Late-summer, morning sun painted her profile gold as she sat on her back step, starring out across the Straight to the mainland. Closing her eyes, she started daydreaming to the neighbouring children’s laughter.

What a blissful cup-of-tea, steeped in a salty sea breeze.

She was grateful in that moment, for every challenge and “learning opportunity,” she had stumbled through since returning to her Island home.

She was grateful for an engaging, stable career with wonderfully supportive management and mentors, both colleagues and clients.

She was grateful for COVID, and being alive to be part of the epoch shift that it’s ushering in, as we all adjust to our “new normal” lives.

Five-years-ago she’d come in pieces. Escaping the world to recover from a life shattering punch to the gut.

Her marriage and career were terminate by a knockout blow delivered in a note left on an old kitchen island.

Standing alone in an empty, half-renovated, country home on the outskirts of Guelph, ON, she longed to be back on Island time, where she could breathe and maybe heal.

Divorced, unemployed and needing cash fast, she picked up two full-time serving jobs to pay her high-interest “wedding” credit card debit, student loans and expenses, while saving every other nickel she earned to move home.

After a few months and a 5,000 KM drive with her beloved D-cat, she backed into a light pole in the otherwise empty parking lot, in Duncan at midnight.

Her sister had given her the wrong door code and locked her out of the house overnight, but at least she had made it to safe harbour and was finally home.

Serving jobs are hard, but fairly easy to come by.

When managed carefully, the money is enough to make ends meet for a single person household.

One afternoon lunch rush, an eccentric Greek restaurant owner, took offense to how she’d carelessly tossed a billfold down on the server station, and that was enough to immediately fire her…until he realized that she was his six-day a week opener.

Given that, she was granted two weeks’ notice, and she was grateful for them too.

In those two weeks she was rehired, but had already reset course on a familiar, but new career path in the investment industry.

Getting to know who’s who; which clients go by their middle names and the pronunciation of some of your last names, has taken some time, but thank you for your patience.

While most phone conversations with clients are transactional, there have been many more that will not be forgotten.

Thank you for trusting me, not only with processing your requests, but to be a sympathetic and listening ear on some of your worst days, or your emphatic cheerleader on some of your best.

So where does my response to Nick’s rant begin?

Why on Earth have I wasted your time with emojis and a silly meme last week, only to present you with an excerpt from the personal life of your Investment Advisor’s associate this week?

It begins here.

Having tried unsuccessfully, for the last five years, to buy my first home on my own, I have found myself a renter.

Being a renter has afforded me the chance to get my feet back under me, and back into a comfortable income range. This is where ends are meeting; there’s enough for monthly savings and an occasional spa splurge.

Hello from the thinning margins above poverty.

Poverty comes back to politics, and this is the most wonderful time of the year, for fellow political junkies, even if its timing during a pandemic is questionable.

While politics is a topic out of our wheelhouse, sometimes it’s relevant to the conversation. Particularly, in this instance, when we’re looking at the housing crisis, which has emerged as one of the top election issues.

The below commentary is not representative of RBC or its subsidiaries position on any political party, position or candidate.

The views below are strictly those of the writer and are intended to be a little tongue-in-cheek. This is not a support or attack of any particular party, platform or candidate.

With a snap-election called for the end of September, national party leaders are publicly presenting their platforms and—often elusive—promises.

At a campaign event Tuesday, Trudeau offered up $6 billion in spending on housing infrastructure; a foreign buyer’s ban and a new tax-sheltered savings account for first-time home buyers.

Great! Except future housing infrastructure takes time; foreign buyers aren’t nearly as big as a threat as institutional corporate buyers, and buying power is diminishing as inflation eats away our pay cheques, at rates far greater than budgets can sustain.

For most renters, there will be little to no cash available, at the end of the day, to deposit into this fancy new investment vehicle, just like there wasn’t enough cash on hand to make this year’s $6,000 TFSA contribution.

So, next?

O’Toole tabled his housing plan last week, which is well intentioned, but selling off government assets can only be done once; deferring capital gains taxes for landlords won’t—in the end—house any more people, and giving poor people easier access to higher amounts of debt for larger mortgages further seals their fates, so far as monetary wealth generation is concerned.

Besides, it’s hard to take the, “I’ll balance the budget,” line too seriously, since it doesn’t really matter in any way, shape or form in these fledgling Modern Monetary Theory (MMT) years.

Next!

According to an August 21, Global News article, “NDP Leader Jagmeet Singh has promised to build 500,000 affordable homes across Canada over the next decade—if his party is elected—and promises to implement rent supports for families.”

Okay, so housing in 10 years is good in 10 years, and rent support would be amazing, but what will this mean for middle income earner wages?

Will corporations see this as an opportunity to freeze them?

What are the lasting economic effects of going all-in on MMT? How deep is that rabbit hole?

Interesting propositions, but next!

.

.

.

NEXT?!

.

.

.

Hello? Green party? That was your queue…guess we’ll have to Google this ourselves.

While we wait for all the party leaders to add to their bountiful election promises draped in rhetoric, where does this leave us?

Earlier this month, the C.D. Howe Institute Business Cycle Council announced that Canada is no longer in recession.

“It’s (been) one of the most unique recessions on record,” Jeremy Kronick, one of the council’s co-chairs, said. “It was the shortest recession on record, but also the deepest since the Great Depression,”

This may very well be the case for many, but many more will be wadding through the aftermath for much longer.

Our current housing crisis and drug pandemic, in my opinion, is collateral damage from the actions and policies implemented by governments and central banks during the 2008/09 financial crisis.

Given all the money and stimulus injected this time around, what do you think our communities are going to look like in another 10 years?

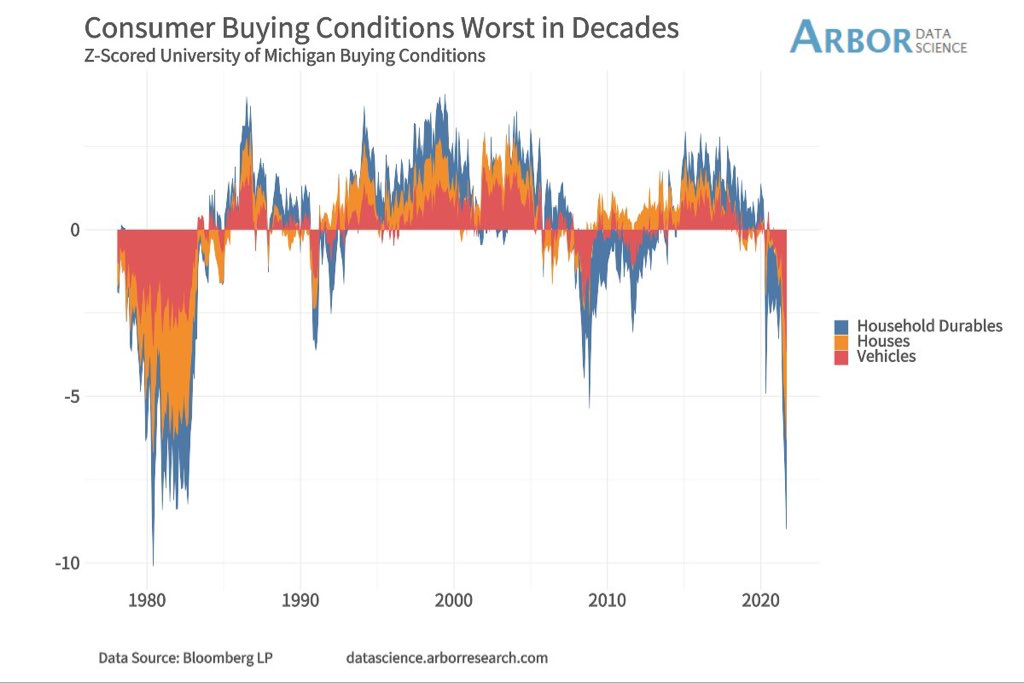

One might point to the 1980s, in the chart above and say it could be worse, but in my opinion, this isn’t true.

In the 80s, it was the high interest rates or costs of borrowing, which were making buying conditions difficult.

Today, asset valuations have been driven by increased consumer access to debt products like mortgages, lines of credit and credit cards, as well as the central bank policies that have kept the party going.

It will be interesting to see how markets respond to upcoming Fed tapering.

“The Fed has been purchasing $120 billion a month in bonds to lower longer-term interest rates and support borrowing and spending,” Associate Press reporter Christopher Rugaber wrote Friday, in an article on Bloomberg. “Such a move could lead to higher borrowing costs for mortgages, credit cards and business loans.”

Canadian’s are not richer than they think.

As Nick mentioned in his rant, 40 per cent of American’s can’t withstand a $400 financial surprise.

He went so far as to check this at factcheck.org, and found that while there’s no clear evidence supporting the exact amount and number of households, the “general assumption that most American families do not have the funds to subsist for an extended period of time during an emergency is almost certainly correct.”

I don’t see rising, “transitory” inflation as making this any less likely to be true, nor will higher borrowing costs.

The replies back from last week’s teaser post have been fantastic! What a wealth of perspectives and lived experiences our readers and clients have to share.

Thank you so much for taking the time to respond! I was a little nervous that the emoji’s would have scared you all off ;-)

One client summed it up nicely.

“The top two per cent of people have more than half the wealth in the world,” she wrote. “There is no trickle-down economics.

”Fed policy benefits the rich,” she said. “If you are poor, you have no assets to increase in value.”

To the point and hard to argue.

A personal story that may be familiar to some of you, came in another reply, and also put forward a great question that is far beyond my payscale to attempt, at this point in time.

She wrote: “Having lived through multiple crises over the many 59 years of our marriage, when we started out, there was hope to get ahead.

“Our fixer upper house was a $500.00 down payment and a reasonable mortgage. Today a fixer upper is at least a million in Vancouver,” she said. “Where is the hope for our children and grandchildren today?” She implored.

Imagine it would be difficult to watch your children and grandchildren innocently playing in the yard, as you listen to the evening news, wondering what kind of world is being left for them and their future children.

What I’ve learned in my time working with you is that while our accounts and investment are different, you and I are much the same.

We all have the same basic needs.

We all have good days and bad.

We all have hope and vision for the future.

We need to begin to voice our outrage at what is going on in the world, another client wrote. “Perhaps it’s the only way we can effect change.

“What needs to happen so people realize we are one entity entirely connected?”

Our ideas for the future probably look a little different, and that’s okay. We will be navigating the same volatile markets, economy and social upheaval, so we’re in the same storm.

I’ve got my paddle board and am certainly not resentful of your yacht (hope to have a Beneteau Oceanis 45, of my own day), but please keep an eye out in busy channel crossings.

Enjoy the rest of summer! Let's keep this conversation going! We want to hear what you've got to say. Please email me your feedback, rebuttals and comments :)