Gold and Crypto

Last week’s comment was a general guide to self-regulating your asset mix in terms of risk tolerance, investing time frame, income needs and personal preferences.

This week’s comment has nothing to do with the first three categories mentioned above…it has everything to do with your personal preferences.

So let’s begin with the summary statement: If you invest in Gold or Bitcoin (crypto currencies) it is because you BELIEVE in the narratives created around these asset classes.

It’s that simple.

Have received many questions over the past few weeks about both crypto and precious metals, so hopefully this will help you decide what YOU BELIEVE.

Gold:

Gold has a long standing history of maintaining its purchasing power relative to fiat currency. That part of the narrative is quite easily demonstrated, but the pathway it follows is not easily demonstrated.

The narrative carries all sorts of themes that say when gold should and should not perform well, but honestly, I’m not sure any of them hold completely true in terms of strong, short-term correlations.

Some say high inflation is good for gold prices. Others cite negative interest rates, profligate monetary policy, weak US currency and a whole lot of other economic conditions.

I would say that all of these are true influences of the gold price in the long term, but not in the short term.

It seems like the price of gold is like a winding river that finds its own way as it pleases.

That is why I submit the best reason to own gold (precious metals) is because you BELIEVE it will protect you under the economic conditions mentioned above.

If you are a believer in gold, then make sure you keep your belief in check with your overall objectives.

If you need income from your portfolio, keep your gold exposure to a level that allows your income needs to be met BEFORE you put any money in gold.

By keeping your overall objectives front and center before investing in gold, you will find it easier not to let your beliefs run wild in your asset mix.

Bitcoin (crypto currencies):

Speaking of running wild, crypto currencies are an elixir that have investor’s imaginations running at full throttle, but the reality of crypto investing, is the same as gold; you have to BELIEVE in the narrative.

The narrative has shifted so much for Bitcoin, in a short period of time, that what is most fascinating about HODLers relative to Gold Bugs, is how nimble they have had to have been in their beliefs.

Bitcoin started out as a currency outside of the clutches of the tainted hands of the central banks.

Then it grew to become a store of value.

Next it become an under-owned institutional investment asset.

And now I’m not really sure what the narrative is?

To me, it doesn’t really matter what the narrative is. What matters is what YOU BELIEVE it is!

The level of volatility shown in the crypto-currency markets actually helps anchor one’s beliefs. When something can move 25% per day it simply requires belief because it is impossible to rationalize day-to-day.

So what do you believe?

Do you have any interest in either gold or crypto currencies? If yes, how do you decide the best way to take exposure to these “belief-based assets” without compromising your quality portfolio structure?

Great questions without generic answers.

I am happy to have these conversations with people if they wish to explore their beliefs in these areas.

Feel free to email me back and we can chat.

Gold vs. Bitcoin

It was interesting that on Thursday, while writing the section above, RBC sent out an interesting little report correlating Gold vs. Bitcoin.

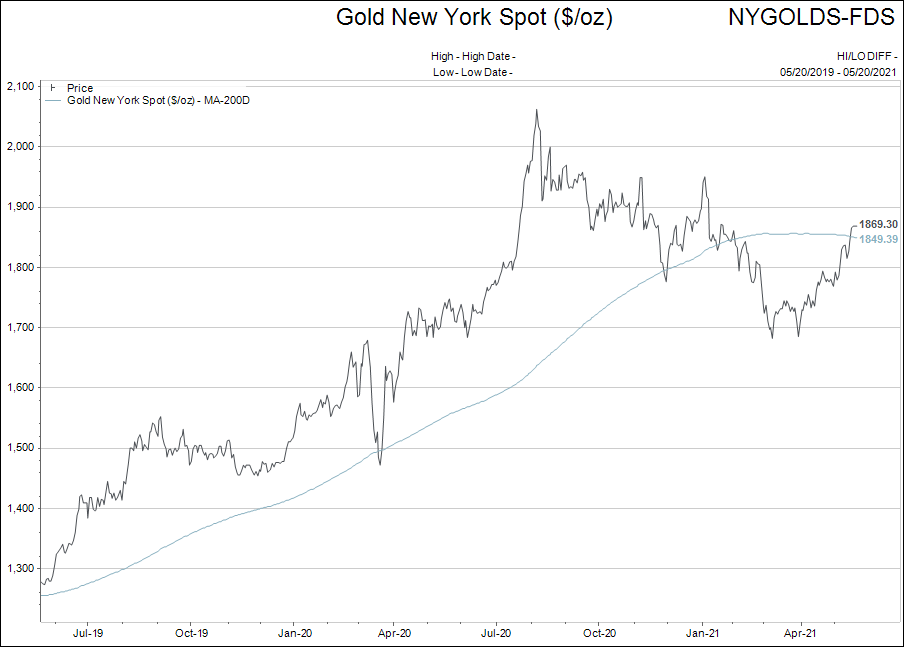

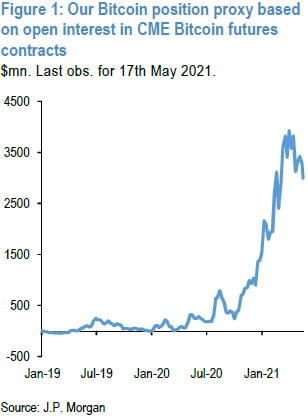

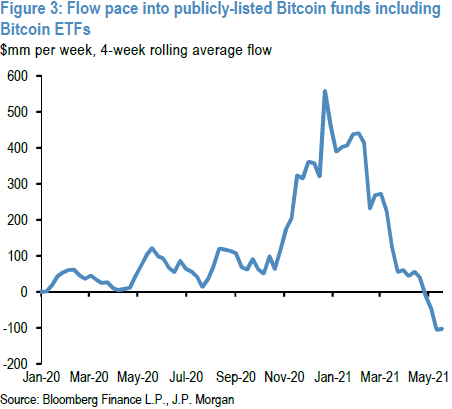

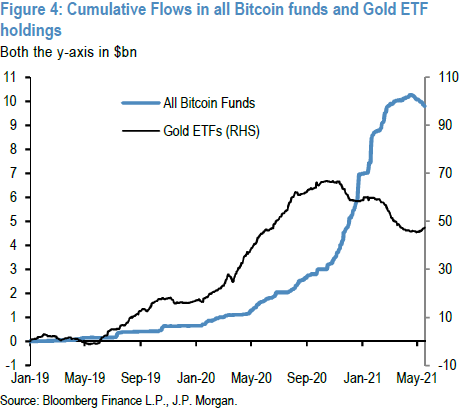

Clearly there has been no contest as to the performance between these two asset classes but some signs have emerged that things might be changing.

Below are a couple charts from the report.

We live in interesting times…