I have written somewhat regularly about the importance of emerging economies. Today we’ll examine this theme from the lens of globe trade & geo-politics.

The geopolitical order continues to shift amid fracturing trade ties and high tariff levels, raising questions about long-term economic and investment implications.

From this, the BRICS association is attempting to chart a new course. China, Russia, and India believe a new multipolar world order is inevitable.

There are signs the world is transitioning from a U.S. led Western unipolar order which had characterized much of the post-Cold War period, to a new multipolar framework where not only the U.S. and its Western allies shape global affairs.

Other countries outside the West also have significant influence.

The intensifying strategic partnerships among BRICS countries are natural, predictable consequences of the ongoing shifts in the geopolitical and geo-economic orders.

Foreign policy Think-Tanks push back against the multipolar theme, asserting that the U.S. maintains its dominant role. Nevertheless, some prominent Americans, including retired General and Joint Chiefs of Staff Chairman Mark Milley, have acknowledged that the multipolar world is already here.

The BRICS association, along with its cousin Shanghai Cooperation Organization (SCO)—both of which include China, Russia, and India—are attempting to chart a new multipolar course.

BRICS has grown from 5 members in 2023 to 10 members and 10 partners in 2025. Members are Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates (UAE). BRICS is not designed to be a formal economic and political bloc like the EU. Its members flatly reject the term “bloc.” Nor is it designed to be a formal military security alliance like NATO or what is emerging in the EU.

There is also no military component to speak of.

Public statements have made it clear that BRICS countries desire deeper trade, financial, strategic, diplomatic, and cultural ties with each other, and want to leverage the economic achievements that are already under their belts and may be ahead.

The association is only getting started and has the potential to integrate and expand further.

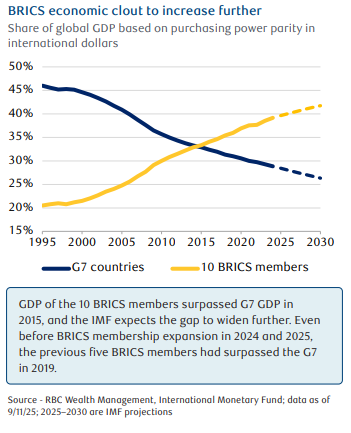

When measured in U.S. dollars, BRICS members represent 5 of the 20 largest economies in the world. But when GDP is calculated by purchasing power parity (PPP or adjusted for the cost of living).

BRICS member countries move higher in the ranks, representing five of the top 8 economies.

In 2025, the 10 BRICS members are expected to make up 40 % of global GDP vs. 28 % for G7 nations, (International Monetary Fund, IMF). This gap is forecast to widen through 2030.

It is safe to say that BRICS is too big to ignore.

A BRICS currency is a red herring for now, but other currency initiatives are not. Despite significant press and blog attention over the years about the potential creation of a single BRICS currency, this is still not formally being considered.

3 BRICS currency-related initiatives could further reduce the proportion of global trade in U.S. dollars and within the Western-backed SWIFT payments network.

- Trading In National Currencies: Members want to expand bilateral trade in their own currencies and to improve financial and banking systems. This trend picked up pace among BRICS countries and others following economic sanctions on Russia related to the Ukraine crisis.

- Cross-Border Payments Initiative: Members seek enhance their own interbank communications systems and provide an additional alternative to SWIFT that cannot be disrupted by Western governments’ sanctions.

- Grain Exchange: Members are creating a new commodity exchange to trade grain and expand into other agriculture products and commodities. Agriculture commodity trading has been dominated by the U.S. and other Western exchanges for decades, which effectively set prices globally, and where much of the goods are traded in U.S. dollars. The BRICS Grain Exchange would be an alternative, with the ability to trade in local currencies. BRICS countries repeatedly emphasize they are firmly against using currencies—the U.S. dollar in particular—as a foreign policy weapon, and this shapes their currency-related initiatives.

The Motus Operandi of BRICS: Bilateral trade. Investment. Cooperation.

BRICS is not a quick solution for any of the countries involved, however, by participating in the association, countries have many more opportunities to engage in bilateral investment, trade, and diplomatic discussions.

The recent progress between China and India to resolve their longstanding border dispute and improve relations has been facilitated by BRICS and SCO participation. The entrance of Middle Eastern and Southeast Asian countries into the broader BRICS association in 2024 and 2025—particularly the UAE, Indonesia, and Malaysia— has enhanced the group notably and opened many more economic opportunities.

The involvement of these regions, along with those in Africa and Latin/South America, integrates BRICS more deeply, providing a bigger voice in world affairs. This will likely be BRICS’ focus in 2026 when India assumes the rotating presidency

As always, please let me know if you have any questions or comments.