Let’s take a detailed examination of the attractive areas of the European equity market.

This summer has brought heavy news flow in Europe – namely German infrastructure spending to the U.S.-EU trade deal and diplomatic talks on the war in Ukraine.

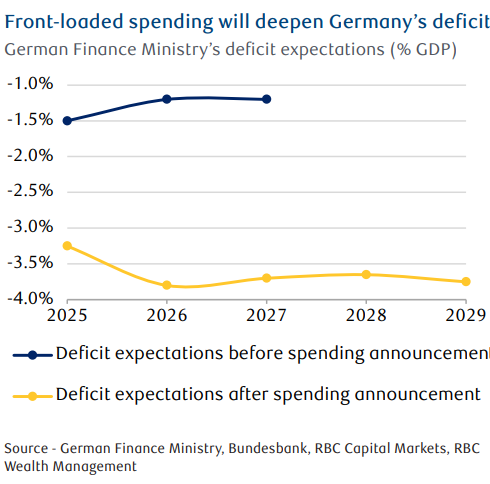

The announcements point to sizeable, front-loaded, spending.

In a radical shift from many years of fiscal prudence, the German government announced in March that it would:

- Create a 10-year €500 billion infrastructure fund which would not count towards the government’s borrowing limit

- Stop counting any defense spending above 1 % of GDP towards that limit. The Federal Ministry of Finance announced concrete figures behind these pledges in late June.

The German government is front-loading its special infrastructure fund, with around €58 billion by 2026, alongside some €25 billion in annual defense spending.

The German government is front-loading its special infrastructure fund, with around €58 billion by 2026, alongside some €25 billion in annual defense spending.

The details released by the Finance Ministry show that a high share of the spending is going to areas which should boost economic growth. In 2025, €22 billion, or about 0.5 % of German GDP, is going to rail sector improvements, €4 billion per year for housing projections, €4 billion for digitalization, and €6.5 billion for education and childcare.

RBC Capital Markets EU growth estimates of 1.3 % and 1.5 % for 2025 and 2026, respectively.

The U.S. and the European Union (EU) reached a deal in late July that introduces 15 % tariffs on most EU exports, including automobiles, pharmaceuticals, and semiconductors. Tariffs on steel and aluminum remain subject to global tariffs of 50 %, notwithstanding continued negotiations.

The European Commission committed to investing $600 billion in the U.S. economy and purchasing $750 billion in U.S. energy exports over the next three years.

This was poorly received in Europe.

The 15 % tariffs were higher than the 10 % tariffs which had been in place since April 2025, so it seemed the EU had capitulated. The agreed-upon tariff is lower than the 30 % U.S. President Donald Trump threatened in June.

While the 15 % rate doesn’t compare as favourably with the UK’s 10 % tariff, trade deals with other nations are at or above 15 %, suggesting that the EU is not in a weaker competitive position after all.

It should be noted that, while The EU has the authority to negotiate trade deals, it has no power over private investment, nor does it have the authority to tell companies where to buy energy.

The EU will attempt to regulate U.S. multinationals operating in Europe. It also wishes to impose a digital services tax. It also appears that Trump has abandoned the idea of treating the value-added tax—a sales tax typically over 20 %—levied by EU member states as an unfair tax barrier to U.S. exports.

Overall, this deal is not as disadvantageous to Europe as early reactions have suggested.

European equities have stalled in Q3 as compared to U.S. tech sector and currency adjustments. Overall, the STOXX Europe (ex-UK) Index has still returned over 13 % year to date in local currency terms, vs. S&P 500’s 9.5 % return in dollar terms.

From a different lens: U.S. dollar weakness helped returns of the STOXX Europe (ex-UK) increase 28 % in U.S. dollar terms. Performance has been driven by value stocks including banks (up 60 % in local currency). Construction, materials, insurance, and utilities have all gained more than 20 %.

A diplomatic resolution to the Ukraine conflict could act as a positive catalyst for European equities. Hope of reconstruction efforts could arise though this would require hostilities to come to a sustainable end.

Lower energy prices could also benefit the region. Any price improvement is likely to be marginal as EU sanctions on Russia will likely persist, even with an eventual ceasefire.

While the issues are complex, the investment case for Europe remains interesting, based on lower interest rates, German fiscal spending, and the EU’s commitment to investing in its defense industry.

The STOXX Europe (ex-UK) Index trades at 16.2x the next-12- months consensus earnings forecast, slightly above its long-term average - warranted given the region’s improved medium-term growth outlook.

Preference should be given to sectors which would benefit from the fiscal stimulus, (industrials, defense, and materials). Banks should benefit from the region’s improved medium-term growth outlook, while continuing to offer attractive dividends and share buybacks opportunities.

As always, please let me know if you have any questions or comments.