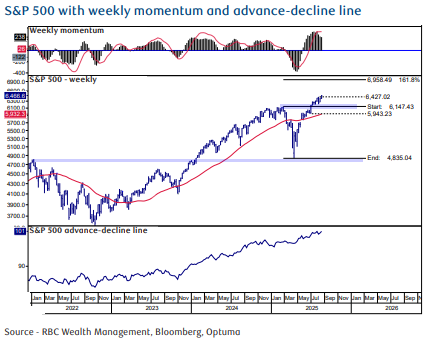

The S&P 500 uptrend reached an all-time high this week, but there could be more challenges for the remainder of Q3 and moving into Q4.

Momentum indicators are now overbought and turning down following a 30 % rebound by the S&P 500 from the oversold levels that developed at the April lows.

The S&P 500 along with the leading large-cap growth stocks are becoming well advanced from an intermediate term (3–6 months) technical perspective. Growth and cyclical stocks (i.e. Industrials and Financials) have started to pause and pull back.

These pullbacks may prove to be short-term in duration, investors can expect further choppy trading until the end of Q3.

Here are some of the larger challenges the market will face:

Market Cap Concentration

With the largest two stocks accounting for 15% of the S&P 500, the highest since 1980, and the largest four stocks accounting for 25% of the index.

Put differently, while the uptrends for these stocks remain firmly intact reflecting strong fundamentals, continued upside for the S&P 500 is dependent on just a few companies. Any hiccups in their optimistic outlooks likely to result in the entire S&P 500 pulling back.

Seasonality Often Turns Negative For Equities In Q3:

Quite common in the year 1 of a new white house administration.

Valuations Appear To Be Stretched For Many Growth Stocks.

Our market technicians are not bearish given the underlying trend remains positive but are finding relatively few timely opportunities following the April rally.

These factors support a cautious approach when allocating capital to equities.

The Importance Of Portfolio Rebalancing:

At the end of the day, our focus is on preserving capital for investors. As such, diversifying exposure from well advanced groups and stocks to those that are showing signs of either bottoming or emerging is prudent.

Sector and group rotation is often the lifeblood of a bull market wherein a leading group pauses while lagging areas rebound to fill the leadership vacuum.

While we don’t see a major shift away from the leading growth and artificial intelligence stocks, select groups that have lagged through 2025 are showing signs of improvement.

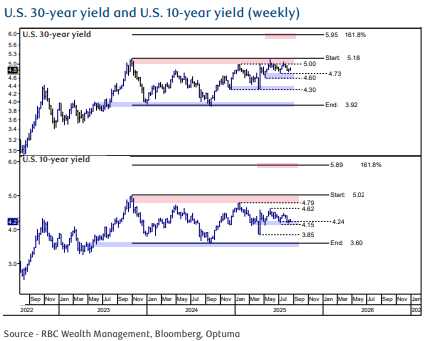

Interest Rates:

U.S. 30-year and U.S. 10-year yields - Inflation concerns remained a risk at the end of May. Interest rates have cooled, pulling back to test their next downside technical levels at 4.6%–4.7% for the U.S. 30-year Treasury yield and 4.15%–4.24% for the U.S. 10-year Treasury yield.

The technical backdrop for long-term interest rates as likely to remain range bound/ neutral into Q4.

- 5.00%–5.15% for the U.S. 30-year Treasury yield

- 4.6%–4.7% for the U.S. 10-year Treasury yield

A move above these levels will signal that long rates are starting a new major up leg.

Given the recently improved behavior of a growing list of interest-rate sensitive equities, such as homebuilders, biotech, banks, and small-caps, one can expect long-term interest rates to remain in a flat to weaker range through Q3 with those industries signaling the potential for an interest rate cut by the Federal Reserve in September.

As always, please let me know if you have any questions or comments