Nice Start to the Year

Investors were treated to a nice start to 2019.

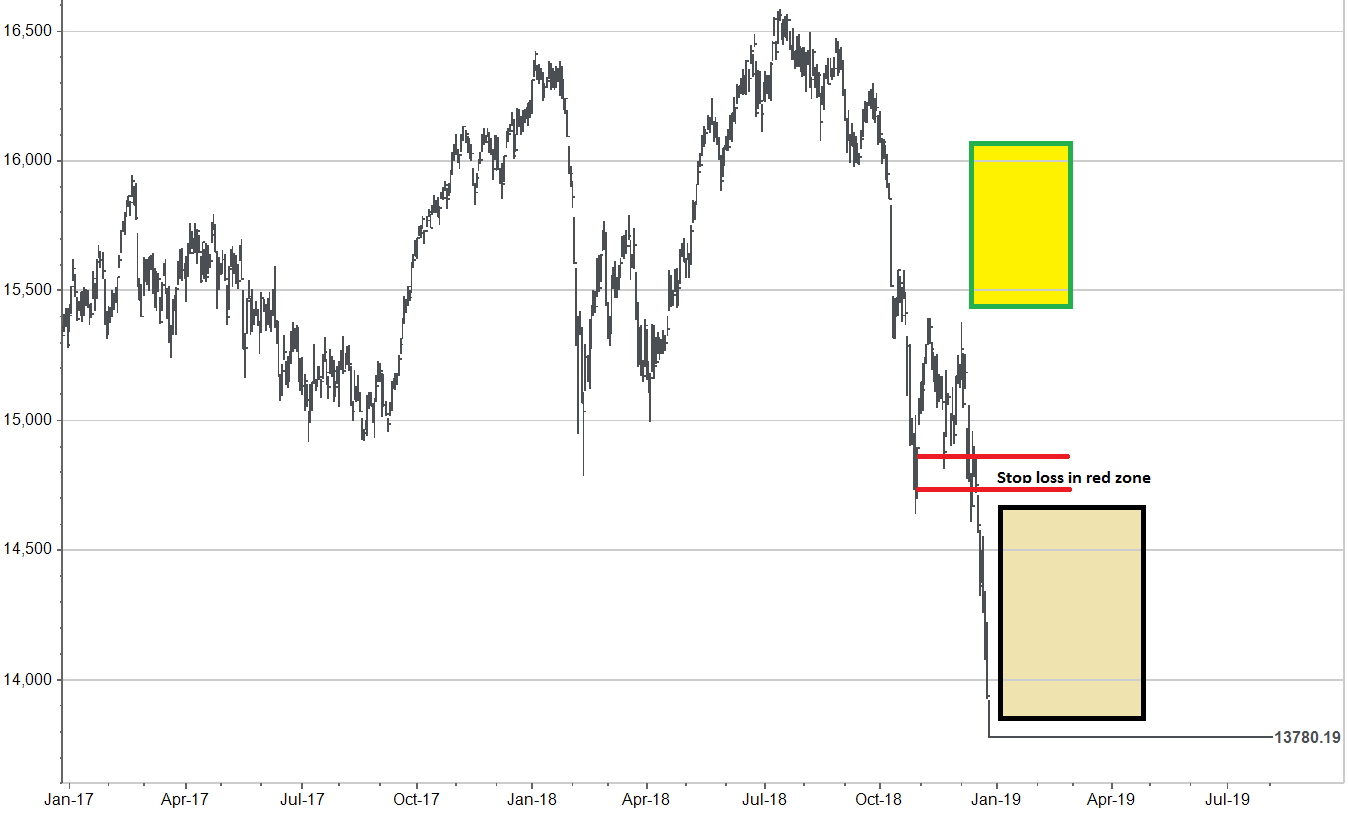

Stock markets recovered from a rough 4th quarter of 2018, and have now recovered back into “resistance” identified in my last report.

Since I am just back from vacation and have lots on my plate I am going to jump right into my update and keep it short.

Below are the two charts I left you with at the end of 2018.

The first shows the expected recovery bounce I was looking for in 2019; the shaded beige box shows the zone target used in that report.

The next chart I used at the end of last year shows the shape of the recovery bounce I expected.

I was expecting a recovery bounce up into the 14,700 level before a retest of the lows was initiated. As you will see in the present day chart below, the recovery bounce has exceeded what I would have expected and climbed to the 14,900 level.

I was expecting a recovery bounce up into the 14,700 level before a retest of the lows was initiated. As you will see in the present day chart below, the recovery bounce has exceeded what I would have expected and climbed to the 14,900 level.

The key to the chart above is that I still expect a correction of the short term run higher in the markets since December 24th, and a retest of the lows before this market can consider itself “out of the woods” for the mid-term time frame.

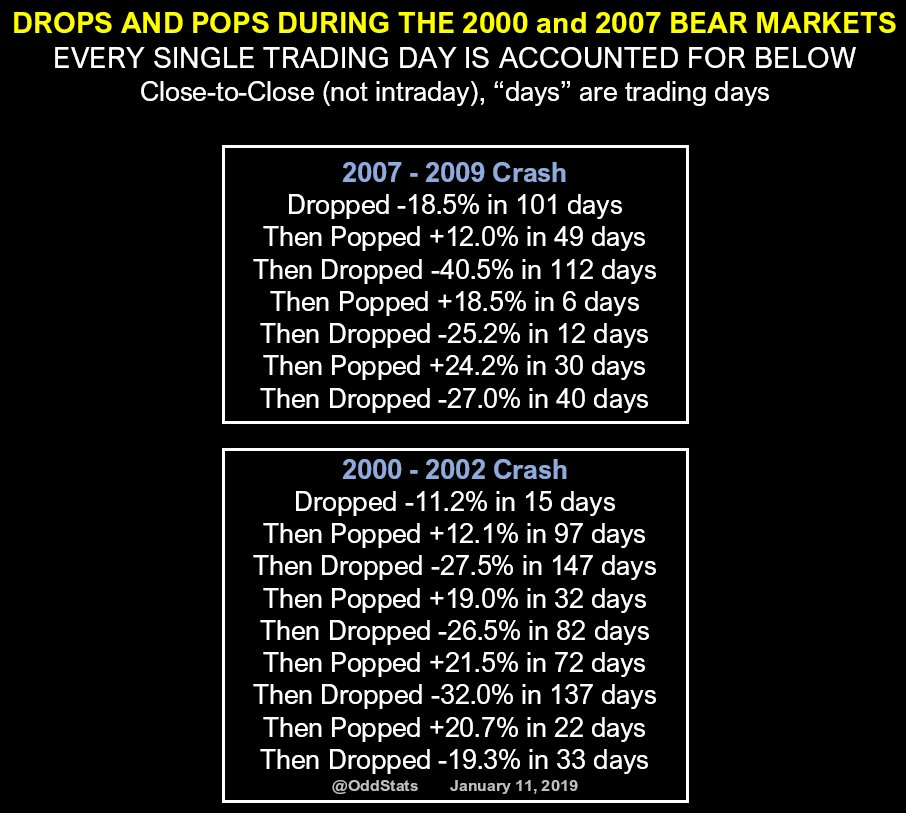

Sharp bounces higher in BEAR markets are to be expected and are very difficult to gauge in terms of magnitude. Check out the graphic below to see what I mean.

Those are some crazy bounces during the last two BEAR markets.

What caused this sharp bounce is really the main point of discussion to finish off with this week.

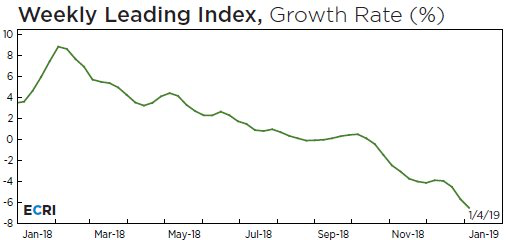

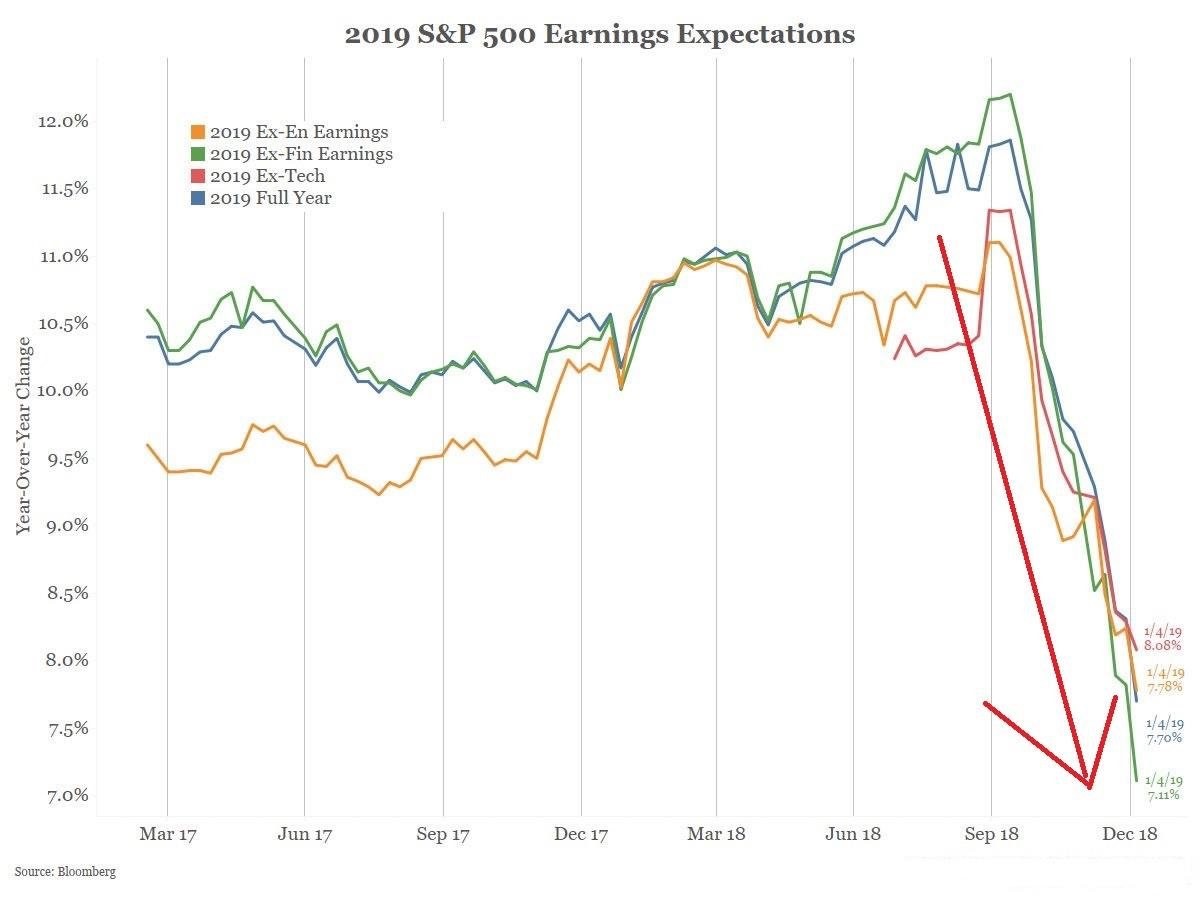

You see, the US central bank did a very sharp reversal in its held position of raising interest rates. I believe the US central bank is correct to be cautious given the global economic data (chart 1) and US corporate earnings expectations (chart 2), BUT this pause came much earlier in the interest rate raising cycle than was expected by those who felt the economic recovery was well entrenched.

Chart 1:

Chart 2:

This pause is an important point because, by pausing interest rate increases this soon in the raising cycle, the US Fed has left itself little room to fight the next recession with interest rate policy.

It implies that a greater round of Quantitative Easing (QE) will be required to support asset prices during the next market downturn.

While I was on vacation, I was thinking about what that might mean for investors.

I think it means that the Jerome Powell’s Fed will require a serious decline in asset prices before it re-initiates a new round of QE. Not just another 10% or 20% down from here.

Let me explain why?

I really don’t think the US Fed is at all happy with markets forcing their hand to pause interest rates hikes at this low of level. They believed the economy was more resilient and they believed markets could handle higher interest rates.

Unfortunately, the Fed now realizes they are in the “Hotel California” of monetary policy. Ten years of irresponsibly low interest rates has led to debt dependent asset markets to which higher interest rates are akin to Superman’s relationship to kryptonite.

IF the Fed has to add a new round of QE to the ceased interest rate increases cycle early to support asset prices, then I believe, markets will truly understand how challenged the global central banks are and how large of policy mistake it was to keep interest rates low for as long as they did.

The early Fed pause has been enough to create the present oversold rally. Has it been enough to actually bottom stocks and support asset prices?

It is just too early to tell.

Let’s see how the next four or five weeks play out. With earnings expectations in sharp decline, there is little reason for the stock market to run away on the upside.

Hopefully, the caving in on the US Fed has been enough to allow the late December stock market bottom to hold and we will get a decent “buy signal” in coming weeks.

Feel free to call or email with questions.