While U.S. tariffs revenue continues to rise, trade exemptions have softened the macro impact.

As uncertainty looms and costs gradually pass through, balancing resilient corporate fundamentals against policy is the order of the day.

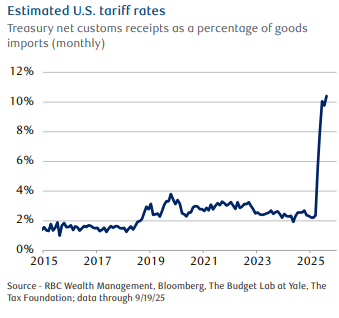

The weighted average applied U.S. tariff rate on imports stands at an estimated 19 %—up sharply from 2 % at the start of the year and the highest since the 1930s (Budget Lab at Yale and the Tax Foundation).

The increase in tariff rates, however, has been less severe than projected.

The increase in tariff rates, however, has been less severe than projected.

Customs duty collections suggest that, as of August 2025, the average tariff rate was closer to 10.5 %, well below the headline estimates.

That difference has helped keep the economic fallout more contained than initially feared, with more muted effects on growth and inflation.

Two main dynamics help explain the gap between the headline tariff rate and actual collections.

- Supply Chain Modifications: High tariffs on certain countries and products incentivize companies to find alternatives. Steep tariffs on Chinese goods, for example, have pushed firms to reconfigure supply chains, rerouting through third-party countries with lighter duties and/or sourcing from alternative markets or substitute products where tariffs are lower. Trade diversion and substitution effects soften the bite of headline tariffs, since imports still flow but through lower-cost channels.

- Exemptions: A large share of U.S. imports is exempt under existing free trade agreements. The United States-Mexico-Canada Agreement (USMCA), for instance, provides sweeping exemptions for Canadian and Mexican goods. RBC Economics estimating approximately 90 % of U.S. imports from Canada are duty free.

While dutiable goods face historically high tariff rates, the real economic burden has so far been more modest than headline figures suggest.

Even at below-estimated levels, the overall cost of tariffs (import tax) is still substantial. U.S. tariff revenues are now around $30 billion per month, putting collections on an annualized pace of $354 billion—roughly $275 billion more than in 2024.

Who ultimately bears the cost ?

- Foreign Exporters through price cuts to remain competitive

- U.S. Companies by absorbing the duties

- Consumers through higher prices

To date, it seems U.S. businesses are carrying a significant portion of the burden. The U.S. Import Price Index has remained steady this year. Inflation has risen somewhat less than expected.

These patterns suggest that companies have likely been absorbing a considerable share of tariff costs, at least for now, rather than fully passing them on.

But this outcome may not last indefinitely.

Once pre-tariff inventories deplete, the pressure to defend profitability ramps up, and may lead to product price increases. Over time, the burden of tariffs could shift more visibly to consumers.

The path ahead for U.S. trade policy appears far from settled.

In November, the U.S. Supreme Court is expected to hear arguments on a case involving the legality of certain tariffs. If overturned, the Trump administration may be forced to reconfigure trade measures, potentially replacing some existing tariffs with new ones under different delivery frameworks.

In November, the U.S. Supreme Court is expected to hear arguments on a case involving the legality of certain tariffs. If overturned, the Trump administration may be forced to reconfigure trade measures, potentially replacing some existing tariffs with new ones under different delivery frameworks.

This legal uncertainty leaves businesses and markets having to contend with a wide range of possible outcomes.

The legal overhang adds to an already unsettled environment, with the second-order effects from global trade frictions still unfolding and the USMCA slated for review next year.

Although U.S. trade policy has generally evolved favourably for markets and the economy, it would be wise not rule out renewed concerns about growth and inflation in the months ahead.

Despite policy risks, resilient corporate fundamentals and strength in the artificial intelligence investment theme, have helped offset these concerns.

Bloomberg consensus estimates for the MSCI All-Country World Index show global profits remaining on track to increase by 9 % in 2025, with another 11 % expected in 2026.

After balancing strong corporate fundamentals against optimistic valuations and lingering policy risks, aligning equity and risk allocations near their strategic targets, with a focus on quality businesses and diversifying across sectors and regions, remains a sensible basis for portfolio positioning

As always, please let me know if you have any questions or comments.