Investment Advice

The changes experienced our world in the last 10 years are utterly unprecedented.

History is full of moments when something suddenly changes and the world starts down a new path, yet the rate of change today is accelerated by technology. Changes that used to take place over decades, now take place within a year, sometimes mere months.

Most of you reading this blog share the following attributes:

- You are investors, or at least very interested in investments,

- You are wealthier than the average Canadian, and thereby, in the wealthiest three per cent of the world's population,

- Your wealth is not the most important thing in your life. Your health and family are exponentially more important to you, and/or,

- You are concerned about the future direction of our lands and culture.

Most of the blog posts here are about investing and money, which makes sense since this is the service I provide, and I promise to get to that, but this first section is going to stray away from the menace of money and waddle into a few thoughts about life in 2021.

The picture above, shows the morning sun cresting over the trees at our farm, taking the September crispness out of the air.

The cows, mulling about, begin their morning pursuit of pasture grass, which will culminate into an afternoon of lounging beneath the cherry tree, chewing their cud.

The mist will soon be gone and the reliable cycle of nature will repeat itself for another day.

You can easily imagine the smells and sounds that accompany such a picture.

There is something that elicits the feeling of consistency in my soul when I see such a setting, smell those smells and hear those sounds.

The act of re-centering ourselves is important at any juncture of history, but has proven to be exceptionally important in 2021.

Our farm is where I can clear my thoughts and see through the daily distractions.

For you, maybe it is a picture of a child, grandchild or dear friend that centers your thoughts away from the cares of today. Maybe it is the thought of visiting someone soon and hugging them again rekindling all that has passed between you, or maybe you are struggling to hold onto anything at all right now to make you feel whole the way you once felt.

There were not a lot of changes that needed to be made to portfolios, so the month of September has been a perfect opportunity to do an end-of-summer reconnect.

Since the first week of September, I have been running through the Rolodex and chatting about whatever you wanted to chat about.

Of course, many of you told me about what you were feeling about your money and the financial markets. We also talked Canadian politics since there was an election going on.

What I cherished most from these conversations was how you shared about what you are feeling inside right now.

You shared dreams, goals, concerns and fears.

Some of those things were related to your “net worth” and “asset valuations,” but mostly how those things were related to the more important aspects of your lives: Health, family and the future.

The most common concern was centered on the generational wealth inequality and how it was impacting the life plans of children and grandchildren.

The idea that young people today do not have the same opportunities by choosing mainstream life-paths to stabilize their family situations was a similar theme.

To offset this problem, many of you are helping your family financially, but realize it is akin to the old proverb: giving a fish to someone feeds them for a day, while teaching them to fish feeds them for a lifetime.

Continuing with the metaphor, we also tended to discuss that the methods of fishing have changed and we don’t even know how to teach our loved ones how to fish in the world today.

My encouragement to you is to do the best you can.

Take the time to share with your family and listen to what they really value versus what you think they value. Sometimes in the listening, we learn our children and grandchildren are happy not following the path we believe they are missing out on.

Let me share the best investment advice I can ever offer you.

Take time to push back the daily distractions and concerns you have and invest in your personal health and wellness of mind.

Invest time in yourself, family and friends.

Share what you feel with those around you, and try to reconnect to what you value most deeply.

No question this can be difficult to do when your worries are staring back at you every day.

This is never to downplay your worries; the idea is to rein them in and put them in that place where all the other good things in your life can push past the clutter in your worry closet.

Seize the day.

The Fed Speaks

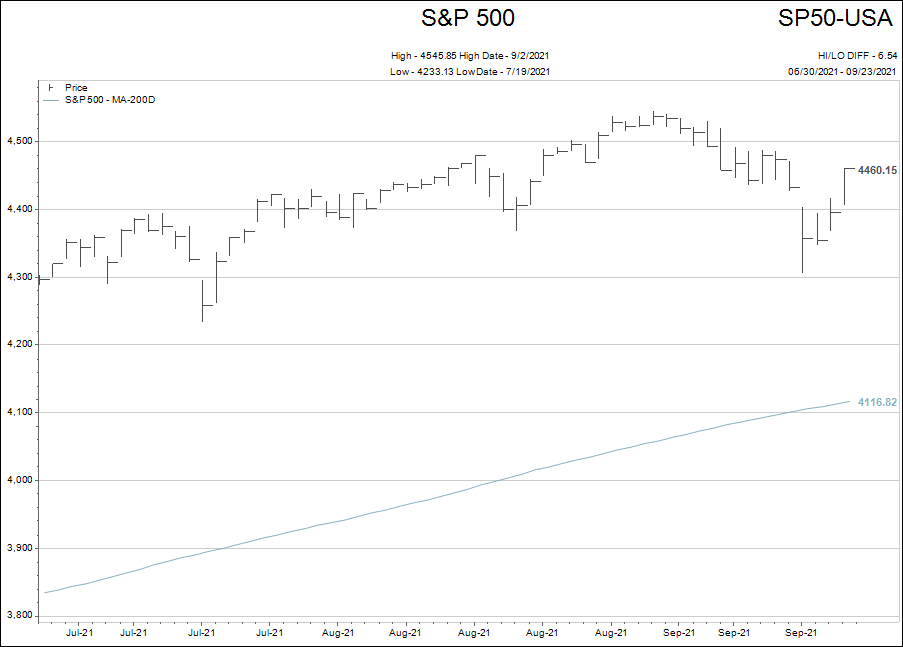

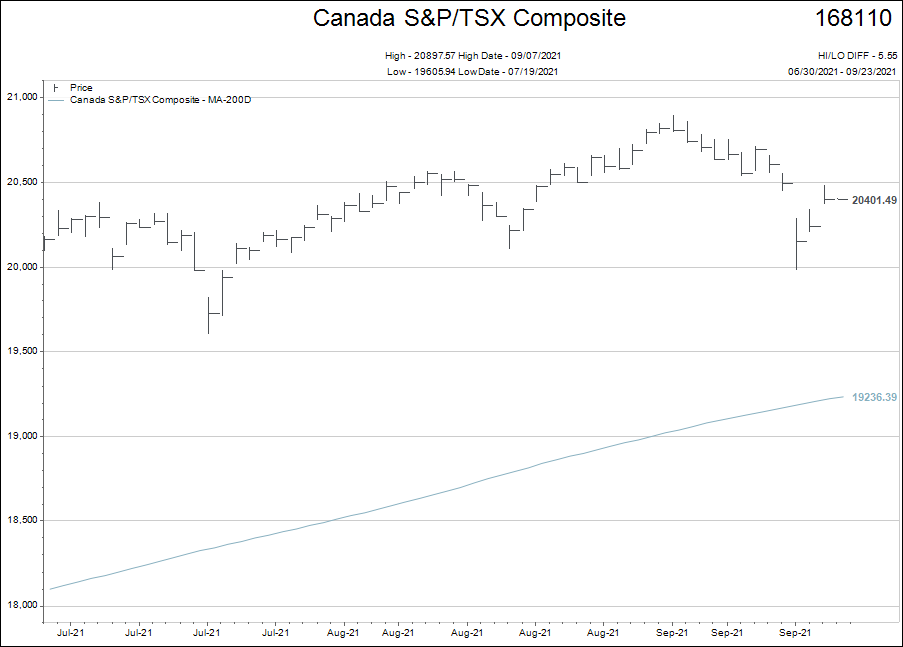

Financial markets have started to discount the reversal in central bank support.

This week, the US Federal Reserve continued along the path to set in place a “tapering” of financial stimulus and towards slowly increasing interest rates.

The Fed missed the mark of actually outlining a timetable to tapering in the formal statement from the meeting, but they did hint at a timeline of tapering, while failing to mention a start date.

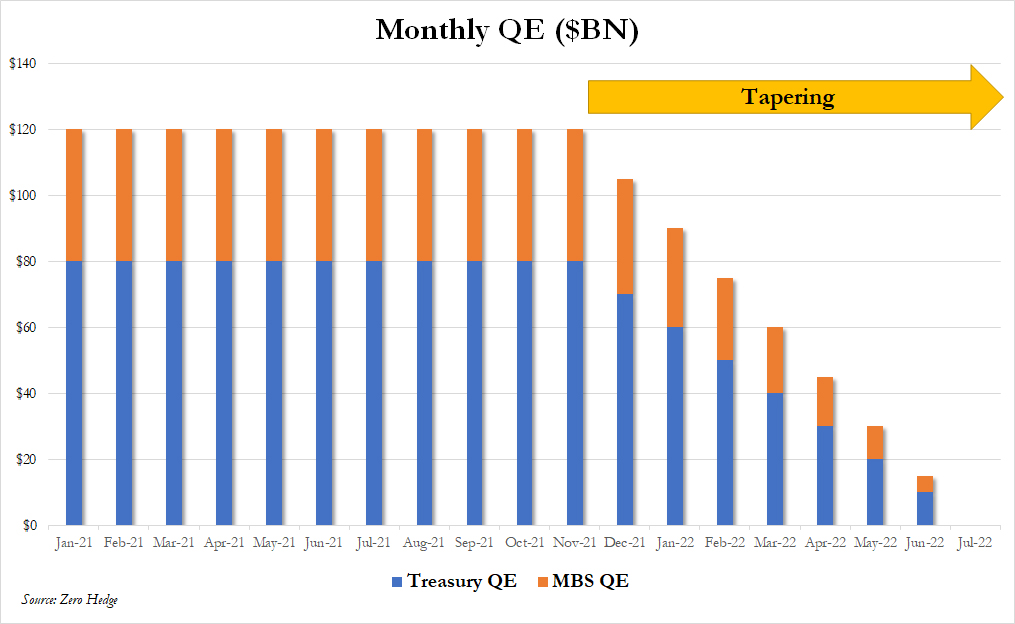

The chart below is from Zero Hedge, and needs to be taken with grain of salt.

In my opinion, the Fed appeared, in this meeting, more trapped in their policy than ever. It knows what it has to do and why.

There is only one good reason why the central banks are finally starting to rein in liquidity: Inflation is high and persistent.

With asset valuations as high as they are, central banks will tread carefully.

From an investment perspective, the Fed gave life to the rally in markets by its soft approach to taper.

I am reminded of the old story of “Canada Bill” Jones gambling in a rigged game in a small town.

When Canada Bill was told the game was rigged against him he famously quipped: “I know but it is the only game in town.”

The central banks have kited asset prices higher for decades with loose monetary policy.

There have been none to stand against them in their policy pursuit, since the politicians like it, business like it, and the wealthy, influential people like it too.

But high inflation causes two significant challenges to society:

- Food insecurity

- Housing insecurity

When the average person is insecure, society can become destabilized.

Central bankers have always known high inflation was a risk of their actions, and despite their words, it remains to be seen if they are truly serious about reining it in this time.

The Fed meeting this week raises suspicions about their courage and nerve.