US Federal Reserve “Blinks” on Interest Rate Hikes

Let me open a quote from the official written statement from Jay Powell, US Federal Reserve Chair, at his Wednesday, November 28, meeting to the Economic Club of New York.

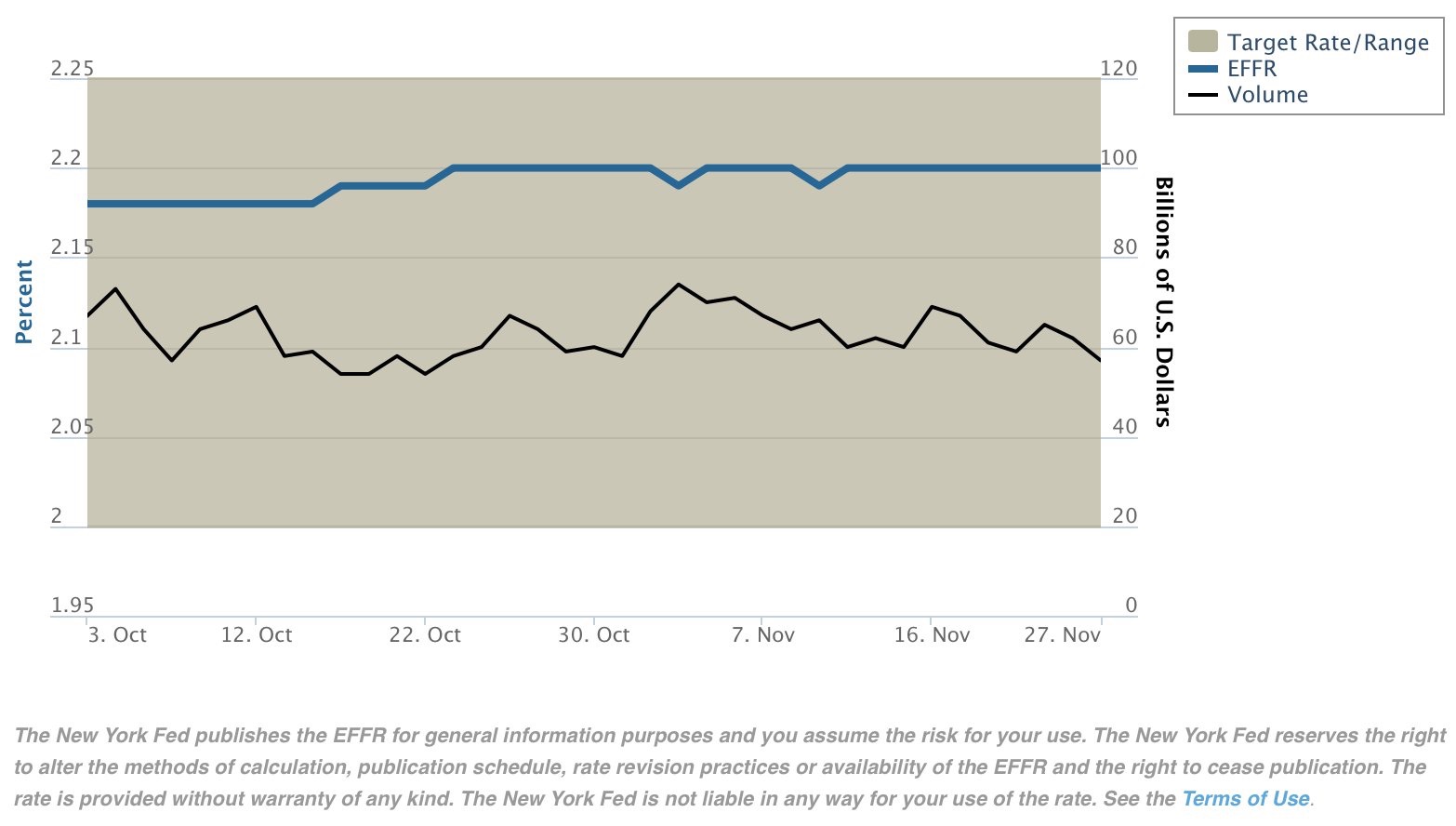

Powell added the Fed’s benchmark interest rate was “just below the broad range of estimates of the level that would be neutral for the economy -- that is, neither speeding up nor slowing down growth.”

The speech Powell gave in September stated that the US Fed Funds rate stance was still “we may go past neutral. But we’re a long way from neutral at this point, probably.”

There is a large gap in language between those two quotes, yet since those two speeches the US Fed has only raised interest rates by 0.25%.

There is a large gap in language between those two quotes, yet since those two speeches the US Fed has only raised interest rates by 0.25%.

What could the difference be?

- The stock market had a 10% correction.

- The economy slowed since September.

- The Fed got threatened by Trump and lost their nerve on raising interest rates to original targets.

Actually, all of the above are true.

As readers of this blog know, I have believed that the Fed would lose its nerve and cave in on interest rate hikes. When this happened I also believed that it would be time to buy stocks and see if the ensuing rally would hold up.

On that note, the Fast TEAM model bought back into the high dividend paying ETF for the Canadian market on the news of Powell’s surrender.

Now it is time for us to think about some other ideas that might take a little longer to sink into the financial markets due to the Fed’s change of heart.

Idea 1: The US dollar is not going to be king for much longer.

I would argue that all the US dollar BULLISHNESS that has been so prevalent is coming to an end. Avoid purchasing US dollars.

Idea 2: Time to look at Gold and Oil names.

Both gold and oil have been hard hit by the rising US dollar. If we believe the “dollar BULL” is at its end, then it would make sense to start dipping our toes into the water with the gold and oil names.

Make no mistake about it, these companies are beat up!

There is a big difference between the prospects for both groups.

Gold is what I would call the “traditional” investment in a market where the US dollar was expected to weaken AND inflation was expected to outpace interest rates. There is a decent chance of those two things happening. There is no rush to flood into this idea…just start to look around at some of the names that might make sense to you.

Oil tends to have a similar inverse relationship to the US dollar.

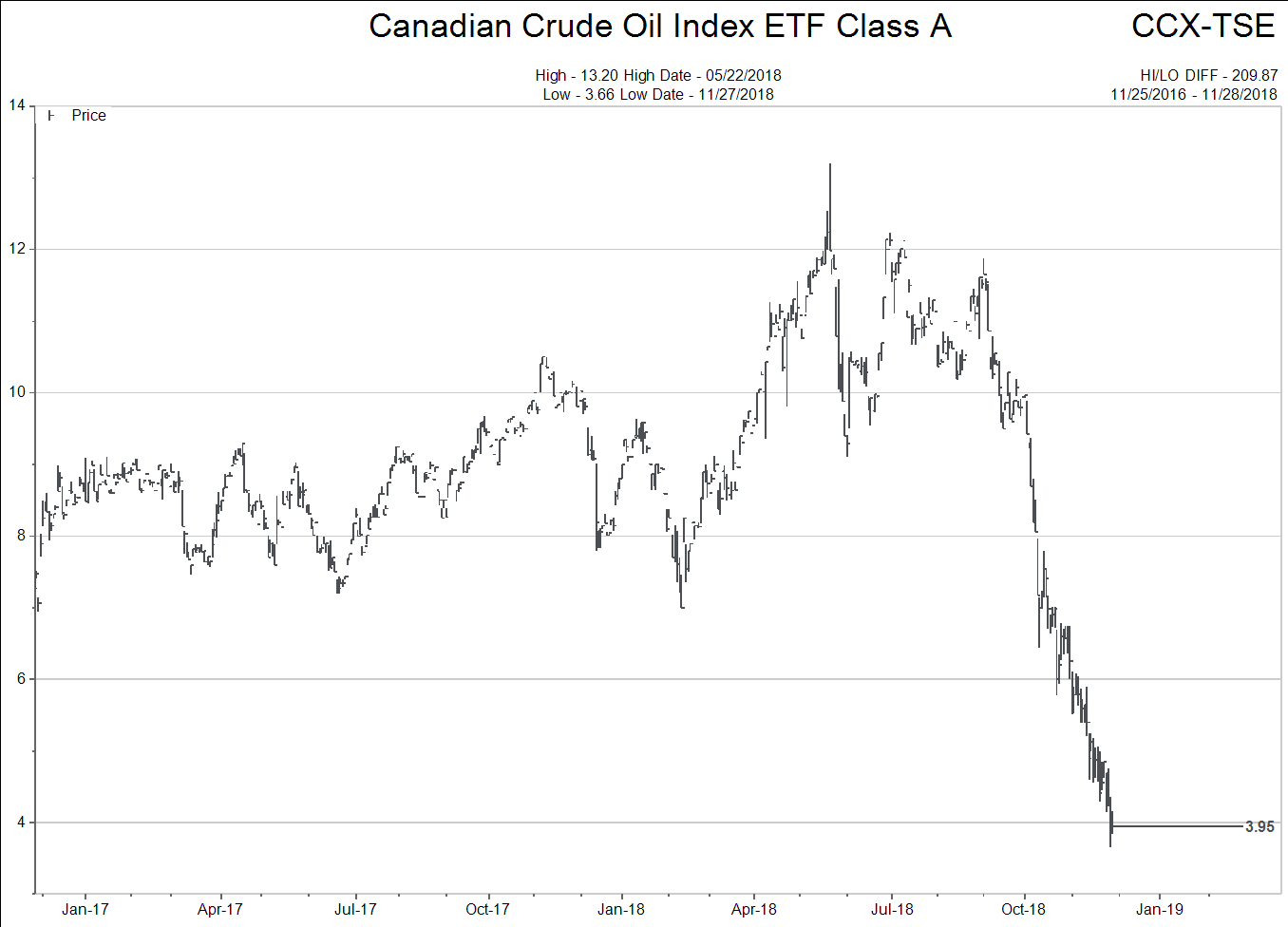

Before we get too excited about the Canadian oil names, we had better take a look at how badly beaten up Canadian crude prices really are. To illustrate this, the chart below is of an ETF for Canadian crude oil.

It has occurred to me that there is nobody left to “hate on” in the Canadian oil sector.

The challenge for investors is that these companies need MUCH higher Canadian crude prices to make money, making them risky investments.

Many of these companies also pay large dividends and if Canadian crude prices do not rise, the dividends are in jeopardy, so it is a classic risk/reward profile.

Keep your investment amounts low, but don’t turn a blind eye to the sector either.

Idea 3: Medium term bond investments

As interest rates stop rising and start falling, bonds will catch a bid. Risk control is required here, but this is another sector that likely has seen a change in its fortunes.

Idea 4: Select Canadian Preferred Shares

There is a very narrow group of names that I like as far as Canadian Preferred Shares are concerned. Please call me if you are interested in more information and a suitability discussion.

Conclusion:

We live in a bizarre financial world; this is a complicated market, but it will like the “dovish Fed.”

How can central banks be so fearful of normalizing the financial “tools” they employed 10 years ago to stop the “great financial crisis?”

When do they believe they will be able to normalize again if they can’t do it now?

And maybe the scariest question…what if pausing interest rate hikes sooner than expected does not stop the stock markets from falling?

I don’t have these answers for you today. All we can do is continue to be vigilant in our adherence to our discipline.

Please email us! Your questions, queries and feedback are welcomed and encouraged!