Why Do Some Stocks Go Up So Much?

The shift from growth focused stocks to inflation themed stocks has rotated with a vengeance, and the dynamics behind these types of theme shifts in markets, have become more amplified during the present cycle.

We understand that more investors buying, rather than selling, a stock is what creates upward pressure on the price, but there is so much more than that to the financial markets…especially today.

The explosion in the use of options has been a large contributor to the prolonged rallies for names like Tesla, Amazon, Facebook and the likes.

This message is to help you understand ONE of the factors that drives this process, and how it works in reverse when the narrative of the market changes to one that does not favour these types of holdings: Delta-Hedging.

To grasp the answer, you need to understand one thing about Delta-Hedging.

Delta-Hedging is what Market Makers do to stay 'risk neutral' while buying or selling options.

It works like this: When a Market Maker sells you a Call option, they also buy more Shares as hedge. That way, if the call ends up being right, they already have the Shares to sell you, and they've made a little profit on the price increase. If they didn't do the Delta-Hedge, the Market Maker would have to go out and buy those shares above the Strike Price, then sell them to you at a loss.

The Market Maker hedging their own book actually creates a self-fulfilling prophecy by creating extra buying pressure in the shares of the company that the investor is trading options in.

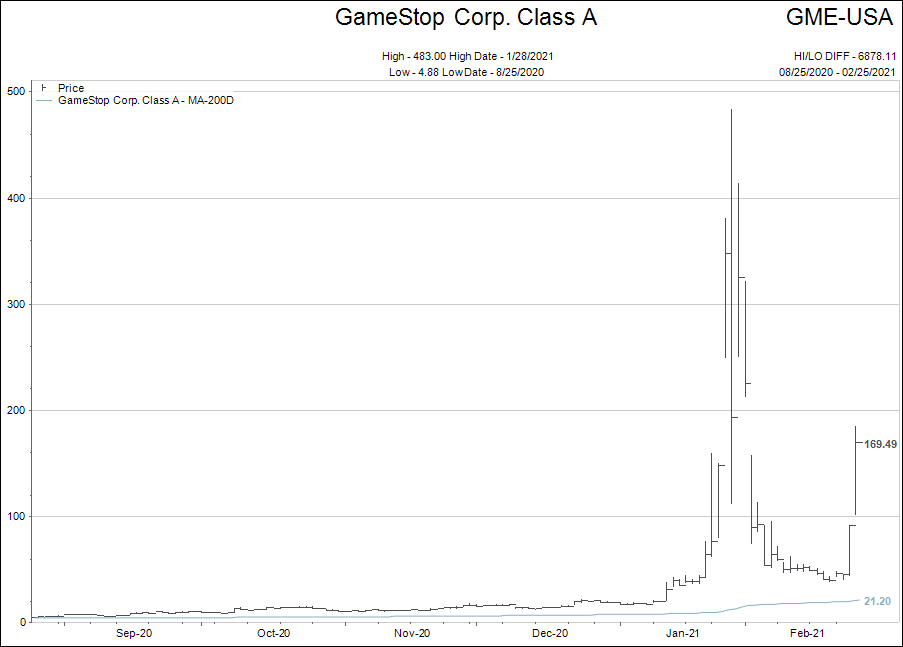

Before we delve into Tesla, let’s use the GameStop fiasco as an extreme example.

This was the perfect storm of all the ingredients of what is screwed up with Wall Street today, coming together in a short period of time.

To begin with, here are the preconditions:

- GameStop had more than 100% of its float held “short” by hedge funds. These funds would have to buy back in, at some point in the future, to realize the profit they had made by betting the shares of GameStop would fall. These shorts were being greedy fools by still being short insane amounts of GameStop at less than $5.00 per share.

- The Reddit crowd that loves “meme stonks” had focused their attention on GameStop as a way to create a “short squeeze” and stick it to the 1%.

- Wall Street heavy weight order flow controller Citadel could see all the hands at the poker table so to speak and began to “get to the right place at the right time” by adding GameStop shares. (Citadel held 8% of the float at the peak of the bubble in GameStop). Adding to the buying pressure.

The moment of truth when it all started to happen:

- People like Michael Burry (“The Big Short” guy) were Tweeting right alongside the Reddit crowd, that there was a huge short squeeze waiting to happen.

- More and more hedge funds poured into the trade buy buying GameStop shares but more importantly the call options.

- Retail traders on Robin Hood (RH) discovered call options and, when RH made it easy as 1-2-3 to open an options account, the fuse was lit.

- This Delta-Hedging story is having a second life with GameStop as I write this note on Thursday, February 25th.

So how do these huge spikes happen?

Like this…

- Short sellers are caught having to buy back their positions sold short as the stock rises to avoid catastrophic loss. They also buy call options.

- New speculators pile in to buy more shares and call options knowing the squeeze is on.

- Market makers have to keep buying the shares on the open market to “Delta-Hedge” all the option trades they are facilitating.

That is one huge wave of buying with virtually no sellers in sight! The chart above shows exactly what the price of the stock did in a very short period of time.

Remember, the price rise had nothing to do with GameStop, the company itself, it was an innocent bystander or spectator in this story.

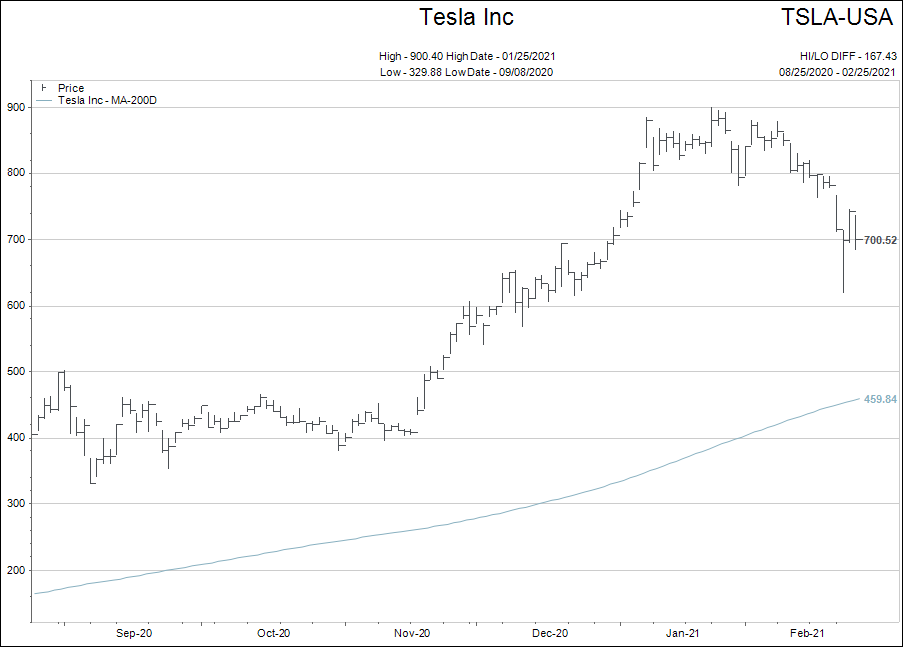

Now Tesla.

Tesla is the same story playing out on a much broader narrative over a longer period of time. But it is the same story…

Call option positions have far outnumbered Put options for years. Delta Hedging has added an incredible amount of buying to a company’s stock that is way over valued by traditional metrics.

However the analyst community has ignored this reality, and continued to invent more fanciful reasons as to why the high stock price is justified.

As long as the stock price keeps going up…guess nobody can argue with them.

So what changed?

- Interest rates going higher.

- Change in narrative from growth to commodity/inflation names.

As more investors who have been rewarded for owning call options in Tesla see losses on those positions, less Tesla calls are purchased. This takes away the Market Maker Delta-Hedging buys, which has been a huge.

As the stock goes down, the narrative begins to change and somewhere in the future, the company finds a more reasonable valuation.

One last point on this topic…

Call options is still running at 300% of normal (down from 800%). Now companies like Freeport MacMoran and Exxon Mobil are seeing high call option buying, and those names have risen quickly as a result.

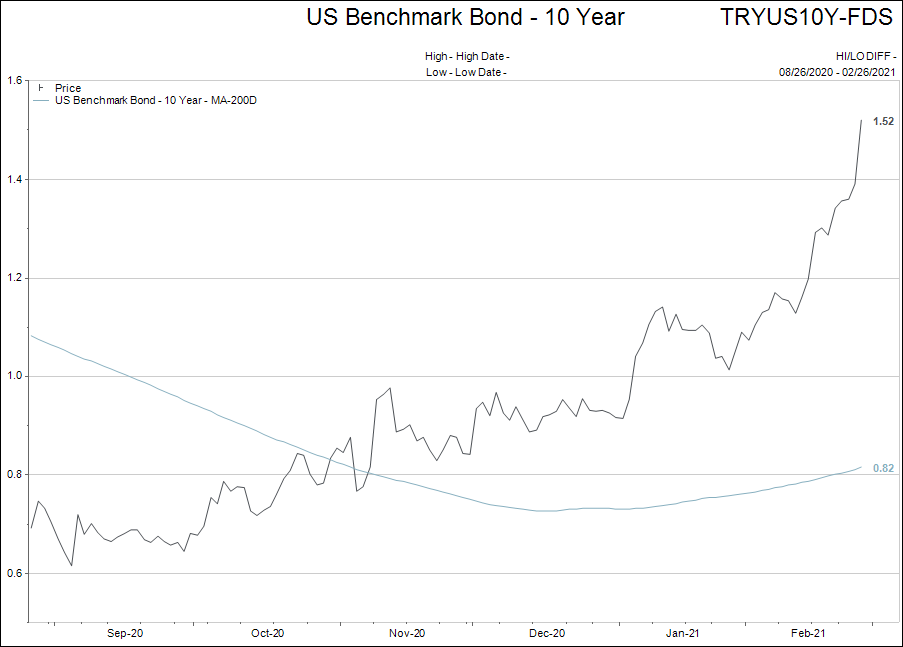

And the really important sector where Delta Hedging is having an impact. In the bond markets.

What if interest rates get driven far higher due to the option activity betting that interest rates are going to go higher? This is happening right now. How far does it go?

The game has not stopped…just shifted…for now.

But higher inflation that brings on “truly” higher interest rates is like kryptonite to this type of speculation.

Keep a close eye on those interest rates.

As always, please email me your feedback and questions, or if you'd like to discuss your portfolio.

Have a wonderful weekend!