This One is for the BULLS

Monetary policy has driven stocks and real estate higher since the Great Recession in 2008. Each time markets start to struggle, more monetary policy action is taken to get prices moving again.

So far, 2019 has been a recovery year from the tough end to 2018 for stock markets.

It feels like a lot of central bank effort has been made to re-energize assets already, yet the stock market is reluctant to take off towards new highs.

It feels like a lot of central bank effort has been made to re-energize assets already, yet the stock market is reluctant to take off towards new highs.

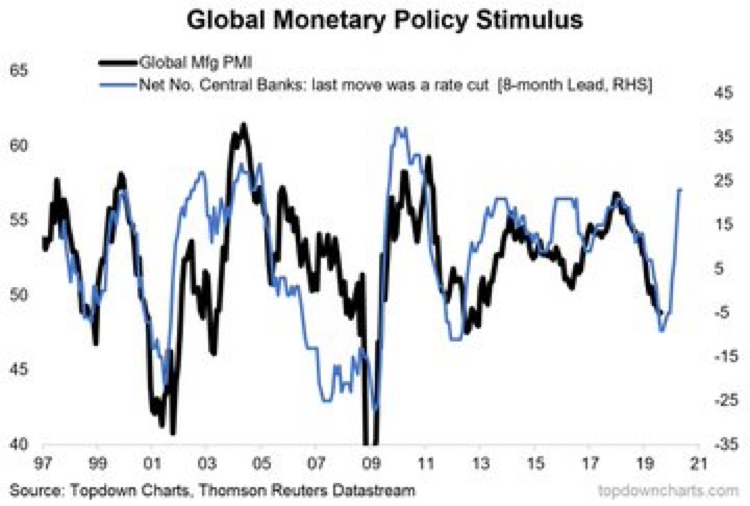

The global central banks have noticed this issue…and from the chart below it looks like they are ready to open the monetary flood gates.

The chart above shows global manufacturing PMI (left) and net number of central banks stimulating (right).

Notice, the black manufacturing line follows the blue central banks stimulating line pretty closely.

In the past three months the number of central banks stimulating has jumped back higher to near new high levels. Will the black line follow this time?

Let me put it this way.

My expectation is that the blue line will, once again, give a shot in the arm to manufacturing. The duration and magnitude of the shot in the arm are what interest me most.

The expression “there is no BULL market without central bank intervention” has been spot on for the past five or six years.

Well, we have more intervention right now…lots of it in fact.

Let’s see if stock markets can recover to new highs or if asset prices stay relatively flat in a range suggesting that the central banks are “pushing on a string” where stocks don’t go higher due to more monetary stimulation?

Pushing on a String

I have used this expression a number of times in these comments and last week someone emailed back asking what it means.

Imagine a two meter string laid out on your hardwood floor in a straight line.

Your goal is to move the far end of the string by pushing on the near to you end. How long do you think it would take to move the far end of the string when you do this?

It is pretty clear that you are going to do a fair bit of pushing before you see any movement in the far end of the string.

Thus, the expression’s meaning…it is going to take a lot of pushing on the near end of the string before you see any reaction in the far end.

There is another way to look at what happens to the global economy when higher and higher levels of debt creation are required to sustain asset prices.

The purchasing power of the currency related back to inflation makes for an interesting study.

The graphic below starts in 1913, which is the year the US Federal Reserve Bank came into existence. As you can see it has been a slippery slope down ever since.

What Was $100 Worth in 1913 Over Time?

| 1913 | $100 |

| 1923 | $57.89 |

| 1933 | $76.15 |

| 1943 | $57.23 |

| 1953 | $37.08 |

| 1963 | $32.35 |

| 1973 | $22.30 |

| 1983 | $9.94 |

| 1993 | $6.85 |

| 2003 | $5.38 |

| 2013 | $4.25 |

| 2019 | $3.87 |

One thing to notice in the numbers above is how, during the Great Depression in the 1930s, the purchasing power of the US dollar increased.

When the value of currency increases debts become much more onerous to maintain because the value of assets have to fall in this situation.

That is why the world fights even a mild recession so vigorously today.

Hence, the central banks would rather print money even if they are “pushing on a string” than have a recession where asset prices fall.

Worth keeping in mind before one becomes too BEARISH of stock or real estate prices. Also worth considering when looking at commodities and precious metal investments.

This One is for the BEARS

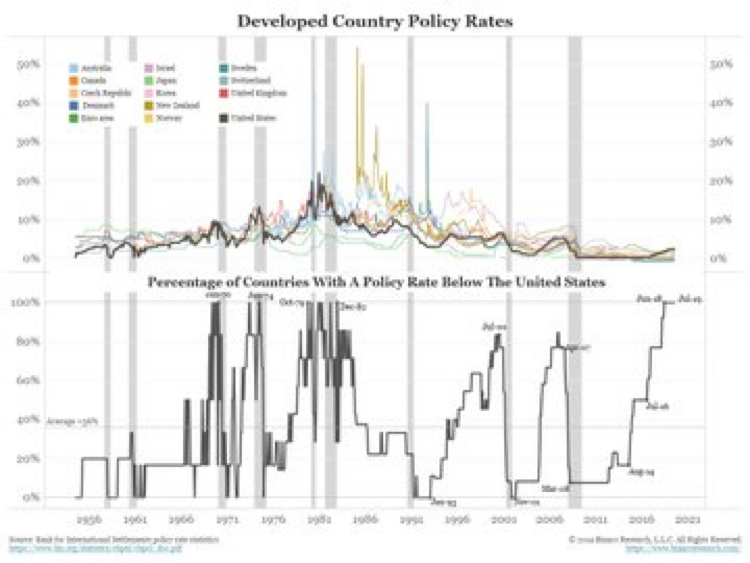

When the US has the highest interest rates in the developed world it has normally been another signal that a recession is looming.

In the chart below, the gray bars are recognized historical recessions and the black line shows the percentage of developed countries around the world with interest rates lower than the US.

Note that the world is at 100% right now.

I’m sticking with my theme that as long as interest rates can go lower in North America, stock markets are going to hang in there.

It is going to be a difficult to see a huge difference between our time of expansion and recession in this cycle.

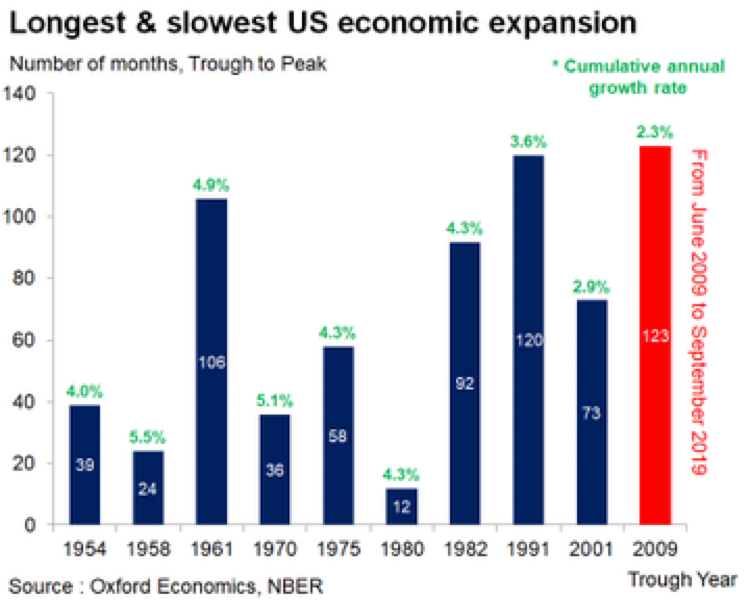

That is because this economic expansion has been both the longest and slowest on record.

My expectation is for the recession to be very mild with less than 1% economic contraction rates.

In summary, this seems like the economic equivalence of the difference between lukewarm bathwater that didn’t really feel warm enough that gets just a little bit colder; and you know it is time to get out of the tub.

The actual temperature difference is small, but your body senses the change.

All three of these sections basically tie together in a theme where economic cross currents continue to get tougher to reconcile into a meaningful theme.

Growth is slow, but interest rates are low.

Let’s continue to watch and see if the slowing economic data can bottom and energize the global economy again.

If you have any questions or concerns regarding your portfolio, or know someone looking for a second opinion on their portfolio, please shoot me an email anytime; I would be happy to review and discuss.

Have a good week!