Update Canadian “Bounce” Status

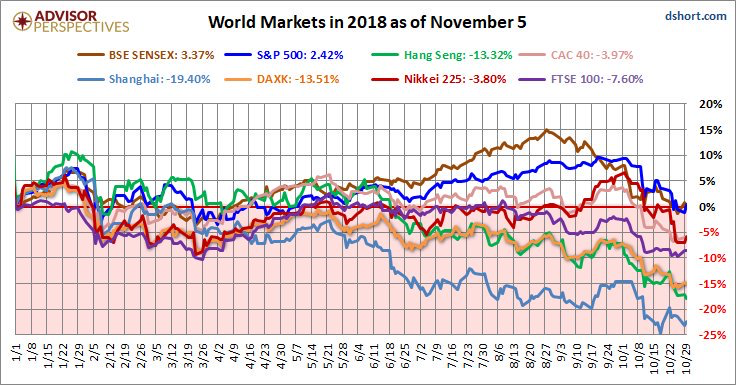

Let’s take quick look at the major global stock market indexes year-to-date for 2018 before we talk about the Bounce.

These trend lines are a week old and the stock markets rallied last week, but I think you get the picture; 2018 has been a rough year.

In the November 5th comment, I focused on a bounce in the TSX markets from the October lows. Below is the chart I posted in that comment.

As of Friday, November 9th, this is how our “bounce” chart has progressed.

Bounce chart on Friday

The US stock market completed its bounce chart on Wednesday last week after the US mid-term election results came is as the polls predicted they would. Note the rally back into the “purple box.”

The consensus opinion is that markets will give investors a “free pass” to the end of the year and continue to work their way higher. There is no reason to pick a fight with that opinion at this point in time.

But there are some serious differences in the fourth quarter of 2018, and the rest of the fourth quarters since the era of Quantitative Easing began 10-years-ago:

1. Quantitative Easing (QE) is not a thing on a global basis anymore.

Check out the red line on the chart below. It shows the cumulative amount of employed by central banks around the world. The peak amount of QE passed early in 2018, there is no reason to believe the central banks are going to turn the “spigot” back on without some kind of financial crisis to try and alleviate.

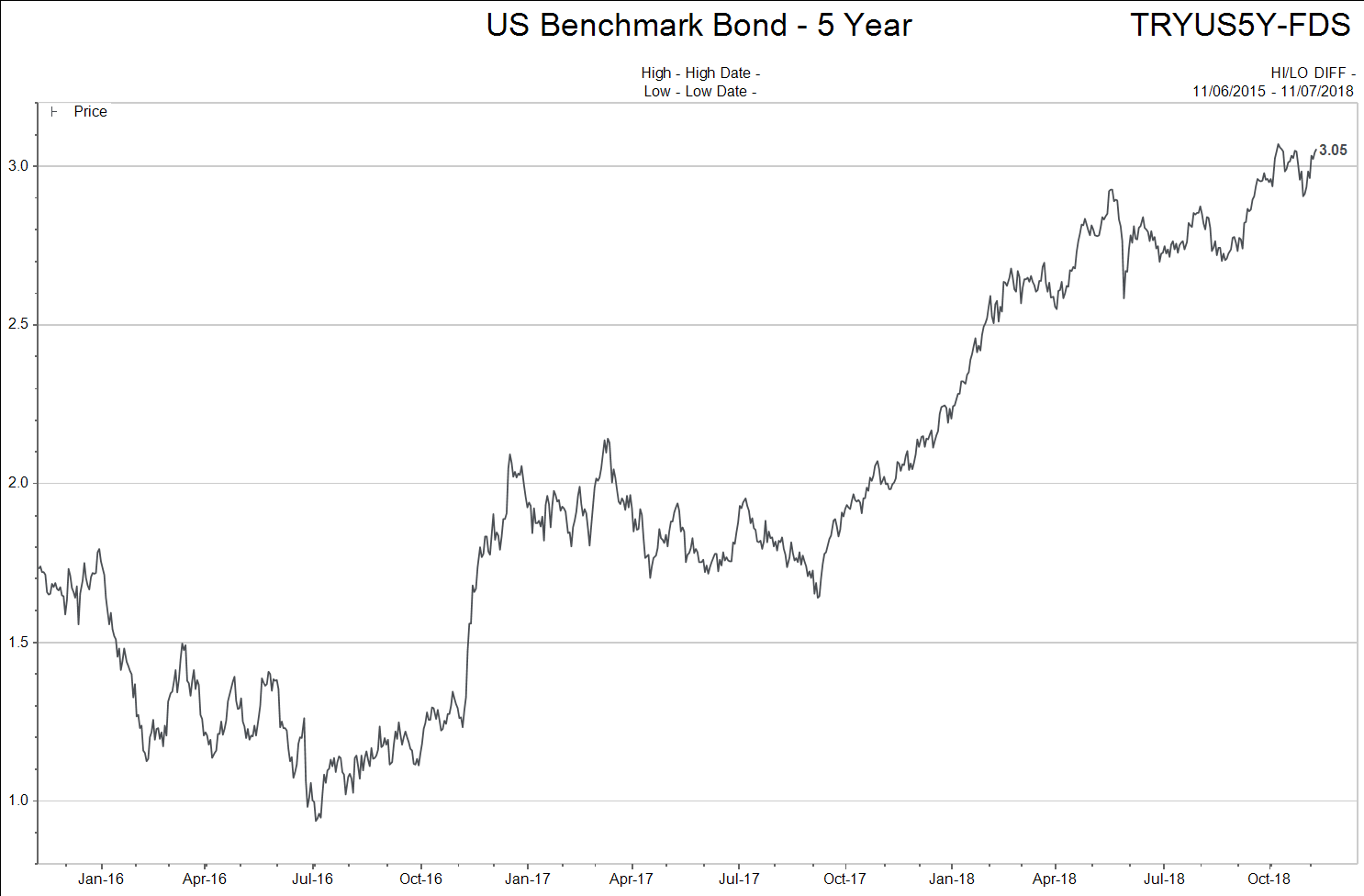

2. Interest rates are still moving higher.

The chart shown below show the yield on the 5-year US Treasury bond yields. Even with the stock market turmoil of last month, it is still very near three year highs.

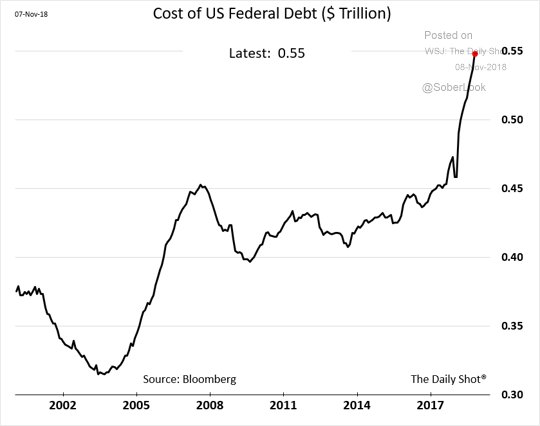

Do the higher interest rates really make that much of a difference? There are wide ranging opinions on that topic. Personally, I believe the higher rates are starting to bite companies and governments already.

Check out the chart below of the added cost to the US government debt caused by these higher rates. Hmmm?

I think, at the very least, everyone can agree that the higher interest rates are not helping the stock market.

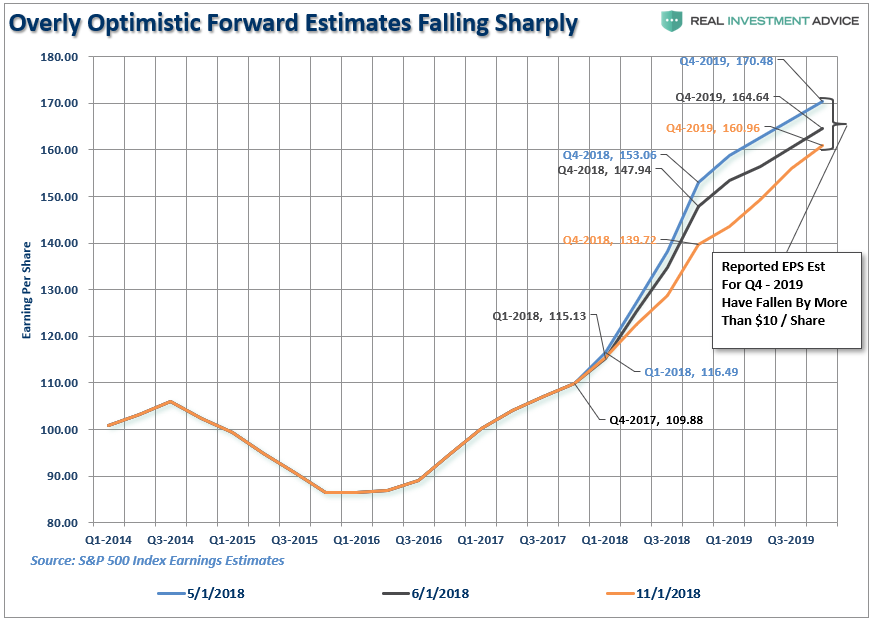

3. Profit margins are being squeezed.

Higher interest rates, higher wages, rising energy costs, tariffs, a stronger US dollar, and higher transportation costs are all rising faster than companies can offset with end market price increases. As they try and raise prices, the companies add to the inflation problem and the central banks try to raise interest rates to stop the inflation…sound familiar to any of you older readers out there? A little like “That ‘70s Show.”

Let me show you how these factors have impacted Wall Street estimates for 2019 S&P500 earnings estimates.

Just back in May 2018, analysts had the total earnings for the S&P500 to be at the $170 level…now that number is near $160.00.

Conclusion:

No real surprise on the bounce in global stocks after a wicked down move in October.

The FAST Team models were able to get reinvested at TSX 14,822 and are still using the “October lows” of 14,550 as a “stop loss” for these investment positions.

While FAST Team model holders wait to see how the Bounce plays out they receive a 5.50% annualized dividend paid monthly. Not bad while we wait and see what happens.

That said, I am not willing to treat the Bounce as a permanent thing either.

The odds are that stocks will hold above their October lows until the end of 2018, but we will continue to manage risk.

Hopefully, the TSX can complete its journey to the “green box.”

Home Equity Lines of Credit (Heloc) Clamp Down

The clamp-down on HELOCs could further suppress credit growth in Canada.

Yesterday, RateSpy published a story that highlights a tightening of lending standard, which has occurred on home equity lines of credit (HELOCs) by the major Canadian banks (TD reportedly made the change November 5).

The article notes that changes apply to borrowers (with existing HELOCs) who apply for new financing (presumably a mortgage) without closing their HELOC. Previously the bank would calculate as assumed payment based on the amount drawn on the HELOC, but the new regime sees the bank assume that a borrower may use all of your available credit and calculates the payment based on the HELOC limit (whether drawn or undrawn).

For a borrower with a $200,000 HELOC, the lender would add a $1,202 monthly debt payment (based on the current 5.34% qualifying rate on HELOCs … this will increase if the BoC continues to increase interest rates) to your financing application. (See below)

Nick comment: This is a totally under reported story. It appears important…I just wanted to keep you in the loop.