Some Perspective on

Interest Rates

Unfortunately much of what gets printed by the media around interest rate policy does not help one understand WHY rising interest rates have such a broad impact on the economy. When the entire planet is trying to lift interest rates at the same time it makes the topic even more important to grasp.

Let’s begin with an analogy.

Imagine you were living on an island with a community of 100,000 people. There are bridges to the island so things can be imported via truck but no airports or deep sea docks since the island was too small and the waters around the island were filled with reefs and too shallow. The island is dependent upon the outside world for a lot of its needs.

From the beginning everyone on the island knew that the risk to island life was that 90% of the land mass was less than 30 feet above sea level. If the waters ever started to rise, much of the island would quickly become uninhabitable.

The belief was the waters would never rise higher since there levels were controlled by the keepers of the bridges. The keepers had stated they would do whatever it takes to keep the waters at levels that the island’s life and economy flourishes.

As decades rolled along the natural levels of the sea were rising. The keepers had to add more levees and pumps to control the waters around the island. There were a couple of times of crisis where the levees were threatened so the keepers decided to buy themselves some time and lower the seas to much lower levels than they would naturally have been at. This way, if a levee started to breach, they had more time to act to save the banks and protect the island’s economy and people.

Then the keepers realized something else happened when the lowered the waters to unnaturally low levels: The island grew its land mass and there was more land to expand into.

The islanders and the keepers figured they had found the secret to great prosperity. The lower water levels worked to create an even more vibrant economy and enriched the islanders.

But the process of keeping the seas unnaturally low was not without side effects. As the levees grew larger they became more unstable. The pumps and ducts required to manage the seas grew more costly and complicated. The resources required to keep the seas at very low levels were far greater than the resources available, so they had to be borrowed.

And the island itself was running into problems. The wealthy islanders were reaping a far greater benefit from the newly created land areas and their development than the average citizens. Inequity had been growing for years but was now at the point where the islanders were getting restless. The seeds of revolt had started to sprout.

The keepers decided it was impossible to keep the seas at these unnaturally low levels. But they had some questions to figure out.

- How do we let the seas come back up again without economically wiping out a large part of the island population?

- How do we know the level at which to stop the seas from rising again?

- How do we know we will even be able to stop the seas from rising again? (A huge volume of water now resided outside the levees).

The decision was made. If the keepers did nothing, the seas could potentially wipe everyone out if the levees broke. Yes, there was going to be damage but the keepers decided to let the seas return to a more natural level.

Let me stop there for a moment. If you can see the “seas level” as the level of interest rates and the “island” as the general economy, you start to get a feel for why it was so hard for our leaders to back away from artificially low interest rate policy.

Low interest rates and high levels of monetary liquidity created a greater level of demand and stronger economic growth than would have naturally been present. Just as the size of the island grew in our analogy, the size of the economy grew beyond normal parameters under supportive monetary policy.

Our analogy ended at the place where the world found itself in November 2021. Supportive policy had created so much demand that raw materials and resources were in short supply. Add to the short supply dynamics a war in Ukraine that shuttered supply chains via both production and sanctions, and we find ourselves in a position where a slowdown is required to rebalance the economic engine.

Does all of the above help you make sense of what we are seeing from the central banks of the world? The mistakes these central banks made are not happening right now in terms of how high interest rates are going. Their mistakes were made for how long they kept interest rates too low and liquidity too high.

Like our analogy of the island economy, the pumping of the water and the building of higher and higher levees without considering the resources it was taking to maintain those level and what was happening to the islanders was the mistake. It was not deciding to let the waters go back to more natural levels.

Below are some number Markus and I cobbled together considering how significant of impact the higher interest rates are having on real estate affordability. (All figures assuming an $800,000 mortgage).

Variable Rate Mortgage at Lowest Level: 1.35% Monthly Payment: $3143.00

Variable Rate Mortgage today: 4.00% Monthly Payment: $4223.00

5 year fixed Rate Mortgage today: 5.35% Monthly Payment: $4814.00

To view this data as most potential homebuyers would view it you would say that, with a monthly budget of $3143 to spend on a mortgage payment, the potential buyer can now only borrow $525,000 at a fixed interest rate of 5.35% as compared to $800,000 with a 1.35% floating interest rate in 2021.

To wrap this comment up, let me be quite blunt about what our own Bank of Canada is doing.

After the 1% increase in the Bank of Canada rate last week they have made their intentions clear: They desire lower asset prices. They want your house to be worth less. They want your stock portfolio to be a lesser value.

Why?

Because they want you to curtail your spending. They want you to save rather than consume. They want to let the markets balance out to where buyers and sellers are more evenly matched.

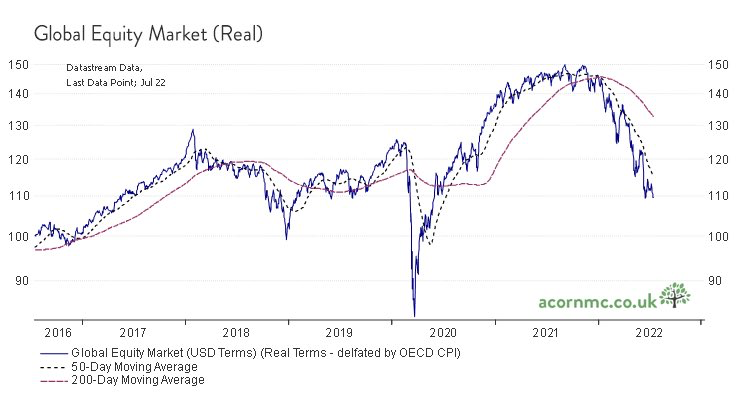

The charts below show they are succeeding at making this happen.

These are unique times. For the duration of my career there have only been 3 instances where the central banks in North America were trying to slow things down by raising interest rates and contracting liquidity. Each ended in a recession.

The present attempt is GLOBAL and it is coming in the face of already contracting economic data!

Please remain patient in your investment choices. Give things time to work themselves out and stick to your/our process.