Market rallies are in essence a double-edged sword.

The S&P 500’s recent rally has been terrific, but it’s pushed the market’s valuation back up to lofty levels.

Today we will discuss key drivers of the valuation expansion and how investors should factor valuations into the portfolio decision-making process.

Over the years, one of the key points I have attempted to impress upon our readers is the importance of valuation.

With the S&P 500 marching higher since the spring tariff scare, the market’s valuation has risen nearly in lock step, causing price-to-earnings (P/E) ratio to elevated levels

With the S&P 500 marching higher since the spring tariff scare, the market’s valuation has risen nearly in lock step, causing price-to-earnings (P/E) ratio to elevated levels

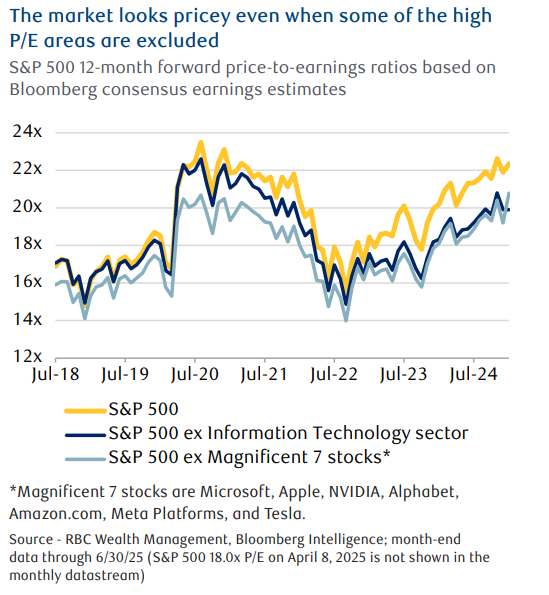

The S&P 500 has rallied 27.6 % since the April 8 low and 8.1 % year to date, as of yesterday’s close. Since the April 8 low, the market’s 12-month forward P/E has jumped from 18.0x to 22.3x, almost a 24 % increase.

This valuation level is above the 18.6x 10-year average and is much higher than the 16.5x average since 1990.

It’s not just the Information Technology sector nor Magnificent 7 stocks that carry elevated valuations. Even when these two areas are excluded, valuations look high, as the chart shows.

Fears about the Trump administration’s tariff policies have diminished. Market participants seem to believe the worst of the tariff announcements are in the rearview mirror.

While U.S. economic data has remained stable, investors shouldn’t be complacent about this.

RBC economists still anticipate tariffs will constrain economic growth and boost inflation during the second half of this year and into 2026.

Equity market participants have embraced the One Big Beautiful Bill Act’s taxpayer-friendly and pro-business provisions. The stock market has largely ignored the bill’s negative impact on the federal deficit.

These risks are showing up within the U.S. Treasury market, at the long end of the yield curve.

The 30-year bond yield has been elevated near 5 % for the past few months. The corporate profits outlook—the lifeblood of the stock market—is still viewed positively.

Q2 earnings reporting season has been good thus far. The S&P 500 2026 consensus earnings growth forecast of 12.6 % has given the investors much to cheer about. Whether it can continue is another question.

The artificial intelligence (AI) buildout is a key factor.

AI is now viewed by many market participants as a transformational technology—similar to the personal computer, development of the internet, or the industrial revolution and railway buildout over 100 years ago.

Chinese academic Wang Wen, professor and dean at Renmin University in Beijing, goes further. He likens AI to one of the biggest changes in the past four centuries.

Chinese academic Wang Wen, professor and dean at Renmin University in Beijing, goes further. He likens AI to one of the biggest changes in the past four centuries.

The AI transformation is advancing at its fastest pace in the U.S. and China. So it should be no surprise that the U.S. market is benefitting from having relatively high exposure to the emerging technology.

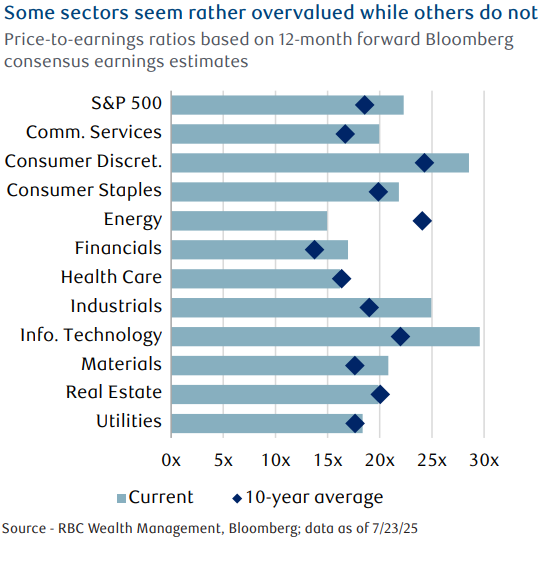

AI is not just impacting valuations of technology firms that have been at its epicenter for the past few years.

Companies in the Industrials, Financials, and Utilities sectors have seen their stock valuations expand in the past year partly due to their potential ability to leverage AI to cut costs and/or improve their goods and services.

It’s reasonable to think stocks in other sectors could benefit from AI in the future.

For growth companies alone, overall market’s valuation have historically been a poor market-timing indicator. Let’s explain why.

P/E ratios and other valuation metrics can stay elevated or depressed for longer than investors feel it reasonable. Examples such as the technology bubble more than 25 years ago, or the financial crisis of 2008.

In summary: Valuation is important !

- It tells us what stock (and the overall market) is worth

- It can help determine how much (or little) equity exposure is suitable in a portfolio at any given time.

- It is NOT a useful tool for short-term buy or sell decisions. Technical analysis is much more useful here.

Now – Let’s examine the importance of diversification.

Though there have been valid reasons for the recent valuation expansion, the current P/E ratio gives us pause.

It’s one reason we continue to recommend holding U.S. equity exposure at no higher than a Market Weight level in portfolios.

There are two additional reasons that make us reluctant to chase the market and position more aggressively:

- Potential economic vulnerabilities due to tariffs and the possibility that second-half 2025 and full-year 2026 earnings results could fall short of current consensus forecasts. (chart below).

- We still like Information Technology but would not be adding exposure at current levels. The S&P 500’s stretched valuation is also an argument for diversification into markets outside of the United States. Valuations of European and Asian developed markets and Asian emerging markets are near or slightly below their 10- year averages.

We think investors who have traditionally held high levels of U.S. equities exposure in portfolios should make some room for investments in these markets as well.