Welcome to my monthly comment on key issues in the market, and how they affect your investments.

April 2024

Playing hide and seek

When my siblings and I were just small, our family lived on the edge of town and we spent summers mostly on our own, running through the corn fields behind our house or cycling to the nearby beach. But when I was about 8 or 9 we moved into the centre of town. No more fields, no more beach. Instead we had neighbours, and this turned out to be the start of a new kind of fun. We quickly made friends and now summers were spent together exploring the city’s downtown or, in winter, skating on an ice-rink we built for ourselves in the backyard. And in fall, as the sun started setting earlier, it was time for hide-and-seek. We played this game hard, for hours at time, each of us hiding or seeking by turns until parents had to drag us in for bedtime. I loved the hiding part and got rather good at it. One time I crawled under the low branches of a fir tree and was never found at all. When I finally pulled myself out, I found the others had given up searching for me and had gone inside for hot chocolate.

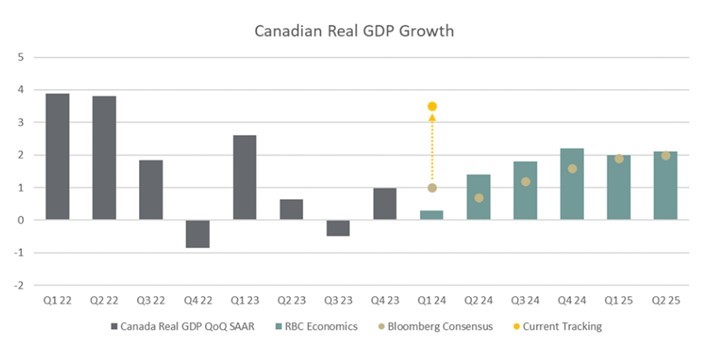

Investors have been playing a game of hide-and-seek of their own for the past year. We’ve been looking for a recession and can’t seem to find it. Instead, contrary to all expectations, economic results have come in looking fairly favorable. Take for instance Canada’s latest GDP figures, below. The trend for Q1 is distinctly strong.

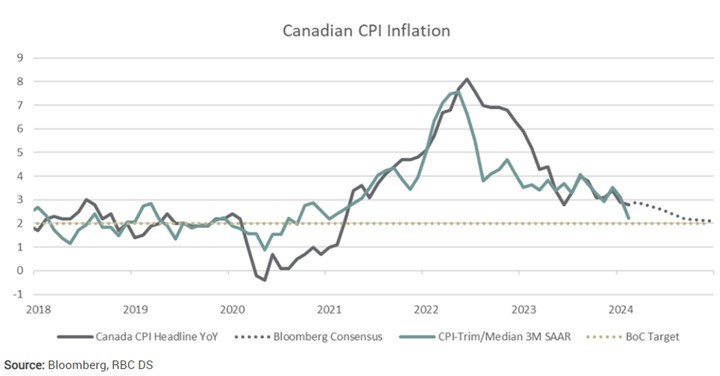

The story for inflation is also looking good, with actual readings closing in on the Bank of Canada’s 2% target.

Of course, no one really wants to find a recession, so naturally investors are happy it hasn’t turned up. Time, then, to call it a day and head inside for hot chocolate?

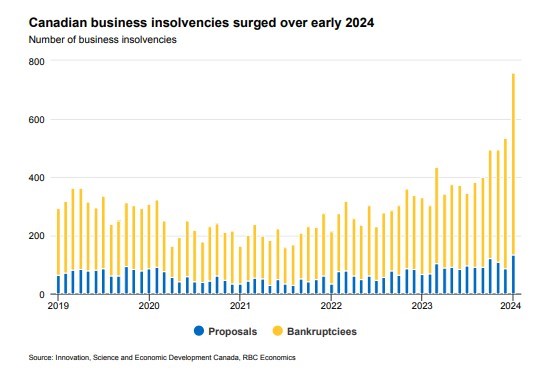

Not so fast. Higher borrowing costs are hitting borrowers hard, especially low income households and small businesses. In one piece of recent research, you can see that business insolvencies have shot up in 2024, which is clearly a sign of concern.

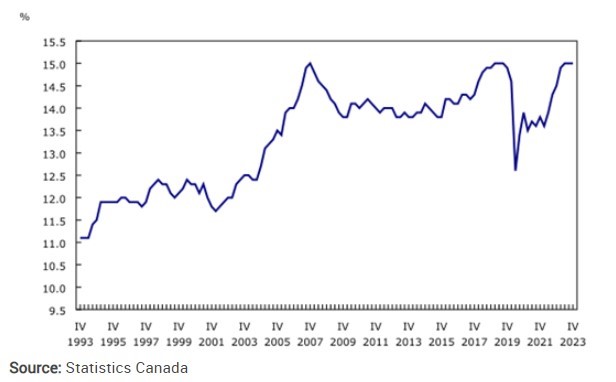

And a Statistics Canada report shows that 15% of disposable income is now going to service debt, which is the highest it’s ever been.

We welcome good news whenever it comes, but we remain prudent investors, mindful that just because you can’t find the recession where you expect it doesn’t mean it’s not lurking out there. So we’ve increased our allocation to less risky investments and won’t call the game over just yet.

Meanwhile, in other news…

AI is all over the news and is now affecting nearly every business. Banking is no different. But some companies, like JP Morgan, are way ahead, using AI to streamline operations, improve customer service and manage risk. RBC ranks pretty highly, too (3rd, in fact), according to the Evident AI index.

RBC’s ranking is largely owing to its own in-house AI research unit called Borealis. Nice to see RBC ahead of the pack, but rest assured our team is still in the driving seat here.

And update on e-waste

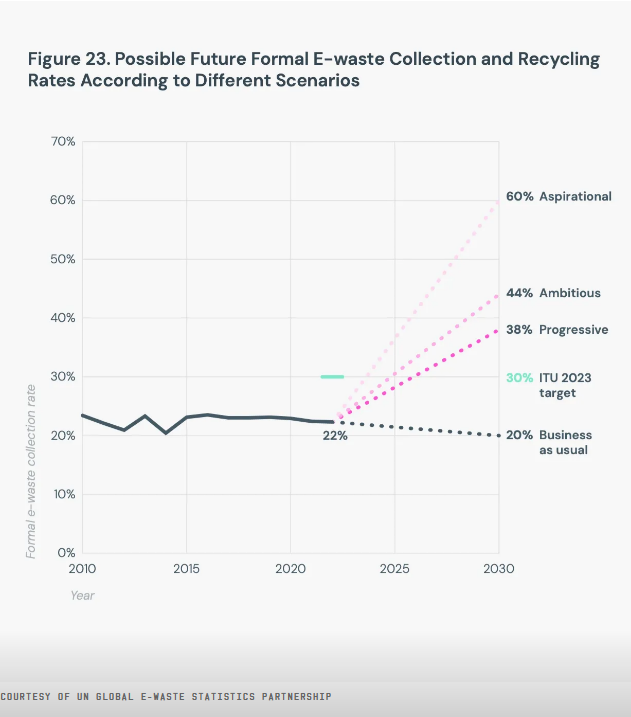

An unwelcome side effect of new tech is the problem of disposing of the old tech. A recent report in Wired takes us through the story of e-waste. Currently only 22% is recycled. There are ambitious targets to triple that number. Check out this article to find out more.

And finally…

For anyone interested in local politics, this exciting conference will inspire you!

Disclaimer. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. ®Registered trademark of Royal Bank of Canada. Used under license. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under license. ©Copyright 2023. All rights reserved.