“Confidence”

What would happen if Canadian politicians all agreed to go back to normal and open everything back up on Monday? Would life return to normal?

The more I think about it, the more I believe that the return to normal without a vaccine will be muted at best.

Will the “muted normal” be enough to get unemployment down? Will restaurants and coffee shots fill again? Will businesses regain all of their old customers?

Out of interest, I started asking this question of people I happened to be speaking with throughout the week. Only one person felt they would go back to normal right away.

I was reading about China’s return to normal. It didn’t really take off as soon as businesses opened. And as we read in the news now, the second wave of the COVID-19 cases started to spread and China has had to shut things down a second time.

We have all been hoping for a short term (30 days) shutdown to flatten the infection curve and a return to normal life. That hope appears to be distant.

What looks more realistic is a medium term (60-90 days) shut down with a muted economic re-opening that many people choose to not participate in because the disease is still going to be out there.

Here are a few other questions I have been thinking about given the view emboldened above:

- How long does the government support consumers and companies? Are mortgages and rents forgiven for 6 months, 1 year, longer? Are wages subsidized by taxpayers forever?

- How likely is the second wave of COVID-19 to run through society and do people respond differently to the second wave given the hope/fact that our medical community will be more prepared to deal with it?

- How much of the change people have taken on in “social distancing” the past month do we incorporate into our “new normal” lifestyle? Working from home, shopping less frequently, living life in a simpler manner again. Some of these things may be viewed as desirable and held on to.

- How much of life shifts to online rather than bricks and mortar? People are being forced to do things online right now…will they choose to go back to the old ways after the crisis is ended?

I guess what I am asking you to think about: How confident would you be to go back to your normal life without a COVID-19 vaccine?

How do you think the rest of society would answer that question?

Let’s move on to the financial markets.

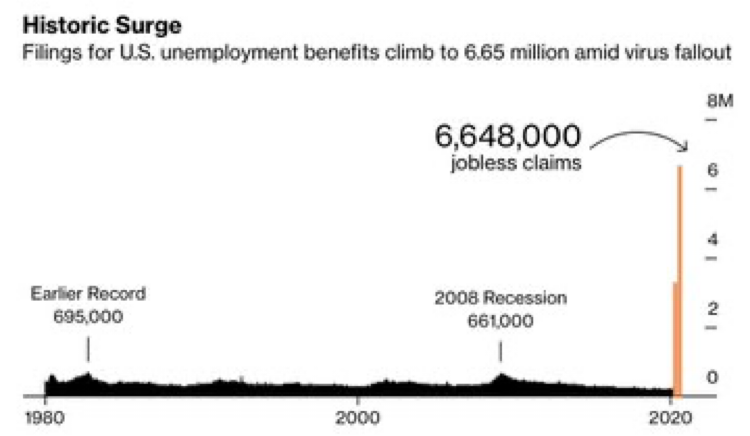

The first place we should look is at the number of weekly US unemployment claims.

Think of how many people lost their jobs in the 2008/2009 recession. Now look at the huge number of claims in the past two weeks. The total job losses in 2008/2009 were in the 39,000,000 range. In two weeks the US has equaled 26% of that total.

The hope has been for these jobs to snap back at the end of this pandemic.

But the more I think about it, the less likely I believe that to be.

My look at the financial markets is going to be from a long term this weekend, rather than the short term views expressed the past couple of reports.

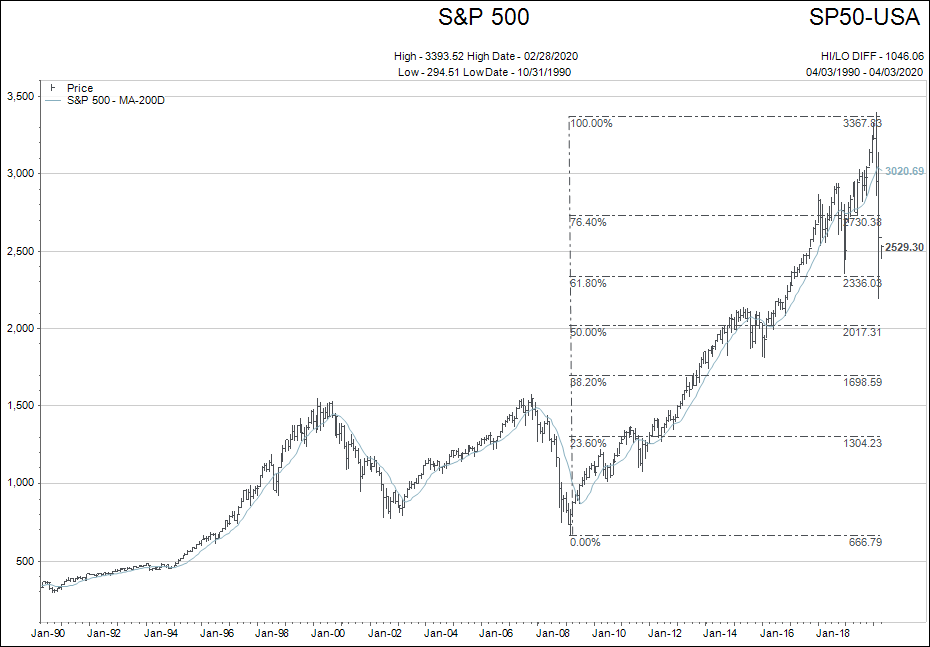

Since the largest stock “bubble” in the past 10 years was built up in the US financial markets, I am going to start there with the S&P 500 index.

BEAR market will last.

The main difference is how quickly governments have stepped in to support stock markets by printing insane amounts of money and “fire hosing” it at everything imaginable.

Will it be enough to hold back the traditional 50% retracement of stock markets in BEAR markets? We will see.

Downside target for S&P 500 remains 2017 at the 50% retracement level.

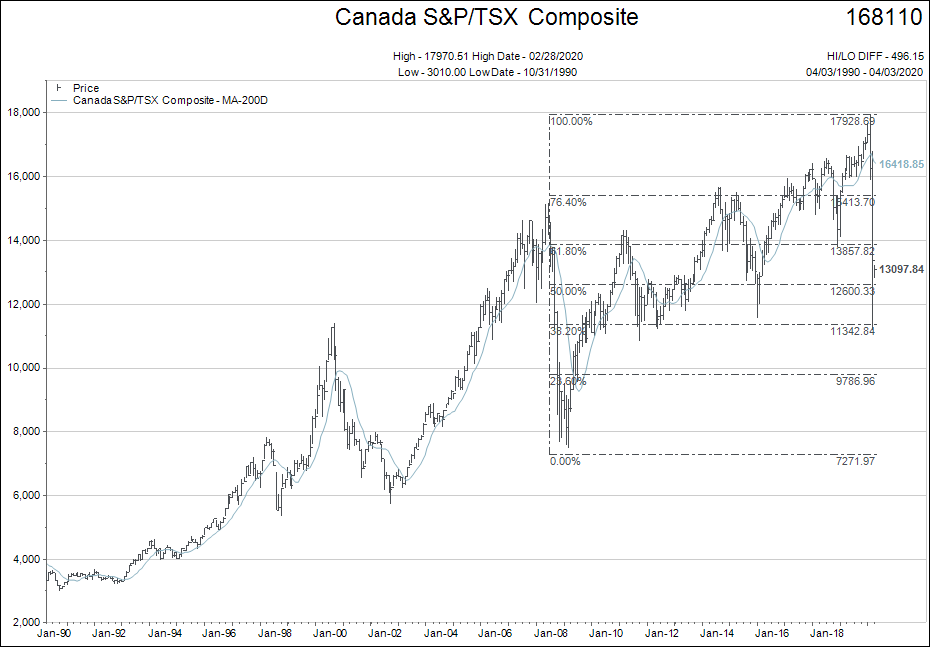

Canada is a different picture.

The most obvious difference for Canada is the lack of increase that came during the last 11 year BULL market relative to the US market.

The TSX nearly hit its BEAR market target of 10,750 on its original decline in March 2020.

The 10,750 target would also take Canadian stock valuations back to the levels of the peak in 2000…20 years earlier!

Imagine wiping out 20 years of market gains.

This is one of the reasons I am significantly less BEARISH on Canada than the US right now (Lower valuation).

The other reason is because I believe Canada has done a much better job managing COVID-19.

Make no mistake…if the US actually falls to some of the target levels charted above, Canadian stocks could overshoot my downside target of 10,750 on the TSX.

But there is more relative value in Canada than the US. Or stated differently, the BUBBLE was more extreme in the US than Canada.

My summary does not change from last week.

- If you want to buy something that pays a great yield and you plan to hold on to it no matter what happens in the market then, by all means, buy what you think helps you accomplish your long term financial goals.

- If you are moderately exposed to the stock market already and feel relatively comfortable, just be patient and stay the course.

- If you feel like you are too exposed to the stock market and you were really feeling panicked earlier in the week, give me a call and we will do some changes now that the markets have had a good bounce.

Thanks to all of you who wrote back and told me how you felt about your holdings relative to the categories above.

I am proud to say not one client emailed back to say they were in category number three. I have talked to a few of you who have felt over exposed to stocks, but that was two weeks ago.

These are not easy times for our world and our lives.

Financial stress is coming in all shapes and forms.

If you have investments, you are worried about losing money.

If you have no money and no job, you wonder how you are going to make ends meet.

And no matter what your socio-economic status, you are dealing with the stress of the COVID-19 changed world.

Please don’t be afraid to reach out by email and I will call you to chat.