A Rolling Loan Gathers No Loss

The US Federal Reserve went ahead with their anticipated 0.25% on Wednesday, July 31st.

It is still my perspective that financial markets are on the path to “near zero or zero percent interest rates.” By suppressing interest rates around the world, governments are free to expand their profligate spending without seeing their interest costs rise.

Low interest rates also fuel the incredible number of share buybacks being done to support stock prices. It is hard to believe that the number of share buybacks in the US is now well over $1 trillion per year.

In addition to share buybacks, the low interest rates also allow zombie companies to stay in existence and makes it difficult for healthy companies to expand their market shares because they still compete against these zombies.

In a nutshell, the world of low interest rates ensures that rolling loans can always be financed again, usually at a lower rate and therefore thA Rolling Loan Gathers No Lossey gather no loss.

So much for Schumpeter’s creative destruction.

This week I want to go back and look at two ideas that continue to play out positively given the lower interest environment the world is trending towards.

Gold

Gold has been hated for years. Actually, for the past three years, it has been more ignored than hated.

No question this is changing.

It is not a landslide sort of change. It is the type of change investors often see at the beginning of a BULL market in any asset class.

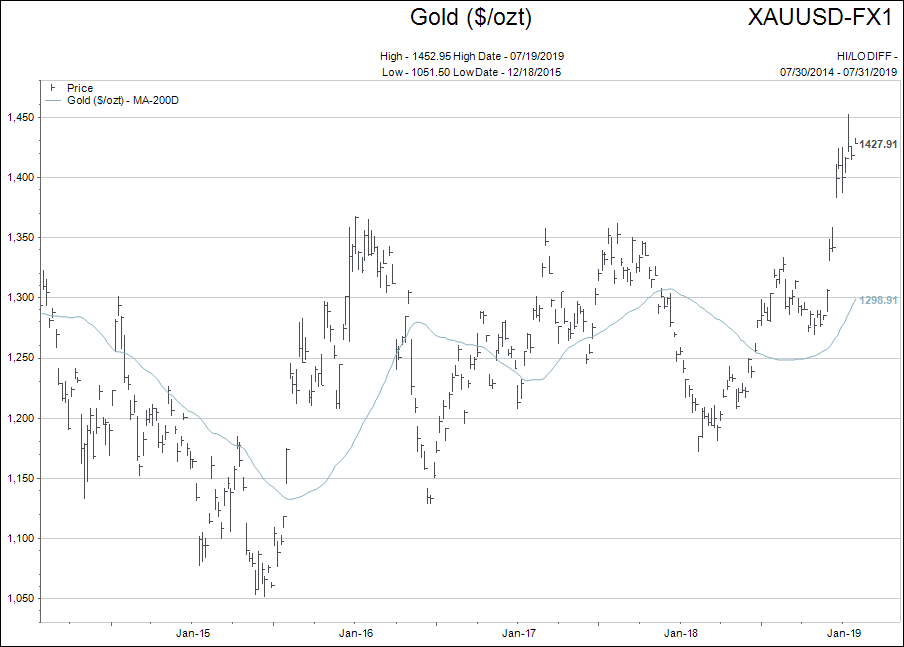

Below is a longer term chart of Gold bullion in US dollars.

Just at a casual glance, the chart above looks like something a person would want to invest in.

Just at a casual glance, the chart above looks like something a person would want to invest in.

Let’s connect the “rolling loan gathers no loss” and “gold” themes right now.

The only way the heavily indebted world keeps asset prices high is by keeping borrowing costs cheap. That means no matter how much inflation there really is in your life, you are going to be told inflation is too low and central banks must lower interest rates to spur greater inflation.

The understating of inflation and the subsequent lowering of interest rates will continue to be the major driver for gold prices in coming months and possibly years.

What is really quite funny is the fact that the central banks know this to be totally true.

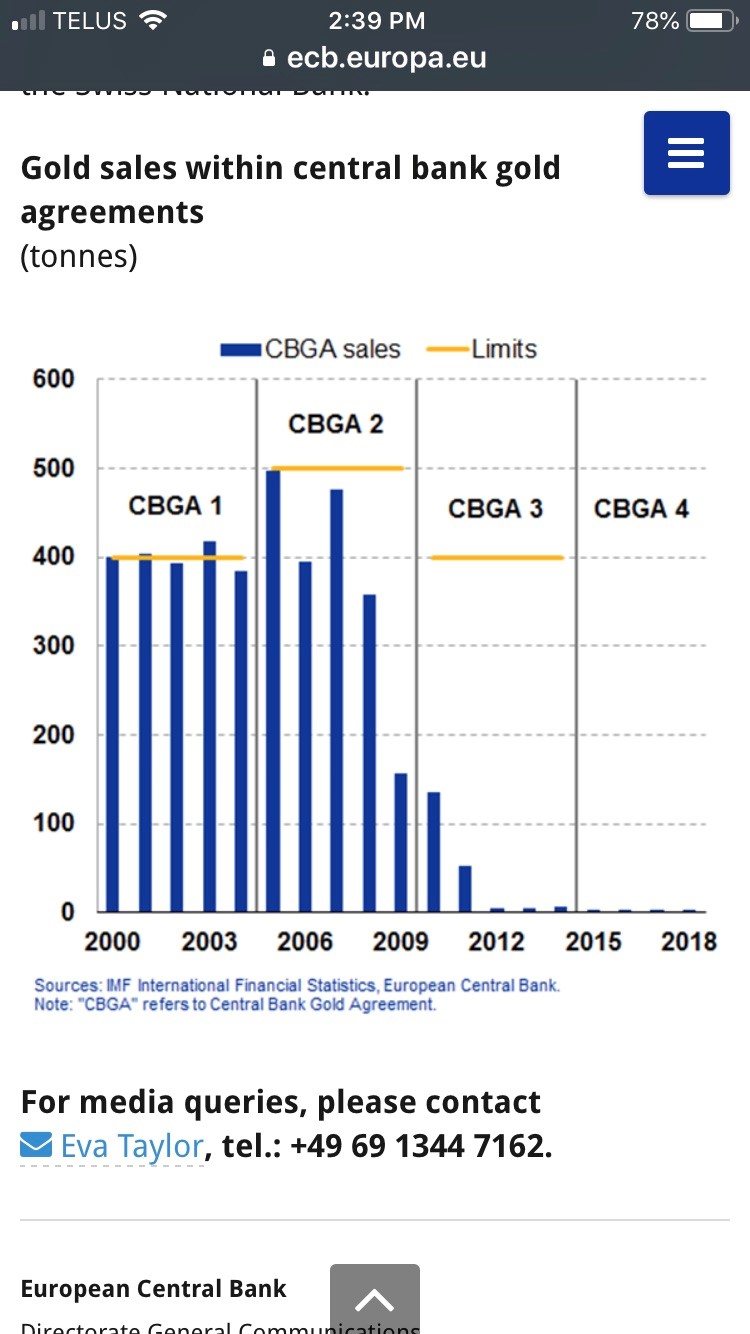

Check out the chart below.

This chart shows how central banks stopped selling gold bullion from their holdings right around the time that the low inflation narrative took off. Do you think they didn’t have a good idea where the global financial system might end up?

I’m sure they hoped their actions would work to spark global growth, but they had to know there was a good chance it would fail.

As a side note, the central banks didn’t even bother to renew the “Central Bank Gold Agreements” that predicate the limits to central bank gold sales. Why bother if nobody wants to sell?

In summary, Gold is a strange investment and not suitable for everybody. It doesn’t pay an income and it feels like you are betting against humanity when you own it.

If you think you want to know more about gold or gold stocks please touch base with me. I am rigorous in my methodology to choosing gold investments.

Let me be clear. When I look at all of the medium sized and junior gold stocks that I follow, and apply the two basic screens I use to pick the companies to own, ONLY seven names clear the screens to be considered for purchase.

To be blunt, if you don’t know what you are doing…don’t do it by yourself.

Utility Companies and Negative Interest Rates

One final thought for the weekly comment.

It makes good sense to find ways to lock in cash flow and yield if one believes interest rates are heading to very low levels.

The correlation between utility stock prices and low interest rates is well known. Lower rates tend to stimulate higher utility stock prices.

But what about in a negative interest rate environment? How do utility stocks behave?

Well, to begin with, the chart below shows why it is important to ask the question. Negative yielding debt is exploding around the world.

But this chart does not tell show us how utility stocks have traded relative to changes in negative yielding debt.

Fortunately, I happened upon the next chart.

For the most part, the correlation is quite strong.

Therefore, utility companies should be held on to in the present situation to both collect yield and to find some capital growth.

That seems like enough content for this week as we go into the August long weekend, but don’t hesitate to contact us with your questions or feedback.

Enjoy yourselves…