Another rate cut from the Federal Reserve this week has taken U.S. interest rates into a new era where every rate cut means that policy gets easier …. and decisions only get harder.

As widely expected, the Fed delivered its third consecutive rate cut to close out 2025, while remaining noncommittal on what investors might expect into 2026.

As widely expected, the Fed delivered its third consecutive rate cut to close out 2025, while remaining noncommittal on what investors might expect into 2026.

But this latest cut could mark an inflection point for policy, the economy, and markets.

As the chart shows, with this latest rate cut to a midpoint of 3.63 %, policy rates now appear to be within the theoretical “neutral” range for the U.S. economy.

In other words - at which monetary policy is neither restrictive nor supportive of economic growth and inflation.

Policymakers judged the range to be from 2.6 % to 3.9 %, with a median of 3.0 %. While unchanged, both the median and the range have been trending higher in recent years from pandemic-type levels.

With this rate cut, is there a risk of a head-on collision with something unexpected?

Economic growth for next year was upgraded sharply to 2.3 % from just 1.8 % in September. A 2.3 % pace would also be well above the Fed’s 1.8 % estimate of the long-term sustainable growth rate for the U.S. economy—something that would normally add to inflationary impulses.

But perhaps not so …………

Expected core personal consumption expenditures for next year was lowered slightly to 2.5 % from 2.6 % in September, though also still well above the Fed’s 2.0 % inflation target.

When pressed on why stronger growth next year was paired with a lower inflation forecast, Fed Chair Jerome Powell alluded to the idea that AI and productivity gains could help to offset inflationary pressures. While possible, technology-driven productivity gains can be fleeting, while taking years to fully understand and realize.

Unemployment is seen ending 2026 at 4.4 %, unchanged from the Fed’s prior estimate, and in line with the current unemployment rate. This stands at odds with a stronger growth backdrop, but this too could be reflective of AI as labor markets face a technology-driven transition and inflection point.

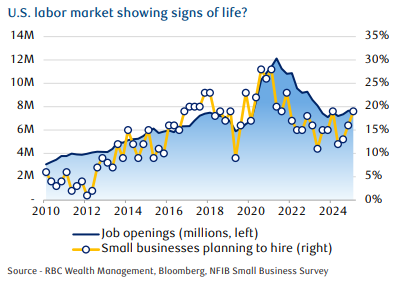

In aggregate: signs of an improving labor market are evident.

This week, job openings through October were much higher than Bloomberg consensus expectations, and as shown (adjacent chart) now appear largely unchanged over the past year, and still at historically high levels. At the same time, 19 % of small businesses reported plans to hire, matching the best reading since 2022.

This week, job openings through October were much higher than Bloomberg consensus expectations, and as shown (adjacent chart) now appear largely unchanged over the past year, and still at historically high levels. At the same time, 19 % of small businesses reported plans to hire, matching the best reading since 2022.

Though intentions to hire can be volatile, this does square with other recent measures of consumer sentiment such as the Conference Board’s survey of whether jobs are perceived as “hard to get,” which fell to the lowest level since June, and the University of Michigan’s survey of job loss probability, which fell sharply in the first part of December.

Looking at the Fed’s updated rate projections, 6 policymakers penciled in rates ending this year at an upper bound of 4.0 %, implying no further rate cut at the December meeting this week.

What does it all mean?

With the Fed on hold, though biased toward another cut, the 2-year Treasury yield is likely to remain around 3.5 %. The 10-year yield, which is more sensitive to economic growth and inflation, likely faces further upside risk from a current level around 4.10 %.

If labor markets stabilize and/or reaccelerate, we could see a move back into a range of 4.2 % to 4.6 %.

This will remain an attractive environment to take advantage of steep yield curves and any backup in yields to reposition portfolios by exiting shorter-dated bonds in favor of locking in higher yields and for a longer time further out on curves.

The Fed, along with other global central banks are at or near the end of their respective rate cut cycles. Some even turning the page toward the potential of higher rates—and an associated turn toward a more volatile market.

If you have any questions or comments, please do not hesitate to let me know.