Market Update

Introduction:

Without permission, I could not resist borrowing this captioned photo from Kevin Muir, the Macro Tourist.

Time is at a premium this morning so I am going to do this in point form.

- From a health perspective, Covid-19 is still a very low risk of infection situation on Vancouver Island and in Canada generally. That said, our leaders are WAY BEHIND THE CURVE when it comes to containment. Therefore, be wise, and use common sense about where you go and what you do.

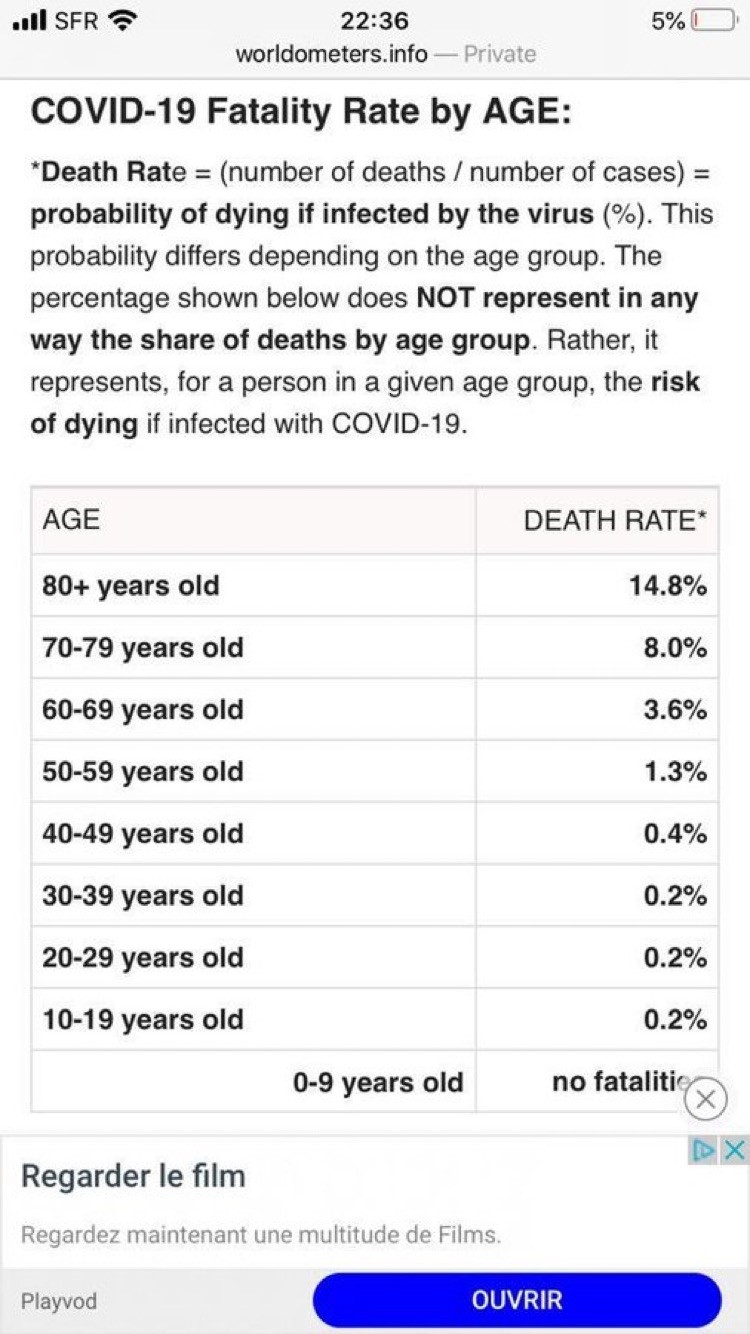

The following graphic will help you understand what we are talking about from a health perspective. For people under the age of 60, in good health, and who are not prone to respiratory illness this is not a big deal. If you are older or have respiratory pre-conditions. Be wise.

- Economically, this is becoming a fairly big deal.

- Global supply chains are breaking down and trade has slowed to a crawl.

- People are getting scared and changing their economic behavior. (Canceling trips, staying at home rather than going out to eat or to events, etc.).

- The potential for “goods scarcity” is actually taking place in North America for the first time in our lifetimes. This means that, as supply chains break down, we might not be able to go buy whatever we want at any time we want for the first time in our lives. Again, this causes panic behavior.

None of this will last very long, but the economic impact is absolutely impossible to quantify in the short term.

Where are we now?

Financial markets are only just waking up to some of these issues and problems. What was first being spun by pundits as “a minor hiccup a long ways from North America,” has become a global concern.

The expectation was for everything to blow over in a few weeks and for financial markets to have a bunch more “liquidity and lower interest rates” to drive them to even higher levels.

Obviously, this narrative has changed.

Where are we going?

In a nutshell, the Central Banks and specifically the US Federal Reserve, are going to cut interest rates again and likely, very soon.

I imagine the “buy the dip” mentality will take hold and rally stocks on such news. Honestly, it is tough to make any predictions when things are like they are right now.

I’m really not sure how much good interest rate cuts are when, economically, we are dealing with supply chain issues.

Can more printed money create any more prescription drugs, car parts, cell phone components, or move anymore imported fruits and vegetables sitting on idle container ships that can’t dock, etc.?

No, it can’t.

Therefore, the economic impact of this Covid-19 situation remains challenging.

Summary:

- Be patient on new purchases. Let things stabilize for a while.

- Possibly, sell some stocks on the hopeful “Fed induced rebound” when they cut interest rates IF you feel you have too much market exposure.

- Start selling bonds that are at all time high levels back into cash. There are some hefty profits on bonds in portfolios right here.

Please call with any questions. It has been the busiest week I can remember on the telephones. Please be patient if you call and I can’t speak with you right away, I will get back to you ASAP.