Bullet Point Review

Canadian Dollar vs. US Dollar –

The Canadian dollar is finding it tougher to hold its value when measured against the US currency. This is becoming truer for a lot of currencies around the world.

Interest Rates in Canada and US –

Below is a chart of the Canadian 1 year and 10 year bond yields for the year.

The blue line shows the 10 year yield, the black shows the 1 year yield. Notice how the 10 year yield has been declining since mid-May where the 1 year has held near cycle high yields.

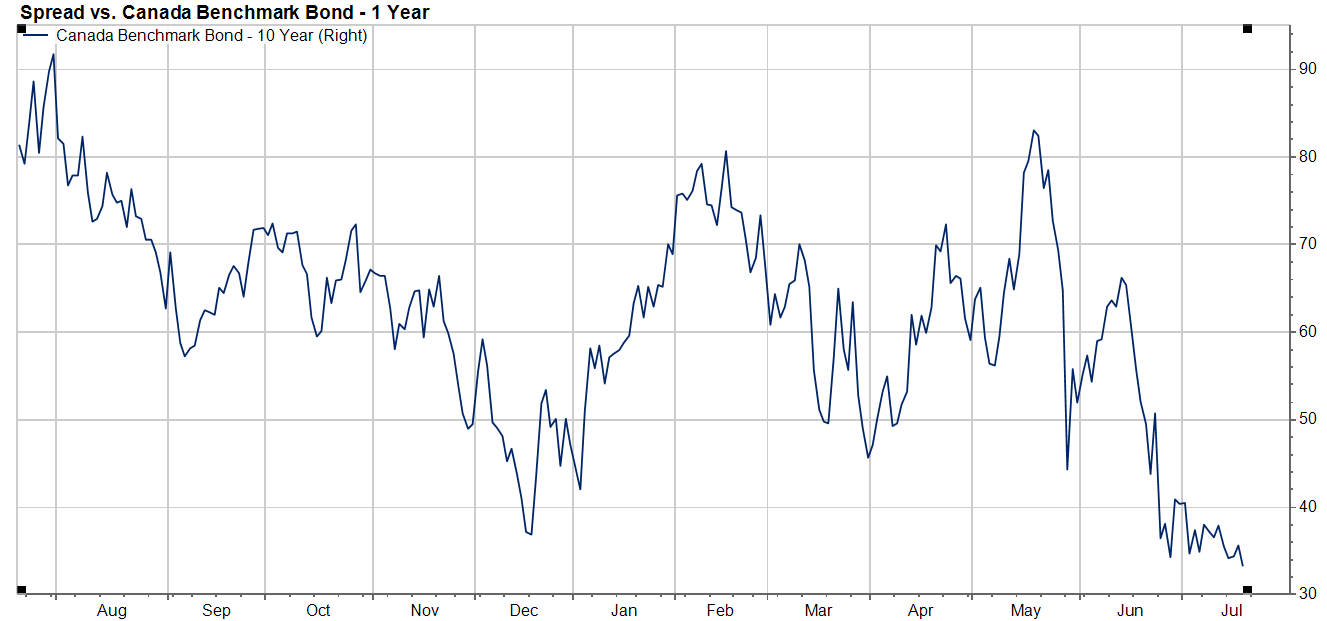

As you know I am most interested in interest difference when you subtract the 10 year yield from the 1 year yield. (Spread).

The spread is at the lowest level for the year as of Friday, July 20th.

Historically, when the spread goes “negative” we consider the yield curve “inverted.” This means that a 1 year bond yields a higher percentage than a 10 year bond. It has also been a historical precursor to a recession in past cycles.

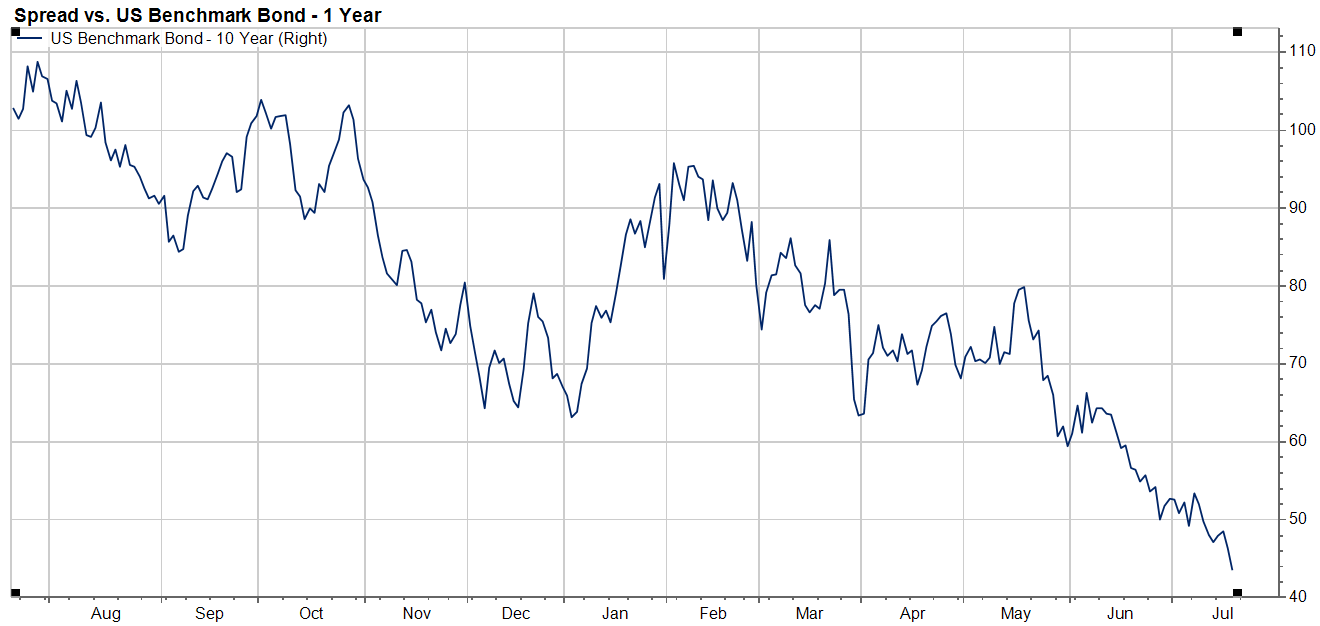

As for the US, I will just include the “spread” between the 10 year yield and the 1 year yield. As you can see, the same story applies.

Global Stock Market Gauge –

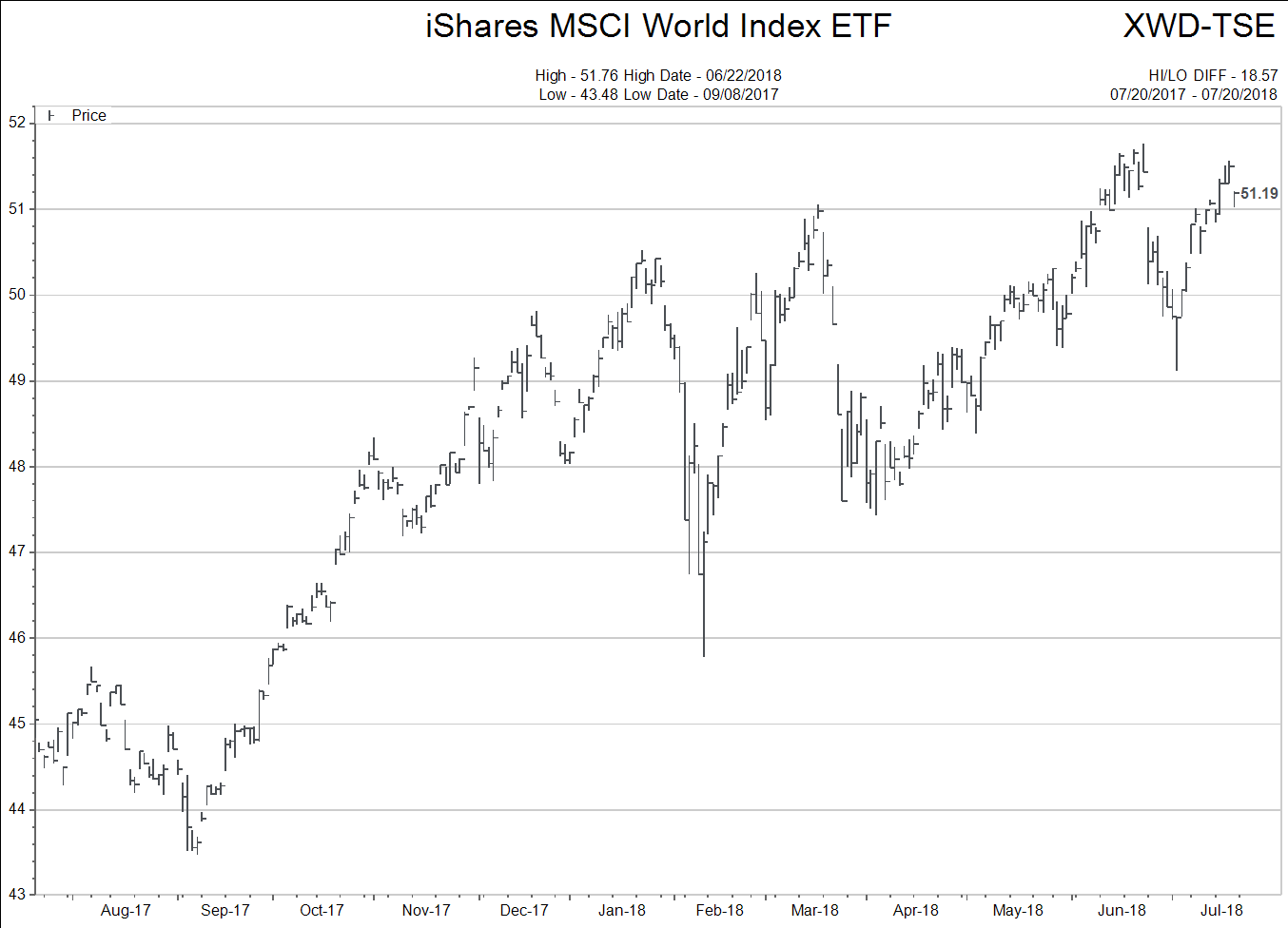

Instead of looking at Canada or the US, I decided to take a look at what a Canadian investor would have experienced if they had purchased a market-weighted exposure to a broadly diversified global basket of companies.

As you can see, the global returns for a Canadian investor have been fairly flat since the beginning of 2018.

Oil, Industrial Metals, and Gold (US$) –

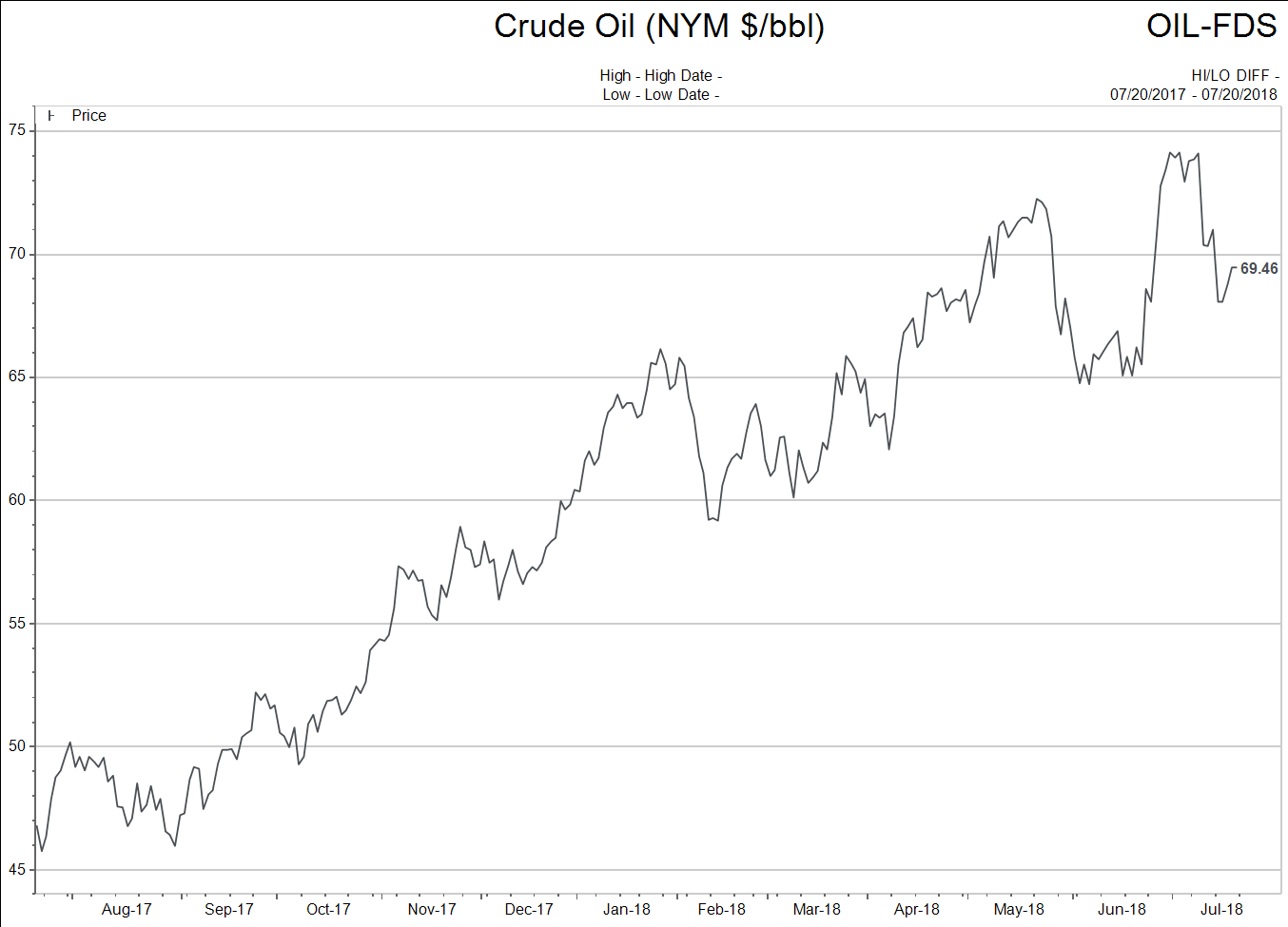

Oil (West Texas)

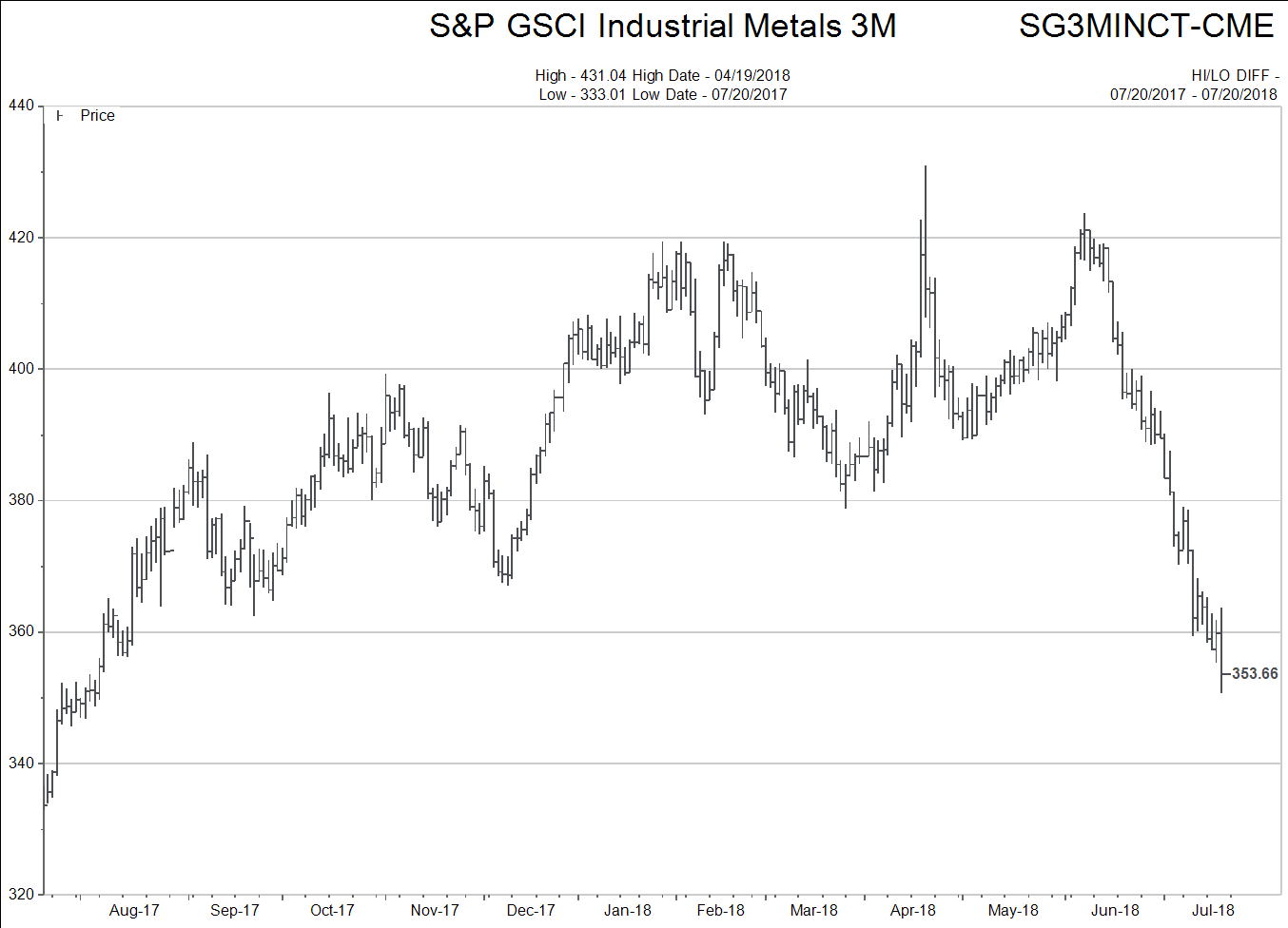

Industrial Metals

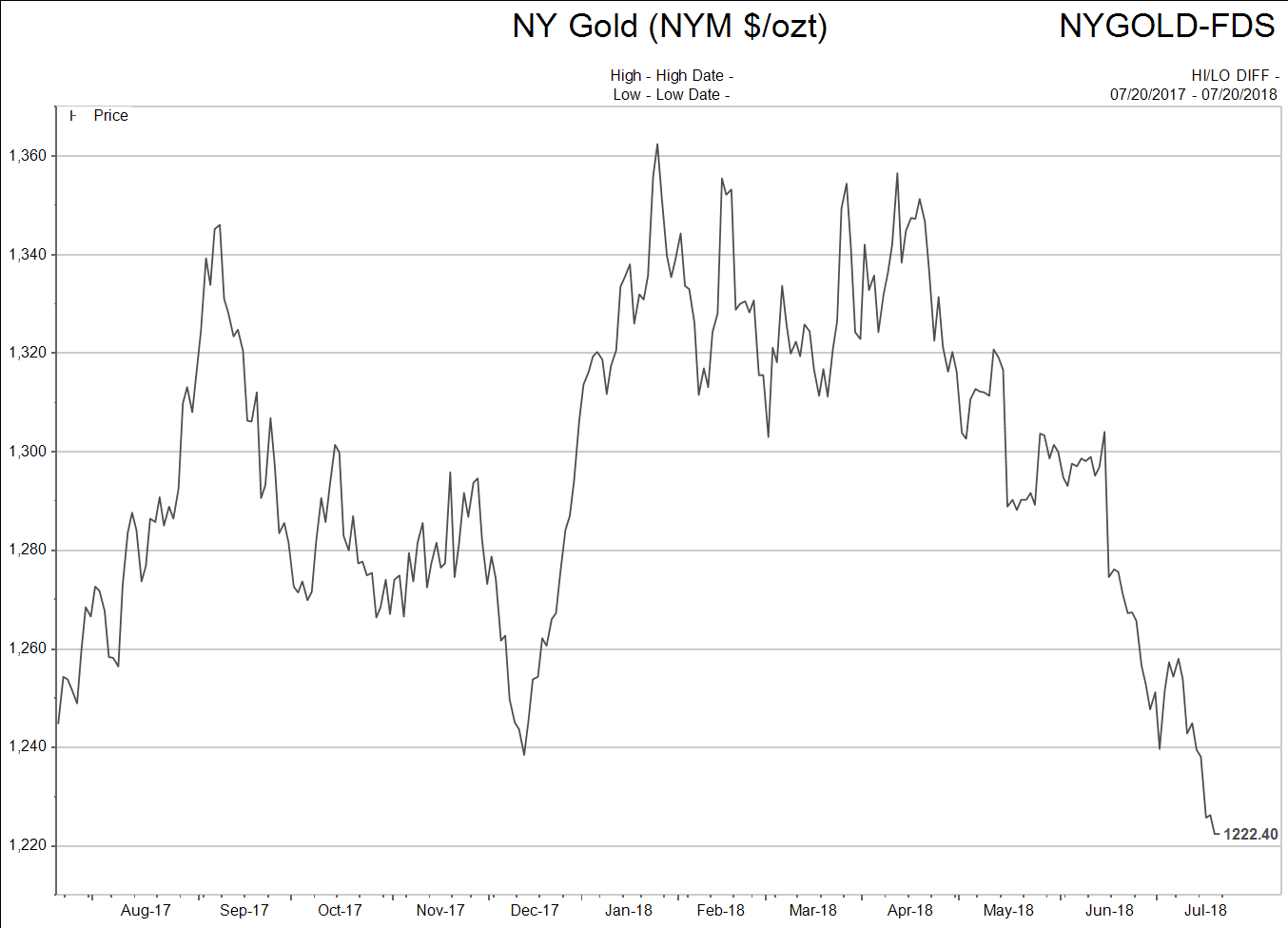

Gold

Gold

The downward bias of the metals charts makes sense against the backdrop of a strong US currency. But might there be more to this story when we include the yield curve “flattening?”

The downward bias of the metals charts makes sense against the backdrop of a strong US currency. But might there be more to this story when we include the yield curve “flattening?”

Maybe…

The company stocks that mine or extract these commodities have fared better than the commodities themselves. It will be interesting to see if the commodities drag these stocks lower or the stocks are signaling a turning point for the commodities?

I will include one more chart that Charles Gave of Gavekal included in his last update. It was entitled the “Recession of 2019.” Gavekal tracks seven proprietary indicators when calling economic turns. The following chart is one of these indicators.

Without overcomplicating the analysis of the chart above…when the **World Monetary Base contracts, recessions can follow.

**World Monetary Base is defined as US Monetary Base + reserves deposited by foreign central banks at the US Federal Reserve.

There is lots of food for thought in the chart above.

Summary –

It has been a while since we have looked at specific market trends. When we last took a peek at what was happening around the world it was noted that:

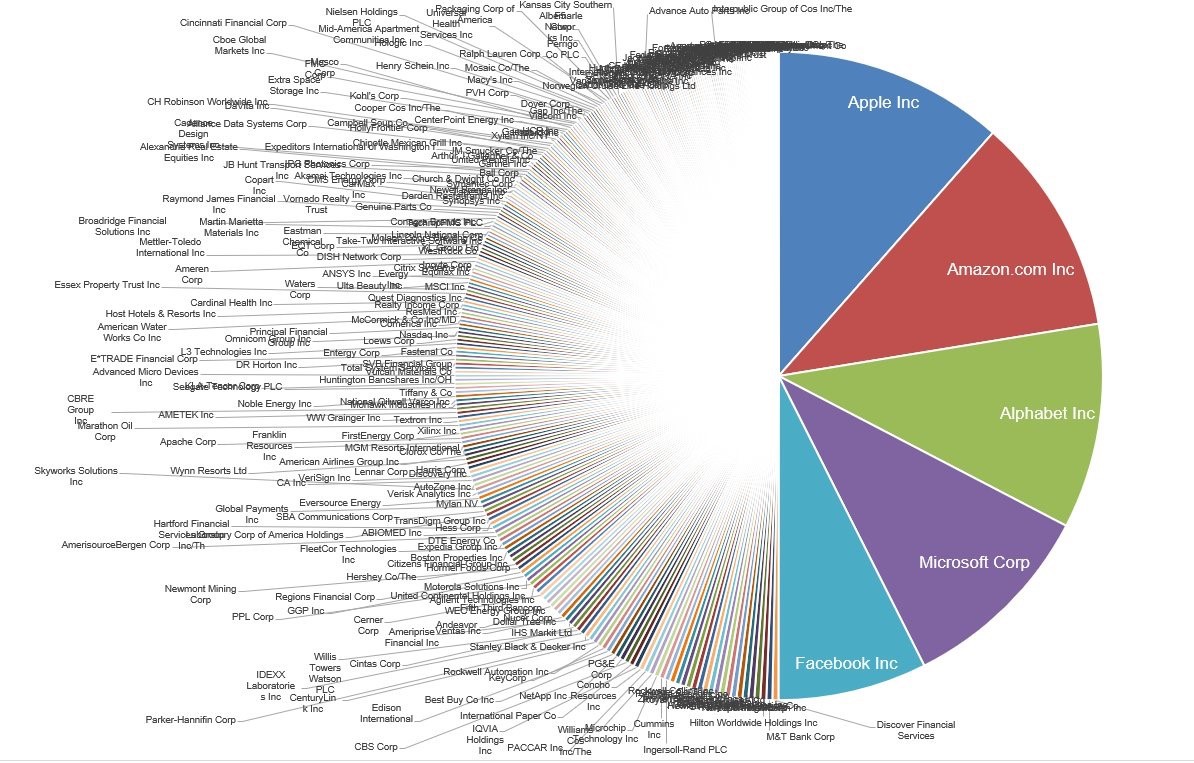

US stocks continue to outperform global stocks.

US outperformance is based on a NARROWER number of companies with very large market capitalizations carrying most of the load.

Of course, those are the FAANG stocks (Facebook, Amazon, Apple, Netflix, Google). If you want to review this idea please click on the hyperlink to read the segment from the prior weekly comment.

Check out this final chart to get an idea just how massive the FAANG stocks are in reality. What this shows is how FAANG is now equal in value to the bottom 283 companies that make up the S&P 500.

That is an amazing visual…

And with that visual I will move on to the next section of the weekly editorial where we see what mega-large sized companies can do in society with the gargantuan power and influence.

“Nudging”

My wife and I were away camping “off grid” the past seven days. By off grid, I'm referring to no running water, electricity, phone or internet access. When I started taking “off grid” trips last year I was a bit jittery for first day or so. Unplugging from our daily barrage of data seemed “unnatural.” Now I quite relish the thought of getting “off grid” and remembering what it was like to live life 20 years ago.

One of the essays I took to read on this trip was by a fellow named Brett Scott. It is a summary based on his book, The Heretic’s Guide to Global Finance: Hacking the Future of Money. I thought you might find his core premise interesting in light of your own “on grid” experience and behaviour.

Technology allows for subtle ways for behaviour modification that can be applied across the entire globe. “Nudging” is not new as a method of influence but how technology allows for it to be implemented is very new.

Nudging is a simple strategy. If a powerful institution wants people to choose a certain thing, the best strategy is to make it difficult to choose the alternative.

Let’s look at an example. Self-checkouts at supermarkets work nicely.

The underlying agenda is to replace checkout staff with self-service machines to cut costs. But supermarkets have to convince their customers. They thus initially present self-checkout as a convenient alternative. When some people then use that alternative, the supermarket can cite that as evidence of a change in customer behaviour, which they then use to justify a reduction in checkout employees. This in turn makes it more inconvenient to use the checkout staff, which in turn makes customers more likely to use the machines. They slowly wean you off staff, and “nudge” you towards self-service.

Banks are “nudging” in a similar fashion towards a “cashless society.”

Why?

For the same reason as supermarkets. Increasing profits by cutting labour costs. But there are more reasons too.

The “nudge” is to make cash less accessible. It goes like this…

First, the banks decrease the number of portals where cash can be accessed from. Fewer bank machines with higher user fees as well as few bank branches accomplishes this goal.

Second, the banks must vigorously promote the alternative which is debit and credit use.

The “nudge” makes people “learn” to want digital, and then “choose” to use debit and credit. I use italics here because the nudge is strongly influencing the choice. Nobody is out in the street running around saying “please get rid of the bank branches and bank machines.”

It is interesting how technology broadens the scope of “nudging.” The ability to “nudge” the cashless society is worldwide; never in history would that be possible before and now it is quite probable.

Finally, “nudging” is popular in politics as well.

Social media is in focus as being a powerful medium to change/influence public opinion. Data analytics create the easy access to individuals who are predisposed to certain types of nudging due to their online social media profiles and searches.

Personally, I don’t like the thought of being “nudged.” Especially when the “nudges” are coming from corporate sources, rather than government.

After reading this short section of the weekly comment, I hope you are more aware of situations where you are being “nudged.”

For those who might be interested in this topic, Brett Scott’s book might be of interest. For me, I just like being aware of what is going on.