Against the Wind

Bob Seger released the ballad Against the Wind in 1980. He conceptualized the angst of the rebel heart growing older in the song by thinking back to running cross-country races in high school…that feeling of how much harder it is to make forward progress into a stiff wind.

One of the lyric packs in the song goes

Guess I lost my way

There were oh so many roads

I was living to run and running to live

Never worried about paying, or even how much I owed

Those words are likely reminiscent of how the US Federal Reserve feels about the past 40 years of choices that brings the global economy to its place today.

The world has entered a period of “stagflation.” The word was coined as a combination of stagnation and inflation. It simply means a period of slowing growth coupled with persistent, high inflation.

Historical eras of stagflation are not always problematic. They tend to be a symptom of long economic boom cycles that are in their late phase of expansion. The inflation component is wrung out of the cycle by raising interest rates and inciting a recession which, in turn, reins inflation back. The recessionary economic pause ushers in the new business cycle and the economy rebalances to healthy once more.

What makes this cycle significantly more challenging is that the global central banks “kept running against the wind” for so long. Instead of accepting the end of the business cycle in 1999/2000 or 2008 or 2020, they just kept lowering interest rates and printing more money to offset the natural resetting of the economy.

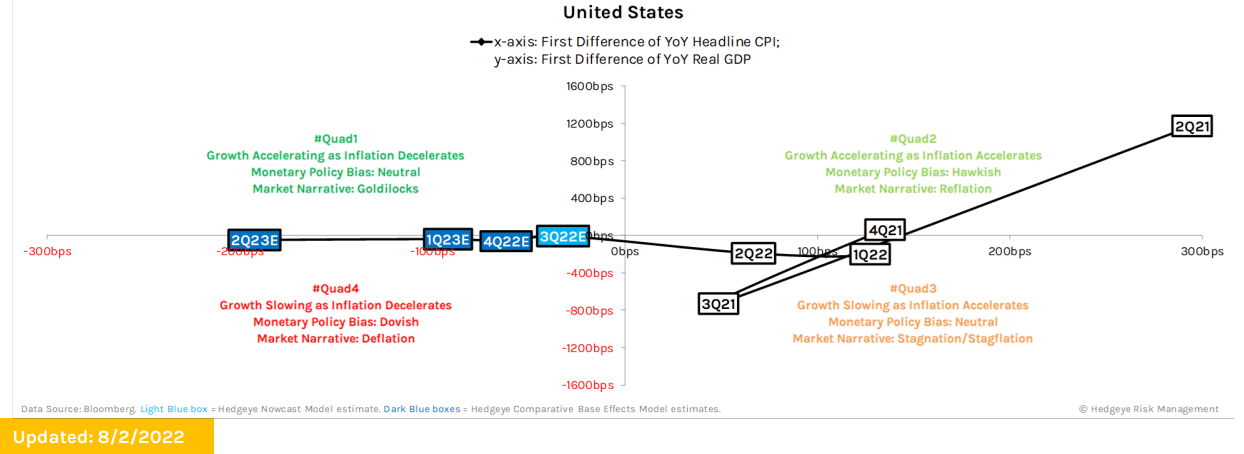

Below is a graphic depicting the economic pathway the natural business cycle travels. (Hedgeye, August 2nd 2022)

The business cycle begins after a recession and emerges in QUAD1. (You can read in the graphic how each QUAD is defined). The economy grows and matures into QUAD2 conditions then, as it ages further inflation accelerates bring along higher interest rates and the cycle moves into QUAD3. This is the “slowing growth with rising inflation stage.” Finally, growth peaks along with inflation and the economy transitions into QUAD4 where both growth and inflation decline.

The graphic shows the placement of 2Q21 as strong QUAD2. This was when all of the COVID support money was being taken up in the economy. A year later the graphic shows 2Q22 as solidly QUAD3 which is like the hangover after the binge.

Please notice where the next 4 quarters of forward data are expected to fall. The x-axis is plotting rate of change in inflation which is expected to SLOWLY ease (staying below 9% and finding a pathway back to 7% by year end) and the y-axis is GDP growth which is expected to remain right around zero. Friends, those four expected quarterly QUAD forecasts are the absolute definition of stagflationary conditions: Sluggish growth mired in persistent but slowing inflation.

Remember, the way to end stagflation is to raise interest rates. That is exactly what the central banks around the globe are attempting to do. But the present business cycle has more debt at every level of finance than any other period in history.

Therefore, the impact of higher interest rates is difficult to monitor in real time and creates inelastic economic conditions.

Epsilon Theory’s Ben Hunt (@EpsilonTheory) Tweeted the following thought after the strong employment number in the US on Friday last week:

Every US company saw the jobs report today and licked their chops. Carte blanche to raise prices as much as they like. This is what an embedded wage/price spiral looks like, and it’s why the Fed must engineer a horrible recession to wring it out…or they won’t, which is worse.

The worst part of the jobs report was the upward revision in last month’s wage increases. There is no rolling over of wages which means there is no rolling over of prices. Fed hikes to date have done nothing in the real economy. Nothing. We are light years away from neutral (interest rates).

Ok, there is a lot in that quote and some of it is economic jargon so let’s unpack it for a couple paragraphs.

Embedded wage/price spirals refer to the idea that higher prices lead to higher wage requirements, which drives prices higher again, which forces workers to lobby hard for higher wages, which leads to higher prices……

A recession will break this spiral because it lowers demand and increases unemployment. Workers have less leverage to demand higher wages and prices come back down with lower demand.

But it is a painful process for those caught with expensive assets and/or too much debt.

Ben ends his Tweet by saying the Fed is “light years away from neutral.” What does he mean by neutral interest rate? (For those who desire the economic definition please click on the hyperlink).

A simple definition is an interest rate that supports the economy at full employment/maximum output while keeping inflation constant.

So, what Ben is saying is, that interest rates need to go MUCH higher to meet the neutral criteria in terms of quelling inflation.

Now I see all those hands going in the air saying, “Hey, if interest rates keep going higher we will have a Depression, not a Recession and that would violate the first part of the mandate to support employment and economic output!”

Yup, you are spot on!

And therein lies the challenge of the present set of economic conditions the world finds itself in. How do central banks raise interest rates in a highly indebted world that has grown dependent upon low interest rates?

I don’t know…but we’re going to find out in coming quarters.

Let’s close this weekly editorial with another lyric from the Bob Seger song, Against the Wind. I would imagine this lyric describes another present day feeling of the global central bankers.

Wish I didn’t know now, what I didn’t know then

Have a good weekend…