Artificial intelligence is seldom out of the headlines in 2025, with defining developments coming one after another.

Today we’ll examine where AI is today and how its promise is matched against technological, economic, and geopolitical challenges.

In January, Chinese tech company, DeepSeek, released AI model, R1, that shook the industry. R1’s cutting-edge capabilities make it seemingly as good a model as those created by U.S. leader OpenAI, the maker of ChatGPT.

What shocked industry observers ?

- The miniscule development cost, ($6 million). This represents a fraction of what comparable U.S. models required.

- DeepSeek-R1 was released as an open-source model—publicly available at no cost.

With this, China gained an unexpected competitive edge, as the R1 model could spread and be adapted far more widely and cheaply than those of its Western rivals. This shook the U.S. tech ecosystem to its core, as until then, it had been confident in its position as the world’s leading AI force.

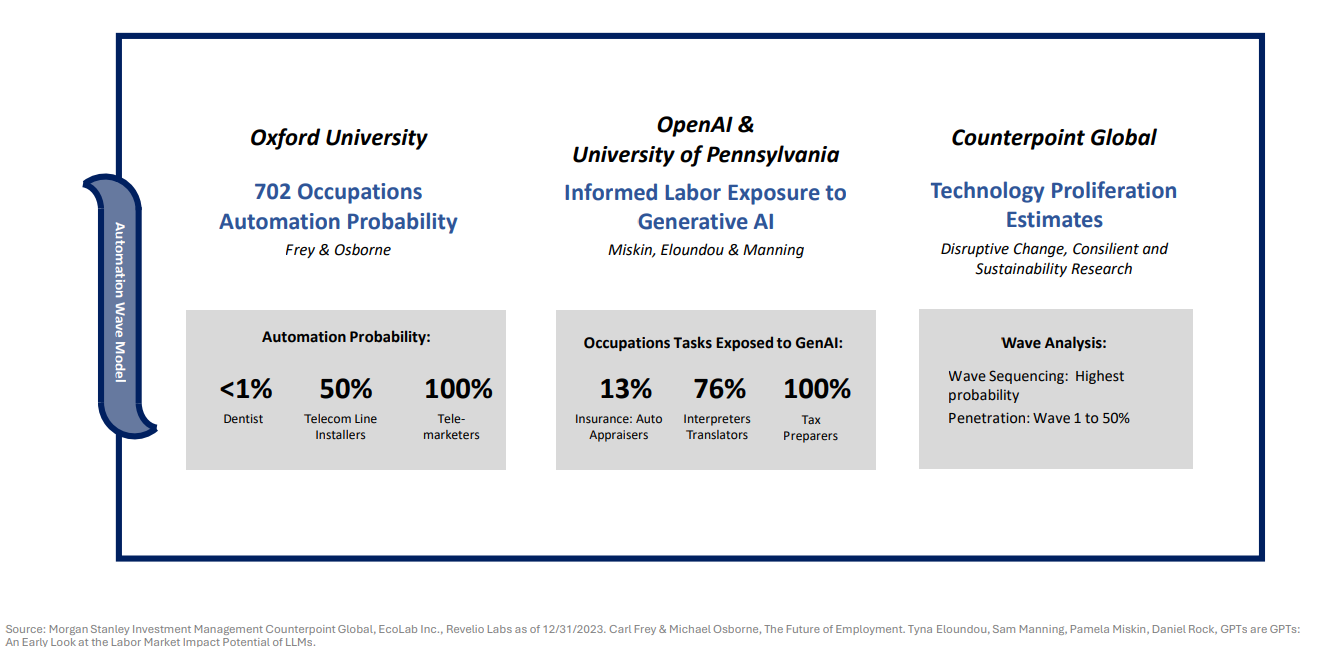

Source: Morgan Stanley Investment Management Counterpoint Global, EcoLab Inc., Revelio Labs as of 12/31/2023. Carl Frey & Michael Osborne, The Future of Employment. Tyna Eloundou, Sam Manning, Pamela Miskin, Daniel Rock, GPTs are GPTs: An Early Look at the Labor Market Impact Potential of LLMs.

China’s AI achievements go far beyond a single company. Millions of engineers and scientists graduate from Chinese universities every year. Spare grid capacity necessary to run the power-hungry AI models, and accommodating planning laws allow data centers to be built swiftly.

The White House initiatives to secure an edge in the AI race included releasing its AI Action Plan in July and changing chip export restrictions to China.

The Plan is built on three core pillars:

- Accelerating Innovation

- Expanding Data Center Infrastructure

- Promoting American Technology Abroad

According to The Brookings Institution, the plan can be praised for focusing on advancing and democratizing AI research, and the development of an AI-ready workforce.

The Trump administration is also using export controls, to respond to the Chinese threat. This time, however, the controls have sent confusing signals.

In April 2025, the Trump administration banned exports of NVIDIA’s H20 chips to China over concerns the technology could strengthen Beijing’s defense industry (H20 chips had been developed two years earlier by NVIDIA to comply with export restrictions). The ban was then lifted in July.

A few weeks later, Washington announced that NVIDIA and Advanced Micro Devices would be granted export licenses to sell specific chips to China so long as they shared 15 % of their revenue from these chip sales with the U.S. government. The policy U-turn points to the difficulty of calibrating the security and economic interests of the U.S. New sources of financing

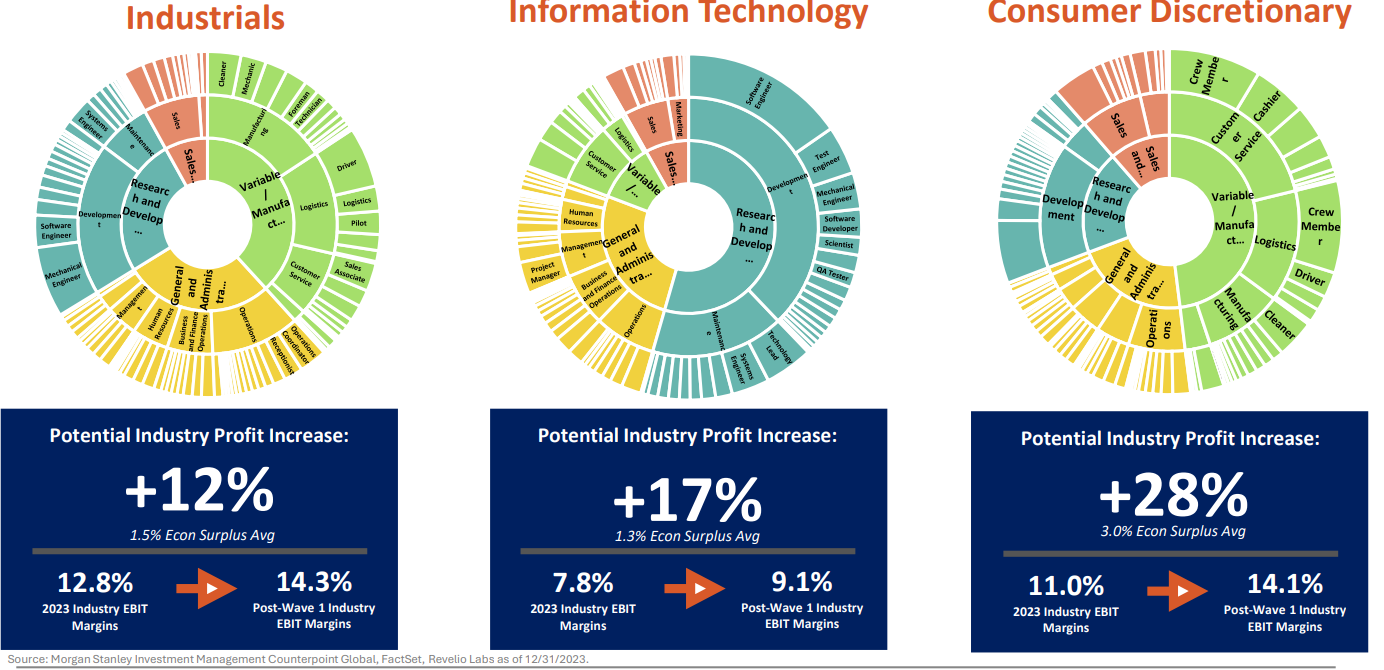

Source: Morgan Stanley Investment Management Counterpoint Global, FactSet, Revelio Labs as of 12/31/2023

Another key AI development in 2025 has been the shift in funding sources.

According to McKinsey, global data centers will need between $3.7 trillion and $5.2 trillion by 2030 to meet demand for AI computing power, including hardware, processors, memory, storage, and energy. Much of this will be shouldered by Big Tech companies that are building large data centers to support their cloud services and AI initiatives.

Tech companies have historically preferred to self-fund these investments, however, financing requirements are so large that companies are turning to different sources.

Investment-grade borrowing by U.S. tech firms was up 70 % year-over-year in the first half of 2025, according to Bloomberg. Debt securitization is also growing, whereby data center-related borrowing is pooled and sold to investors in tranches, (REITs, Other collateralized debt, etc.).

Private capital is playing an important role too.

Data center lending and investing carry additional risks beyond cost overruns. Overcapacity from rapid capital investment can leave assets underutilized while technology risk is also substantial.

Hyperscaler’s are diversified enough to weather these challenges, though they now carry substantial infrastructure and capital commitments—they are no longer asset-light.

Smaller investors and lenders will need to be particularly vigilant.

Many are optimistic that progress in AI will be swift, raising hopes that Artificial General Intelligence (an AI model with human-like cognitive abilities) and even Artificial Superintelligence (an AI model with an intellectual scope beyond human intelligence) could be achieved within this lifetime.

While the enthusiasm is understandable, others guard against too much enthusiasm.

Rodney Brooks, robotics pioneer and former director of the MIT Computer Science and Artificial Intelligence Laboratory, emphasizes that while AI models can use language fluidly, they are essentially pattern recognizers, really good at spotting and repeating patterns in data.

This may not the same as truly understanding or thinking for themselves.

Brooks believes change will come more slowly than is generally expected because rolling out new technology almost always runs into practical hurdles like cost, integration with other systems, regulation, and the need of human oversight—as AI systems are far from being plug-and-play as the hype often suggests.

Investors must bear in mind that corporate adoption of the new technology will be based on return on investment. A July 2025 report from the MIT revealed that 95 % of generative AI (GenAI) pilot programs in enterprises yielded no measurable return on investment.

2025 has been a pivotal year for the AI industry, and 2026 will likely be as eventful. Though new developments will likely keep enthusiasm high, investors should also keep on eye on whether such investments and the application of AI in business are generating adequate returns.

As has almost always been the case in the past, the risk remains that investors may overestimate what the new technology can deliver in the short to medium term.

As always, please let me know if you have any questions or comments.