Good Morning,

The Q2 S&P 500 earnings reporting season has been fair-to-good so far.

There are more positive than negative aspects. Concerns within the Information Technology sector data that call for restraint.

Earnings are on pace to grow 10.4 % year over year (y/y), well above the 2.8 % consensus estimate just before the reporting season began, (Bloomberg Intelligence).

While this is lower than the previous two quarters, it’s a good, above-average growth rate.

Much of the Q2 growth is tilted toward two sectors in large technology and artificial intelligence (AI) stocks: Information Technology and Communication Services - both of which are pacing at over 20 % year-over-year growth.

A little over 81 % of firms have exceeded the consensus earnings growth forecast – well above the 75 % 10 year average..

The highest beat rates: Information Technology, Real Estate, and Health Care.

The lowest beat rates: Materials, Energy, Utilities, and Consumer Discretionary.

Revenues are on pace to climb 6.3 % y/y versus the 4.0 % pre-reporting season consensus forecast. The bulk of the Q2 outperformance is coming from the Information Technology sector at 22 % y/y revenue growth rate.

The only other sector posting double-digit revenue growth is Health Care. The Communication Services, Financials, Real Estate, and Utilities sectors are also pacing above the 4.8 % average since 2014.

The full-year 2025 and 2026 consensus earnings forecasts have nudged up to $270 per share and $303 per share, respectively.

It remains to be seen whether these levels will ultimately be achieved. The full impact of U.S. Tariffs is still largely unknown.

It remains to be seen whether these levels will ultimately be achieved. The full impact of U.S. Tariffs is still largely unknown.

The expectations bar had been lowered a lot in the months leading up to this reporting season as consensus estimates came down—although this often happens.

RBC Capital Markets, LLC Head of U.S. Equity Strategy Lori Calvasina pointed out that management teams’ comments on earnings conference calls have reflected the lackluster levels of corporate confidence in recent CEO and CFO surveys.

After reviewing numerous earnings call transcripts, she remarked that “we have a long way to go to understanding how the recent changes in trade policy will impact demand and 2026 outlooks.”

A key earnings story is the duration of the ongoing disparity between technology-related firms and non-tech firms. This can clearly be seen when comparing the AI-leveraged so-called Magnificent 7 stocks (Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla) to non-Magnificent 7 stocks.

As a group, Magnificent 7 earnings growth has come down substantially—partly due to difficult year-over-year comparisons and because their growth rates have been diverging more among each other.

Nevertheless, the collective Magnificent 7 earnings growth rate still exceeds the rest of the S&P 500, and this trend is forecast to continue until Q1 2026, (the top chart).

Importantly, the point of earnings convergence—when Magnificent 7 and non-Magnificent 7 growth rates are forecast to come together—has been pushed out again. In April 2024, the consensus forecast was for convergence between these two groups to occur in late 2024/early 2025.

That didn’t pan out. By February 2025, the convergence moment had been pushed out to Q3 2025.

Now it’s been pushed out to Q1 2026, according to the latest consensus forecasts. Earnings convergence between the Information Technology sector and non-Tech S&P 500 stocks isn’t expected until Q4 2026, according to Bloomberg consensus forecasts.

Now it’s been pushed out to Q1 2026, according to the latest consensus forecasts. Earnings convergence between the Information Technology sector and non-Tech S&P 500 stocks isn’t expected until Q4 2026, according to Bloomberg consensus forecasts.

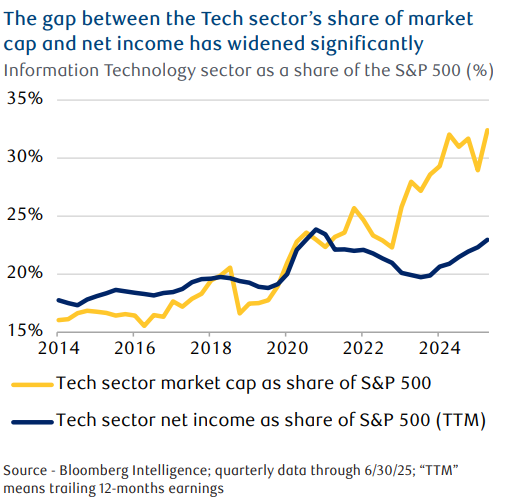

Since late 2022, the Tech sector’s market value as a proportion of the S&P 500’s total market cap has expanded meaningfully, from around 22 % to over 32 %. Yet at the same time, the Tech sector’s net income as a proportion of the S&P 500’s total net income hasn’t moved up much. It’s risen from 21 % in late 2022 to 23 % (bottom chart).

To bring this relationship back to a more reasonable balance, tech sector earnings would need to grow substantially more than the already-elevated growth rates. Analysts logically doubt this will pan out, especially given the difficult comparisons recently.

This is a signal that a lot of good news has already been priced into the Tech sector.

While the Tech sector’s mid- and long-term prospects remain favorable, at this stage, it would be wise not to be excessively overweight the sector or adding new funds to it for the time being.

As always, please let me know if you have any questions or comments.