Wealth Management

A week ago I wrote about fishing for Chinook salmon. It was a lot of fun to read your comments back about your “fish stories” and “BC coastal tales.” Thanks for the feedback.

This week, I am going to steer clear of the markets again and talk about the other part of what my job consists of doing…“wealth management.”

It has nearly been a year since I spent much time on this topic. The format I am using to write about it is pretending that I was starting to build my business over again in 2018 as a rookie. What would I do?

If I were a rookie, where would I start?

It is funny, as a veteran investment advisor working in my 31st year, I find myself asking this question more frequently.

Building value added relationships has always been the most important part of the investment advisory business, but the importance of quality relationships has grown.

- People are living longer and require solid financial plans to help ensure they have the assets to enjoy the types of lifestyles they have worked hard to secure.

- Financial information is now a commodity. It is easy to find and to access…in many cases “too easy.” Trusting someone to help with the sorting out of this information and applying it to their personal goals and dreams requires a high trust relationship.

- The financial world is more complicated than ever before in history. Who can I trust to navigate it with me?

Without a doubt, the best way to build a trusting relationship with someone is to meet them and listen carefully to what they have to say about what they want to do.

Therefore, if I was a rookie again, I would focus on wealth management and life planning to build quality relationships.

What exactly is wealth management?

Wealth management is becoming one of the most over-burdened terms in modern day financial services. Everybody is a wealth manager. Everybody says they are an expert at everything financial.

Therefore, I’m going to keep the definition really simple.

Wealth management melds together the important aspects of family living, retirement goal setting, tax strategies, and legacy planning into a big picture snapshot to help you better visualize your future.

By spending a good deal of time getting to know each other better at the beginning of our relationship we can do a better job helping you choose investments that will allow you to achieve your goals.

OK…How do you and RBC Dominion Securities help me with my planning process?

The key is to establish an active dialogue, listen carefully, and really understand what is important to you.

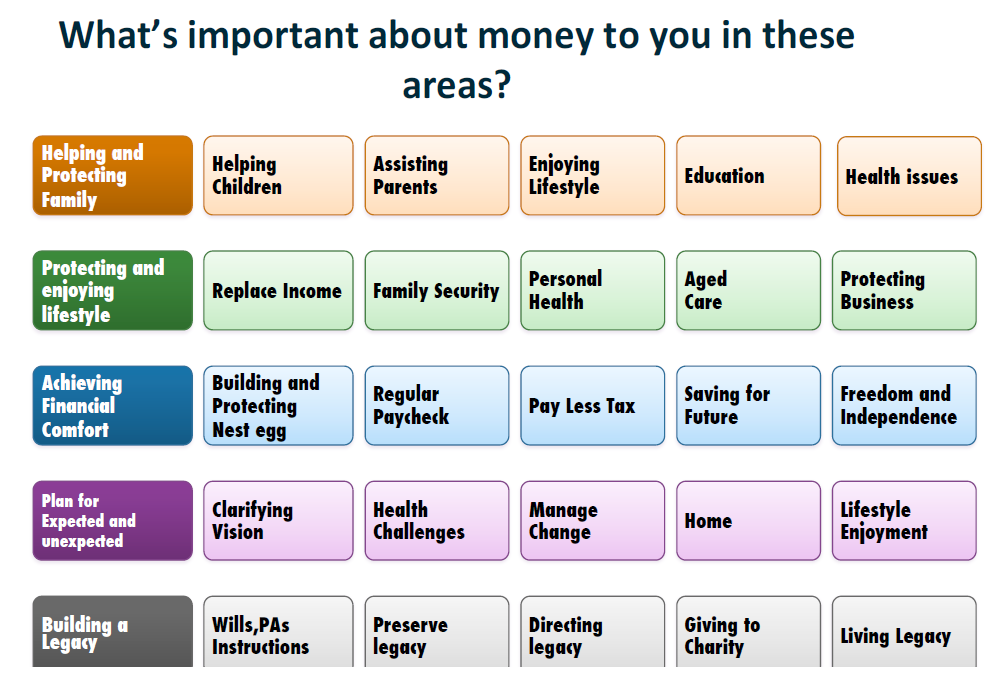

Below is an example of graphic we might use to prompt you to think about what is important to you now and in the future.

Sometimes a lot of ground can be covered in one meeting. Sometimes it takes longer. It is your future and your money so we let you drive the pace of the discussion.

Sometimes you bring up issues that are beyond the scope of our personal expertise.

Fortunately, RBC Dominion Securities has a group of people who specialize in areas where your needs might be highly technical or extremely specific. A Financial Planner, Estate Planner, Insurance Specialist and a host of others are there to aid in the creation of your personal life plan.

Another graphic I like to use cues you to think about specific topics that might jump out as being important to you and need further discussion.

By the time we get to this stage of our discussion, we have a pretty good idea about what types of investments are suitable to your future on both a “risk and reward” continuum.

Building a personalized portfolio that meets you objectives

When we begin to look at the actual “nuts and bolts” to be used in your portfolio we are going to discuss three broad categories of questions. The answers to these questions will frame the investment choices we choose:

- Time horizon

- Risk tolerance

- Income needs

Let me add a little colour to each of these categories.

Time Horizon – It only takes a few moments to discuss, but it is critical to the entire plan. If you have $1,000,000 in your bank account but need $800,000 to pay for a home being built next year, your time horizon is too short to take significant risk in the financial markets. You should invest the $800,000 in a short term, government guaranteed investment to pay for the house and invest the other $200,000 with a longer term time horizon.

As a rule of thumb, a minimum of 3 years’ time horizon should be envisioned to when adding riskier assets to an investment portfolio. (This means you could hang on to your investment for 3 years if you had to.)

Risk Tolerance – Most of us talk a better game of risk tolerance than we actually play. It is easy to say “I don’t care if the market is down 20%, I’m gonna hang on forever and the markets always come back.”

If the decline is only going to be 20%, then I find most people can handle those types of numbers with a balanced portfolio.

But what if 20% is only halfway down? Think of what the news will be like if markets were down…say 30%? Will you really be able to stay in your investments and take the heat?

As we discuss what investment choices are appropriate for you achieving your long term goals, we will definitely spend time on focusing on your risk tolerance. Getting this variable right is paramount to our happy, long term relationship.

Income needs – Finally, we will get a clear picture of how much income you require today and into the future. A basic rule of financial planning is taking care of your cash flow requirements BEFORE planning for your growth requirements.

Now take the thoughts and themes above and consider how they might apply to your personal situation.

Do you really understand the time horizon your portfolio needs to take care of you?

Are you clear about where you are exposed to risk in your investment portfolios?

Have your goals or objectives changed over the past few years and should we be discussing those changes?

Did this editorial make you think of something totally new that you want to discuss with me?

August is a slow month and I have no long holidays planned. If you would like to meet to discuss any of your “wealth management” oriented needs or questions, please touch base with myself or Megan and we can find a time to meet.