Rate of Return Matrix

As of End of 2017

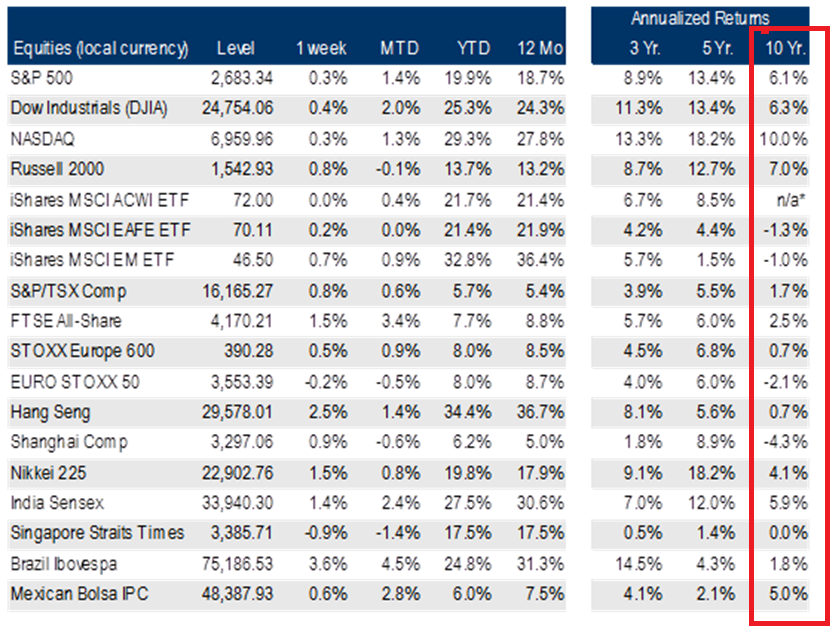

The graphic below shows the rates of return broken over different time frames to the end of 2017.

I have highlighted in a red box the 10 year rates of return for all the global stock market indexes shown. The reason I want to focus on these number is because they are the only rates of return included in the grid that contain the valuations from before the financial crisis 10 years ago.

Most of you reading this publication were investing way before 10 years ago so those rates of return are relative to your long term wealth growth. Maybe that is why the wealth effect so desired by the central banks has been so elusive when it comes to middle class investors?

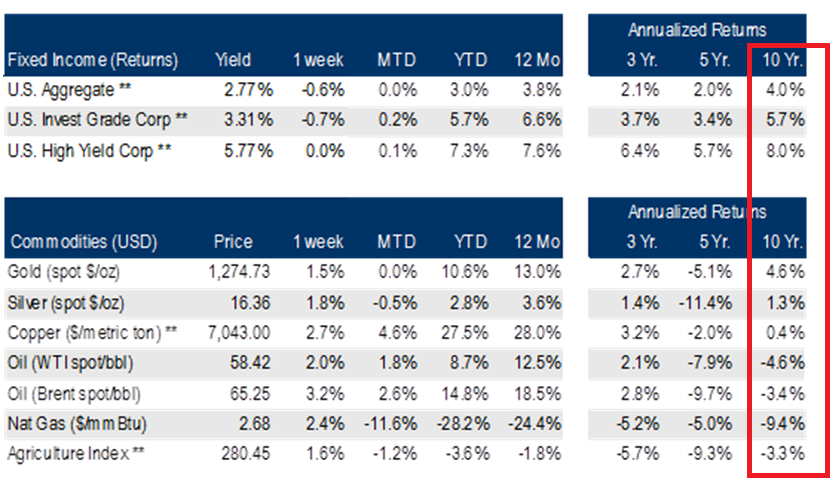

The next graphic shows the matrix of rates of returns for US bond investors and commodity investments.

In summary, the best returns over the past 10 years have been in US stock market indexes and almost all of the global bond markets.

The “un-Forecast” for 2018

Every year at this time it was my custom to do an annual forecast of financial markets. Not that I expected the forecast to be right, but it did provide a framework to view the financial markets from during the year.

At the end of 2016, the markets made no sense to me so I decided not to do a forecast.

Here we are at the end of 2017, and honestly, the markets make no more sense to me today than they did a year ago. (on a fundamental basis.) Valuations are still through the roof and pundits continue to fall all over themselves to justify the markets using stupider and stupider analogies.

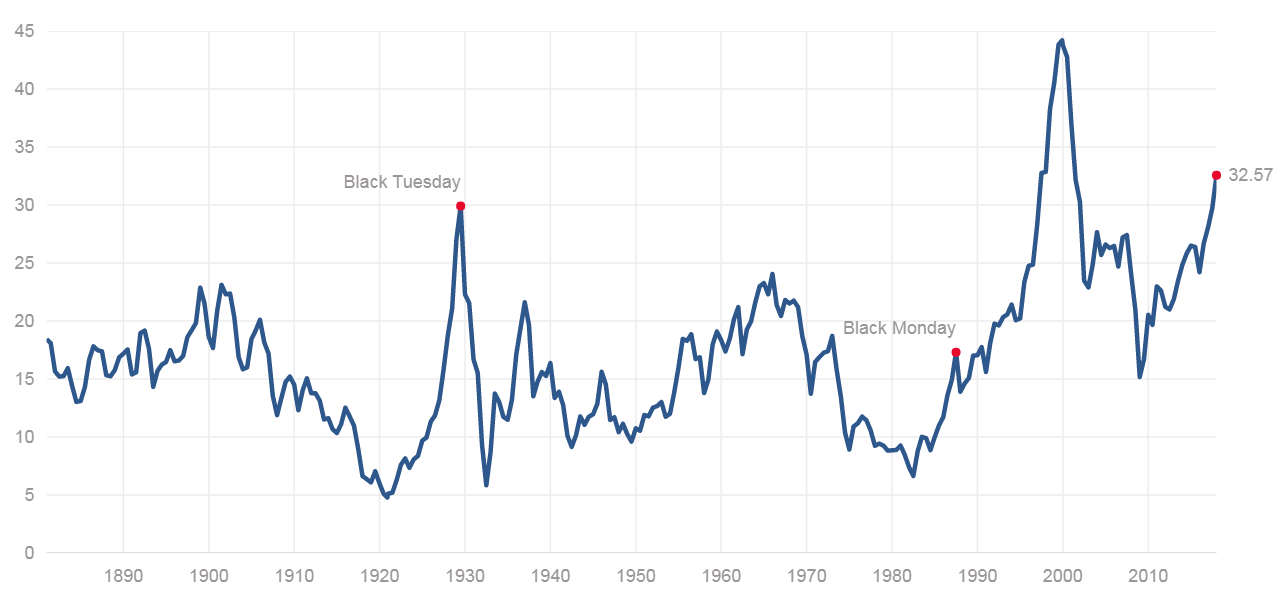

The following chart shows the long term Cyclically Adjusted Price/Earnings ratio as of Dec 15th, 2017. The present US stock market is at the second highest valuation in the past 130 years.

Therefore, my comment is going to look at 2018, from the lens of political policy and banking reform rather than financial market fundamental or technical analysis.

No matter how you feel about the presidency of Donald Trump, you need to separate your feelings about Trump policy and Trump personally.

In a summary statement, the Donald Trump policy has been sweeping, forceful and specific in direction compared to prior administrations. Like a “bull in a china shop” the Trump administration has focused on issues they promised to focus upon. The tax changes are the last key feature to be enacted in the US and they will be measurable.

I am going to put a different twist on the tax changes and try to make a point that could be extremely important in 2018.

The Trump policy package exacerbates all of the problems that were in the process of trying to correct themselves early in 2016.

On a global level, Quantitative Easing (QE) and manipulated interest rates employed by the Central Banks have distorted the financial picture as never before witnessed in human history. As 2016 progressed, the impact each dollar, euro, or yen of QE was diminishing. Central bankers kept telling politicians around the world they needed to do something on a policy front to take over from the QE policies and keep the party going.

The election of Donald Trump and his policy platform came as a God-send to the central bankers. They might not say that in public…but it is true.

But back to the downside of the Trump policy.

The challenge I see is that the US tax package causes the inequalities created by global central bank policies to run deeper and longer than would have been the case if Donald Trump was not elected.

To name a few:

- Debt and deficits are set to grow and expand under the new tax package.

- Inequality issues are still getting worse with the rich getting a lot richer, the middle class getting a little bit richer, and the poor getting poorer.

- Inflation pressures are growing and may be set to push interest rates higher in a world that can ill-afford higher interest rates.

The debt and the inequality issues are not market changing in my opinion. The markets have not cared about those issues for a long time and, even though some day the markets will care, they are not likely the issues that will change the direction of financial markets.

Inflation is another story.

The central banks have been clamoring for more inflation for the past 10 years, and Trump’s policies may give the central bankers all they want and a lot more!

As we begin 2018, it will be interesting to see how much impact the Trump tax package will actually have on the economy. The entire concept of the tax package is based on the old “trickle down” benefit theory of economics. The Reagan era of the 1980s was a good example where “trickle down” appeared to work. But 2017 is a totally different animal the 1980s no matter how one measures the global backdrop.

The narrative surrounding the success of the US tax package may become one of the key things to monitor in 2018.

Financial Planning for 2018

No matter what the New Year brings it is clear that the more representative your financial plan is of your financial goals the easier it will be for us to meet, discuss and maneuver to suit those goals!

Looking back at my business plan for 2017, I knew it was going to be the year of doing financial projections for people. The total number of projections done was 44.

My goal is to do another 30 financial projections in 2018.

If you are wondering what is entailed to do a financial projection please take a look at the Service Expertise Suite on my website to see some of the areas we will explore together and to watch a couple of short videos of clients who have gone through the financial projection process and what they got out of the service.

If this idea piques your interest, please contact me and we can discuss what might work best for you.

Themes You Want Me to Cover

Thanks so much for all the feedback and encouragement with our new website and content. Your input is appreciated!

What are some topics or themes you would like to see me write about in 2018.

Keep in mind that I am restricted from writing about specific stocks or industries on a publically reachable blog but broader topics are totally within the goalposts of what can be discussed in these writings.

If you have an idea that will likely be of interest to others, please email it to me and let’s see what we can put together.

Enjoy the start of 2018!