Interest Rates

A client made me aware that this week was the 40 year anniversary for the infamous 19.5% Canada Savings Bond issue.

A little known fact about that time, was that you could have bought a 20-year Government of Canada bond with a yield to maturity of 17.5% per year.

Let’s look at what happened to each choice five years later.

For the Canada Savings Bonds your 5-year returns were:

1981 – 19.5%, 1982 – 12%, 1983 – 9.25%, 1984 – 11.25%, and 1985 –8.5%

Compounded annually, this would have turned $1,000 into $1,764.97.

But what would have happened if you had bought the 20-year Government of Canada bond? Let’s look:

Your cash-on-cash (current) yield on the bond would have been approximately 13% per year. Therefore a $1,000 investment would have yielded you $1,842.44 in interest income over the five years; a little better than the Canada Savings bond.

Here is the interesting thing. If you sold your original $1,000 bond on the five year anniversary you would have received $431.77 of capital back too!

This means the total return in the 20-year Government of Canada bond was $2,274.21 compared to $1,764.97 in the Canada Savings Bond.

I guess either outcome makes fixed income investors salivate today, but the difference is important to understand in context of today.

Why did the Government of Canada bond make so much more money relative to the Canada Savings Bond?

The key is to remember that as interest rates go down, the price of a bond goes higher. The opposite is also true. If interest rates go up, the price of the bond goes down.

This is why the present environment for fixed income portfolios is so perilous.

If inflation is coming back with a vengeance AND the central banks are going to pretend inflation will be transient--signaling they don’t care about future inflation--interest rates COULD surge.

On the same topic, RBC summarized the Bank of Canada communication from Wednesday’s meeting like this:

“Rising bond yields and stronger than expected economic data have put markets at odds with the Bank of Canada’s relatively downbeat forecast. Given the much stronger than expected GDP growth in Q4 (9.6% vs. BoC’s January MPR projections of 4.5%), market participants are anticipating a taper announcement at some point, most likely during the BoC’s April 21st meeting, during which the updated MPR will also be released. Any updates to the BoC’s economic projections will have to be communicated delicately to avoid sending bond yields sharply higher.”

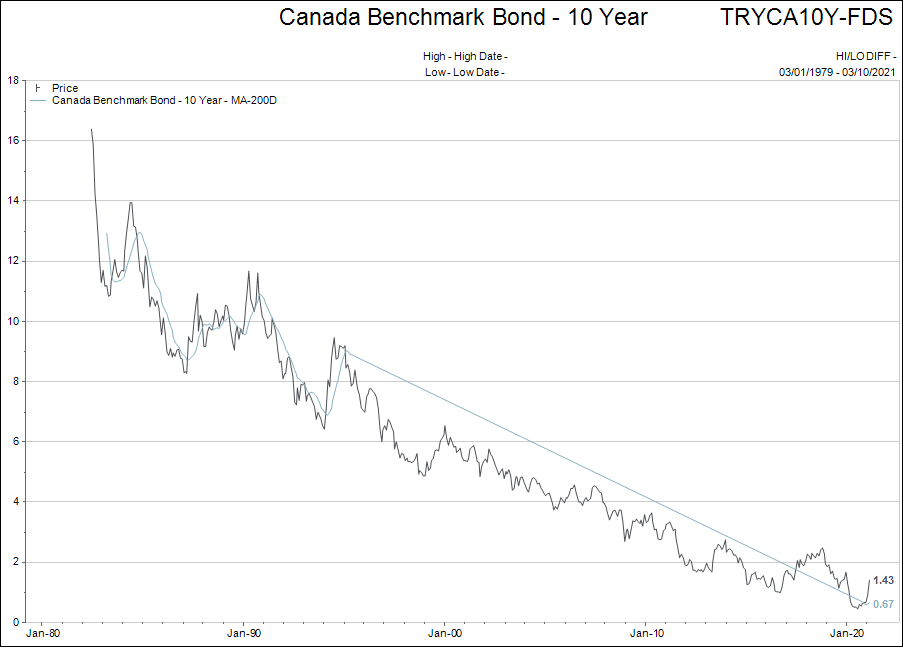

The long term view of interest rates above encompasses the entire 40 year decline. The central banks have recklessly printed money since the 2008 recession, with no penalty assigned to them in terms of inflation.

The long term view of interest rates above encompasses the entire 40 year decline. The central banks have recklessly printed money since the 2008 recession, with no penalty assigned to them in terms of inflation.

Therefore, central banks applied the same policy to the COVID driven recession expecting no penalty again.

Inflation is breaking out higher at present, but central banks are trying to tell us that it isn’t….in contrast, everyone laughs when I ask them if they believe inflation is actually running at 2% per year.

Will investors call the central bank bluff? Guess we will find out.

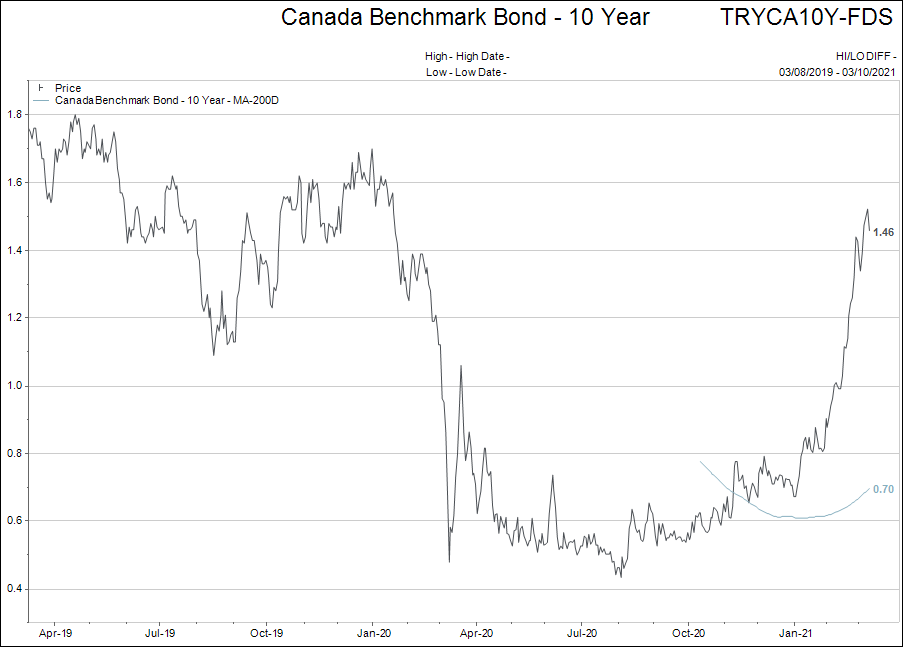

Below is a two year view of the same data as above for the Canadian 10-year Treasury bond. The interest rate is just getting back to where it was before the “COVID-crash” in yields.

There is not much else to say about this situation right now. It needs time to work itself out.

There is not much else to say about this situation right now. It needs time to work itself out.

I will add one more data point.

This newsletter has talked about the possibility of the US Federal Reserve employing Yield Curve Controls, where they fix longer term interest rates by being the “buyer of last resort.”

The US Fed has not formally made this announcement, but they did buy $92 billion in treasury bonds in February…many of the bonds were longer term maturities.

This is Yield Curve Control in action, without formally announcing the program.

Interest rates and the currency markets will lead stocks in coming months. Keep an eye on both…or better yet…I will keep an eye for you!

Canadian Oil

In keeping with the inflation theme from section one, Canadian Oil companies find themselves in an interesting position at present.

This sector was once the second largest sector in the TSX Comp, behind banks; it now trades at a fraction of its past valuation.

For some perspective, Shopify (SHOP-T) trades at a valuation of $177 billion while Suncor, Canadian Natural Resources, Imperial Oil, Cenovus, Crescent Point, Vermillion, White Cap and a host of other small oil companies, add up to a cumulative valuation of about $140 billion.

The other interesting fact I have been researching, is the amount of institutional ownership in the oil sector. It is tough to find up-to-date data, but I can say it is a tiny fraction of its traditional percentage.

Why did this happen?

- Clearly, oil prices were decimated in 2020, and many of the companies listed above were questionable to even survive.

- Environmentally themed investments (ESG) have been all the rage and attracted funds away from the sector.

- Many institution managers wanted to be included in ESG indexes so they sold their “dirty” oil stocks to attract new investors via the ESG theme.

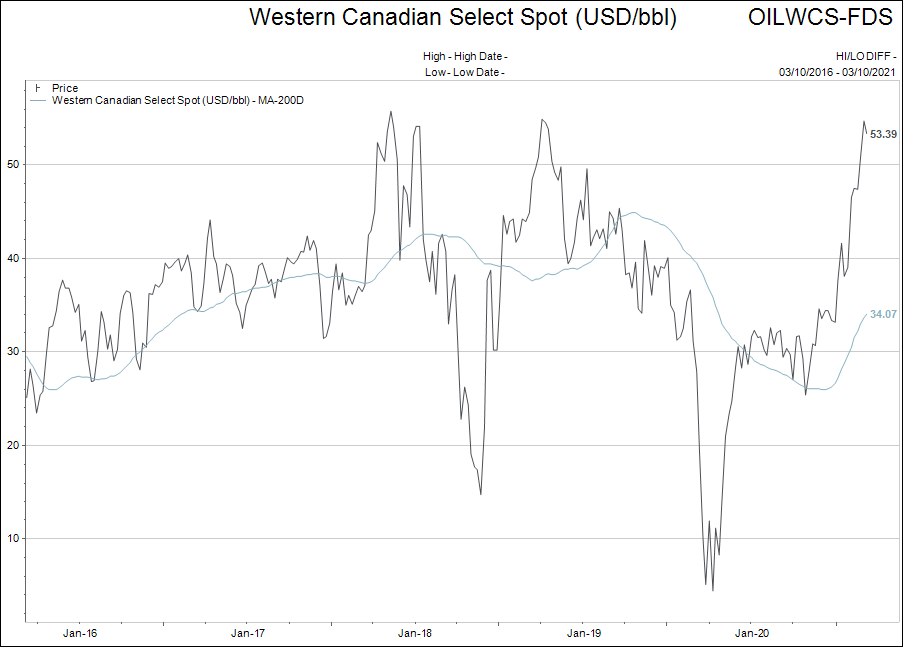

Let’s look at two charts. Chart one shows the prices of Western Canadian Select oil, and chart two shows the prices difference between West Texas Intermediate oil and Western Canadian Select.

I believe that Canadian Oil names are, for the first time a few years, back to being considered “investment grade quality.” With Western Canadian Select oil trading in the $50s, these companies now have some breathing room to profitability.

It seems they are likely “under-owned” institutionally at present as well.

This dirty old sector should be re-visited by investors that do not mind owning non-ESG related names. Within the sector, there are “cleaner” energy choices to be made if one chooses too.

Never hesitate to reach out to me by email with your comments, questions or concerns.