Year 2022

What will the world be like in just three years? What themes will dominate our lives? How many of the narratives of 2019 will still be relevant in 2022?

The first half of the weekly comment has nothing to do with investments, but will present areas where rapid change is running through our world and share a little bit about the meaning of these changes according to some of the experts.

The second half will take a few excerpts from John Mauldin’s weekly comment from two weeks ago. He was spot on with his analysis.

To think is easy.

To act is difficult.

To act as one thinks is most difficult of all.

John Wolfgang Von Goethe

Let’s start with a few bullets about areas of rapid change in our world today:

- Meta data analysis offers more covert information than 85% of traditional intelligence.

- A swarm of AI (Artificial Intelligence) piloted drones can already negate the present US military advantage…and drone technology continues to improve at a staggering rate.

- Military advantage is no longer measured in “budgets.” Information and AI now dominate the field of military advantage.

- Interest rates can go negative and NEVER go positive again.

- Fake news and information via video and photo manipulation is changing news dissemination.

- Quantum computing does not require “physical laws” to work, which opens the door to rates of change beyond our imagination.

- Neural network AI outlines and analyses human choice conditions at rates that are orders of magnitude beyond the human brain with better consistency of analysis.

There are so many more bullets I could have kept adding here, but to keep things moving along, I’ll stop here for now.

The theme each of these bullets is tied to the rate of technological change. It disrupts the way things have worked for long periods of time in very short periods of time; even people with area specific expertise underestimate the pace of change in their own areas of work.

Let me use two specific examples.

Quantum computing and encryption technology.

Standard 2048-bit encryption technology was strong enough to keep normal code-cracking computers at bay for very long periods of time. It was estimated that normal 2019 computer technology would take between 20 and 30 years to do enough computations to crack typical “government and military based” 2048-bit encryption walls.

A private company in California using quantum computers and a “trap door algorithm” lowered this number to….wait for it….8 hours!

There is more to this story that is not meant for the detail level of this editorial, but how do you think this type of change would make governments feel IF it were to become mainstream? On a much lower level, how much of a change would it make to how safe people feel using their credit cards online?

Negative interest rates FOREVER.

Nothing would be the same in a world where only negative interest rates existed.

It is hard to wrap one’s mind around negative interest rates, but the best way I have seen them described is by the following idiom:

Does anyone want to come and cut my lawn and pay me $10 bucks?

Figure I’d get my lawn cut twenty times a day if this were the case.

In our human minds we can’t imagine how interest rates could be negative forever, but in the manipulated financial world where the difference between debits and credits matter very little when interest rates near the zero bound, it is entirely possible that rates could go to zero and never return.

If this were the case, nothing—and I mean nothing—would work the same as it has in previous history.

In summary, neither of those examples are meant to be prophetic. The goal is to shake us all into the realization that none of us really have a clue how the next few years are going to look.

It is important that your investment goals are backed by a strategy that is robust enough to:

Change in the coming years and not get locked into the investment world of the past, and

Look at the world of change and try to find disruptive investments that will benefit from rapid change.

Now onto the second half of the weekly; a short summary of a John Mauldin comment from a couple weeks ago.

“There will be a price to pay for years of easy money.”

- Raghuram Rajan, former Reserve Bank of India, ex-International Monetary Fund economist, cashless society activist AND contender to be next Bank of England governor.

John Mauldin and Ray Dalio engaged in a back and forth rebuttal looking at the present financial world that takes different slants on the present monetary policy choices and how the future expected remedies might play out.

It was an extremely refreshing debate in how respectful and well thought out each reply was. In a world of combative social media trolling and “soap boxing,” it was a great example of how debate used to work!

In the end, both John and Ray agreed on much more than they disagreed upon, even though their political starting points were distant from each other. Again, maybe there is hope in that message too!

Let me lay out the base line thought process:

The “next” recession will come. Nobody knows for sure when but the next recession always comes.

Given the amount of debt AND the combative political landscape, the options for dealing with the next recession are much more limited than in previous historical cycles.

There are solutions to the present problems, but they all come with a cost. The choice to bury our collective heads in the sand does not stop the future next recession from coming.

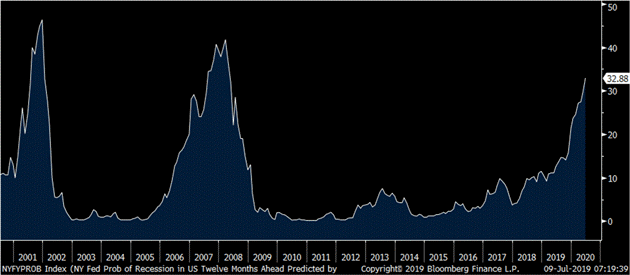

The chart below is the New York Fed’s own recession forecasting model, and it’s worth noting that based on historical data, the likelihood of the next recession is growing.

It all kind or reminds me of the Grinch that Stole Christmas classic. The old Grinch stands on top of Mt. Crumpet on Christmas morning and wonders in amazement, that despite all he did to manipulate the Who’s Christmas into a non-event, Christmas came anyway.

If the central bankers can’t stop the next recession, then our job is to anticipate what might happen during the downturn and have a plan to act accordingly. That, of course, is the theme of many of my weekly missives.

What I am going to include next is what John Mauldin writes about what fiscal policy could do before, during and after the next recession. Remember, I said it would not be painless, but many of these ideas get right to the core of our largest problems. (Following quoted from John Mauldin’s weekly letter linked above replying to Ray Dalio.)

A Radical Restructuring of the Economy and Tax Code

You’ve laid out what you believe to be the basis for how the economy and markets work. Let me offer a few simple assumptions of my own.

There is no political will in either the Republican or Democratic Party to reduce entitlement spending, and entitlement spending is on an ever-increasing path.

There is simply no way that we can raise income taxes enough to close the deficit to within striking distance of nominal GDP growth (where debt relative to GDP growth is equal).

As long as debt is expanding as it is now, we will stay in a slow-growth economy at best, if not in recession. Much research shows that increasing debt beyond today’s level will reduce GDP growth.

What we need to do is very difficult: balance the budget, bring deficits and debt under control, so that we can begin to grow our way out of the crisis. But we can’t do that while thinking about revenues as we do now.

So what can we do? The first step toward getting yourself out of a hole is to stop digging.

I would suggest that the US adopt a Value Added Tax or VAT, excluding food and certain other basic necessary items. I would make the VAT high enough to completely eliminate Social Security taxes on both the individual and businesses, giving lower income earners a significant tax break. We could also compensate those below the poverty line for their VAT costs.

Ironically, you and I will both qualify for Social Security benefits soon. I daresay you need it even less than I do. We aren’t the only ones. I think we should consider means-testing Social Security, and the same for all entitlements.

Consumption taxes like the VAT are the least economically damaging of all taxes, at least according to most of the research that I have read. While I personally (or at least the economist in me) would like a VAT high enough to get rid of all other taxes, I just don’t know if it would be politically possible.

One attraction should be that, if the VAT is high enough, say in the 17 or 18% range, we could have much lower income taxes. Just for illustration, maybe there could be…

No income tax below $50,000,

A 10% income tax on incomes from $50,000–$100,000,

A 20% tax on all income between $100,000 and $1 million,

A 25% tax on incomes between $1 million and $10 million,

and a 30% tax on incomes over $10 million.

… all with no personal deductions for anything. Period. That should certainly produce enough total revenue (along with corporate taxes) to fund the government as currently configured. It might even allow a little bit more for important needs we have deferred (like infrastructure) as well as medical and scientific research.

I totally understand that conservatives are uncomfortable opening the door to a VAT when a future majority might raise income taxes on top of it. I would be among them. In the spirit of compromise, we could amend the Constitution to require 60% majorities in both House and Senate to pass any tax increases. Of course, that would have to be passed by 37 states in order to become part of the Constitution, but that can be part of the negotiation process. Perhaps the new tax regime’s launch could be contingent on adoption by 37 states, which would encourage a more rapid adoption process.

I would also suggest that the tax changes be phased in over three or four years to allow for individuals and businesses to adjust.

This plan would eliminate the need for higher debts and quantitative easing, and would let the Fed keep interest rates at a more normal level. Retirees could once again look for an actual return on their savings, instead of the brutal punishment of financial repression. (We can have a whole separate conversation on allowing the market to set interest rates rather than 12 individuals sitting around a table.)

Please email me if you would like to read and discuss the full article.

Back to Nick:

These are drastic suggestions, but they work on so many levels to help the lower income part of society and equal the playing field.

As Canadians, a lot of this plan sounds pretty familiar.

The point is someone, somewhere has to change the trajectory of all the monetary insanity. I believe it will take a crisis but who knows?

The US Fed meets on the 30th of July; they will most likely ignore everything written above and kick the can down the road again. Ah, but we can dream.

That's enough (from me) for this week, Megan's got exciting news to share in a second post, so be sure to check that out too.

As always, please give us a call or shoot us an email to discuss anything mentioned above.