people.

One of the nuances that captures our present state of entitlement is that we view social rules and laws as “guidelines” that are nice to have but don’t necessarily apply to us.

For example, “I know there is a fire ban on right now for campfires but I can handle this fire and it won’t get out of control so I’m going to have a fire anyway.” No dude…there is a fire ban…don’t start a freaking fire!

Or, “I know that a left turn here is illegal and that is a good thing because it is dangerous but I need to turn left right now and my judgment is far superior to the average person so I can handle it.”

Or one of my favourites, “I realize I can’t afford that (you fill in the blank) but I really want/need it right now and my other assets are going up in price so I am going to buy it anyway.”

You get the picture.

One of the most memorable lines he used regularly in his posts was “people love to buy things they don’t need, with money they don’t have, to impress people they don’t like!”

Now that line really shows its date. Why?

Because stuff doesn’t impress people in the entitled world.

Think of it this way. Money became so cheap and easy to borrow that everybody who wanted to buy stuff just went out and did it.

…because you are entitled to do whatever you want and if anybody else wanted to have all that stuff they could just go to the bank and borrow a pile of money and have it! No big deal.

Hey, I’m not knocking people who choose to do this with their actual net-worth cash. You earned it and that is your purgative.

But, really, nobody cares anymore.

So where does this story intersect with investments and markets?

To be fair, I’m not totally sure it does. But I was thinking about how the world came to be a place where people could just go out and borrow insane amounts of money at very low interest rates and do whatever they wanted.

It wasn’t just people. Corporations and governments found they could do the same thing.

Last week we saw a crazy example of how out-of-hand this idea has become.

Elon Musk, founder and CEO of Tesla Inc. Tweeted that he intended to take “Tesla private at $420 US…funding secured.”

Now I am not even going to get into the securities laws that Elon ground into the dirt, made a laughing stock of, and basically said “these laws don’t apply to me.” I am going to stick to the money part of this story.

At $420 per share Tesla would be worth about $78 billion US. Where does Elon come up with this kind of money?

Just as a relative point, on May 18, 2012, Facebook went public with a market capitalization of $104 billion US. At the time it was considered to be a huge sum of money and how would the markets ever absorb this kind of new capital drain? Oh, how far we have come when a single board of directors feels it can secure nearly $80 billion to take a company private.

We will have to see if this feat can be accomplished, but in the world of Quantitative Easing (QE) all things are possible.

So now I cut to the chase….

The world of QE is coming to an end. Quantitative Tightening (QT) is nigh upon us.

RBC published this short comment and chart on Wednesday, August 8th:

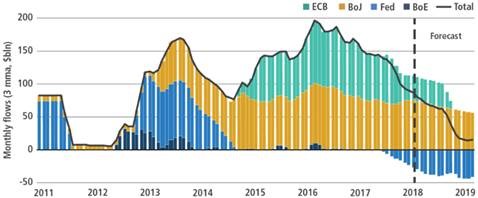

Chart Corner: QE to QT

- The long-awaited transition from quantitative easing (QE) to quantitative tightening (QT) is finally upon us. Global central bank balance sheets, which have been expanding steadily for nearly a decade as policymakers went out of their way to provide monetary accommodation to bolster economic growth and inflation, are projected to peak in the second half of this year.

- Perhaps more crucially for markets, the chart below shows that monthly asset purchases are on track to drop to zero by early 2019 from an average of around $150 billion per month for the past few years. As monetary policy support gradually wanes, investors should be mindful that one of the potential implications of the draining of liquidity via QT is that macroeconomic and financial asset price volatility is likely to normalize at higher levels than the benign environment that generally characterized the years when QE reigned.

Key statement: “Investors should be mindful that one of the potential implications of the draining of liquidity via QT is that macroeconomic and financial price volatility is like to normalize at higher levels than the benign environment that generally characterized the years when QE reigned.”

What this quote fails to mention is the higher interest rates that likely accompany QT because the net buyers of last resort (central banks) switch to be net sellers during QT.

Who buys all the expensive bonds now?

QT and higher interest rates together are the base of my thesis that as “volatility” increases…code for stocks and real estate prices fall…the central banks will find themselves back at the QE trough trying to pump up asset prices again.

My investment strategy continues to be to wait for lower stock prices to take hold and be a strong buyer on news of the reversal of QT back to QE.