A Decision to Make: Should I Stay or Should I Go?

With apologies to “The Clash” rock anthem of the same name, the weekly comment offers a summary view of an important decision making process facing investors.

There is a classic quote by Lord John Maynard Keynes, that states “markets can remain irrational longer than you can remain solvent.”

Great quote, and is meant to invoke fear in the hearts of contrarian investors, betting against an over-extended trend because trends tend to continue longer than anyone believes they will.

A second rendition of the Keynes quote, which is antithesis to this is: “I can remain solvent longer than markets remain irrational.”

The nuance is important to grasp and is applicable to the present situation.

The original Keynes quote wreaks of stubbornness and arrogance on the part of the investor. The second, patience and control.

Hopefully this editorial steers us towards patience and control, not stubbornness and arrogance.

Section One contains some short statements that look for your agreement or disagreement with. Section Two is a more what to do about it if you agree.

Section One:

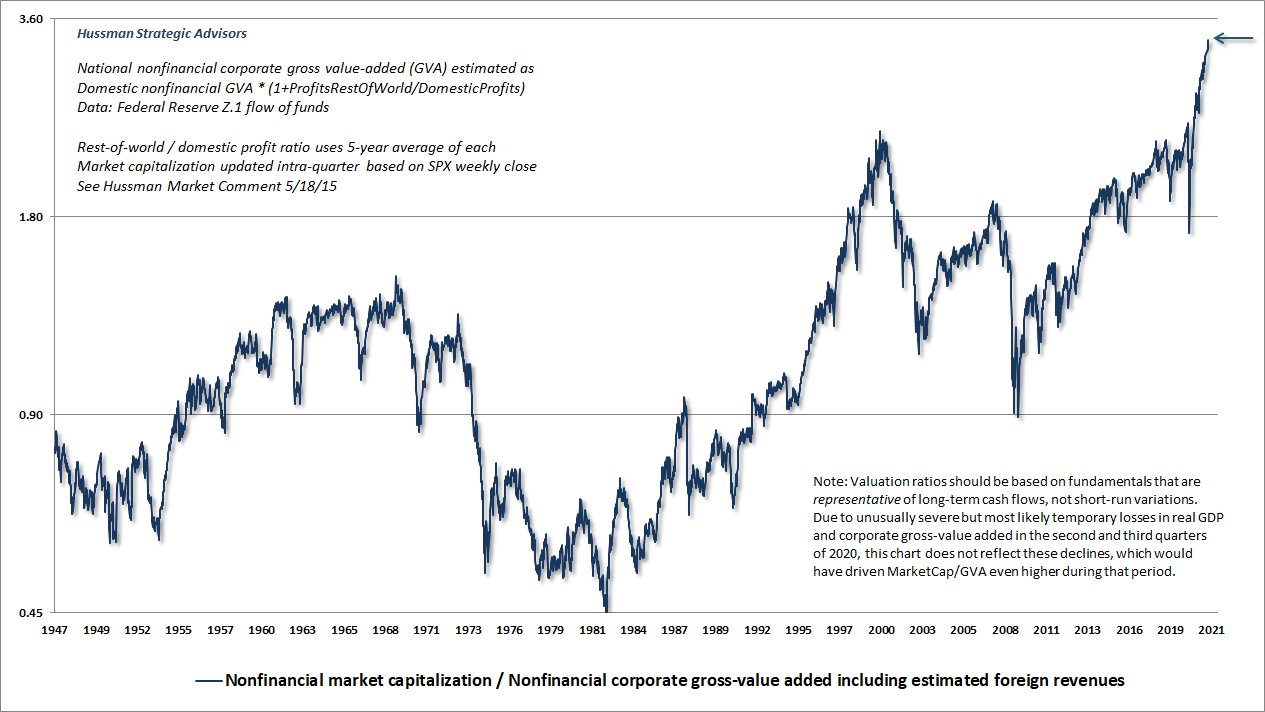

- Valuations in stocks, bonds, commodities and real estate are high. Some markets are more overvalued than others. Below are two examples of price structure. The first is the comparative valuation of the US broad stock market. (S&P 500).

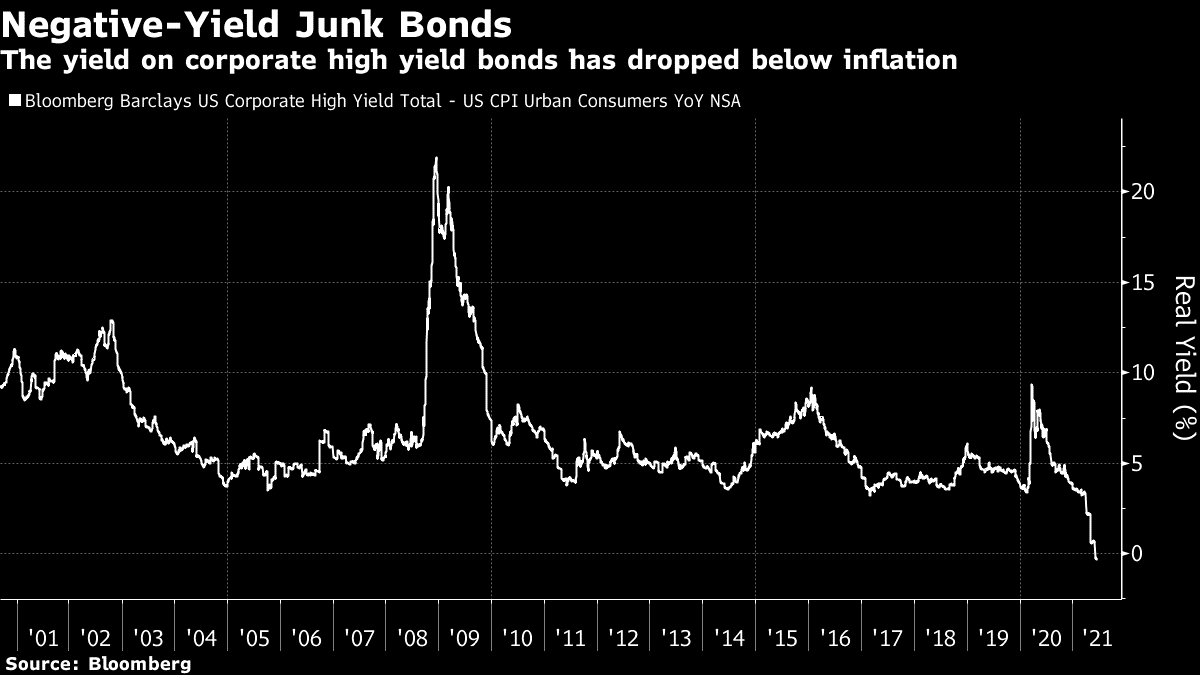

The second is showing the real yield (nominal minus inflation) of Barclays Corporate High Yield (Junk) bond index.

Note a lower yield means more overvalued.

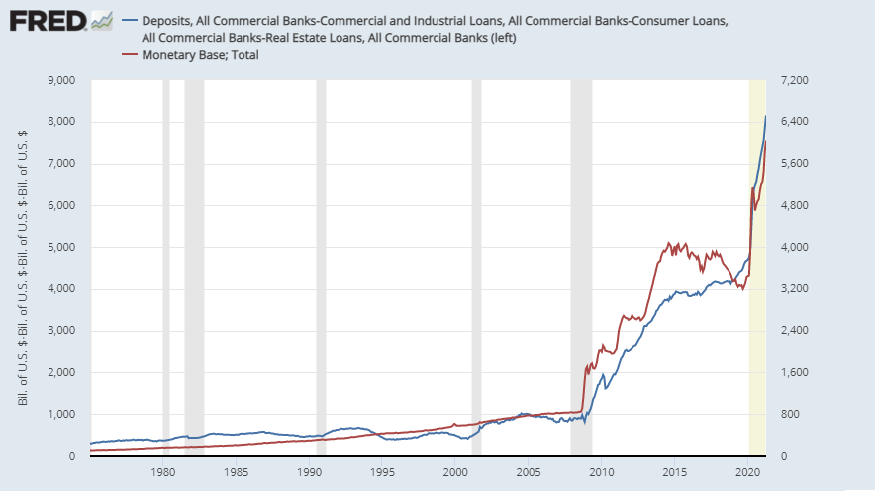

- Valuations require ever larger injections of liquidity to maintain their lofty levels. The amounts of money being created are beyond historical reference.

Please recall that money is created by both central bank decree and by loan originations by financial institutions. Both of these sources of liquidity have been on full throttle.

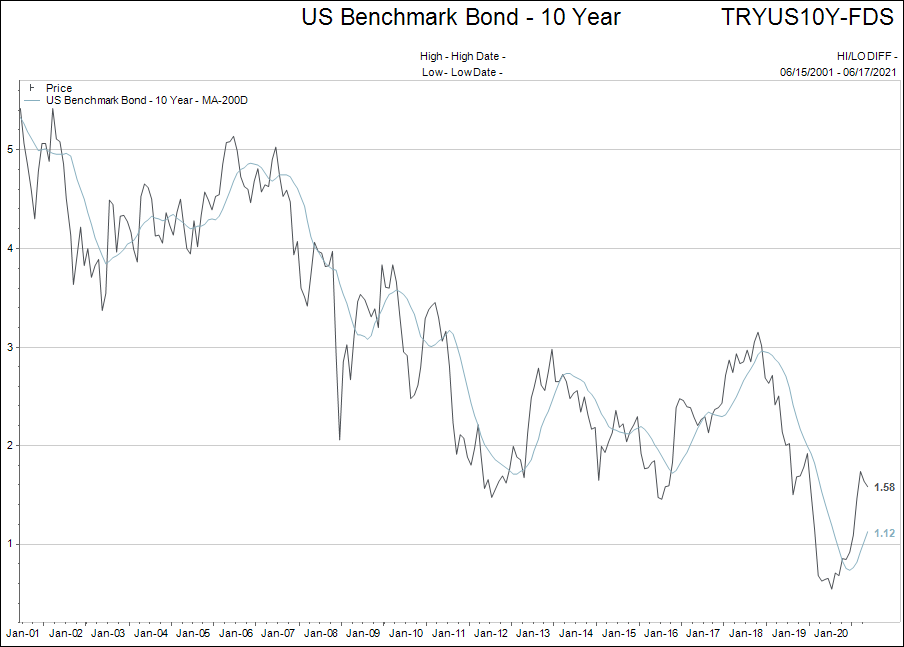

- Interest rates still pay next to zero rate of return. Interest rates are negative when measured with inflation taken into account. Bond yields have risen some, but are not even close to reflecting the increases in the cost of living.

- Monetary authorities around the world are starting to feel the pressure of leaving monetary policy too loose for too long. Interest rates are going to rise and liquidity is going to be reined in. Here is the final and key point for you to consider. If the above statement is correct, what is the right asset mix for your portfolio?

Section Two:

Portfolio management is about well thought out strategies that enhance your personal financial goals. It does not matter what anyone thinks the financial markets are going to do because nobody knows for sure. It matters that we manage your affairs with your personal situation in mind.

Let’s use two examples.

Example one is a 35-year-old, lawyer who has just made partner at her law firm, and is engaged to be married to another high income earner. They have paid off most of their debt and have bought a mid-range home together. Other than Tax Free Savings Accounts, they have little in savings.

This is an example where the current market situation has little bearing on the investment planning for our young lawyer. She is beginning her prime earning and investing years and she has lots more spending to do.

They will likely buy a larger home, nicer cars etc. over time. The goal here is to set aside some amount of savings in tax sheltered plans and hold quality growth assets for the long term.

The market cycles are nearly irrelevant in this example. A regularly paced savings plan will offer a dollar-cost averaging approach to the market valuations over the next 30 years.

Asset mix: 90% stocks and 10% liquidity for emergencies.

Example two, is a 60-year-old couple with their children mostly self-sufficient. They have virtually no debt, a $1,000,000 home and a $1,000,000 in savings; there is also about $1,000,000 of inheritance money to fall in some day in the future. The husband is retired with a small pension and the wife is six months from retirement, with a $3,000/month pension ready to kick in once she leaves her work. They need about $5,000 net per month to live.

This example requires the couple to be far more sensitive to what investment markets are doing and what asset mix to hold.

To be clear, it doesn’t mean they have 100% of their savings in the stock market one week and a month later they have nothing in the stock market. The portfolio will have a core amount of money that never leaves the stock market that is predicated upon their income needs and risk tolerance.

But there is a choice to be made.

Does this couple have the mental capacity and risk tolerance to ride out a 50% decline in stock markets (if that were to happen), and not panic and sell when holding 70% of their portfolio in stocks?

It is easy to hold when markets are rising…but what about during longer duration declines? (I know, those don’t happen anymore because of the Fed…but please, just humour me and think about this).

Maybe this couple needs a “swing” or “tactical” component to their portfolio that stays invested during prolonged uptrends and stays in cash during times of doubt? Maybe the portfolio is 40% fixed income, 40% long term buy and hold, and 20% swing/tactical?

You see, the same financial market conditions warrant different advice for each person depending upon their goals and needs.

How do you see your situation? How comfortable are you with swings in your asset base? When the asset markets are at all-time highs in valuation, how much risk is right for you?

If you have questions about these thoughts and how they pertain to your situation, please don’t hesitate to reach out.