While U.S. equities continue navigating waves of volatility on the way to new highs—the environment certainly was not as favourable.

Today, we’ll look at four key catalysts the drove recent outperformance and examine whether they can be sustained.

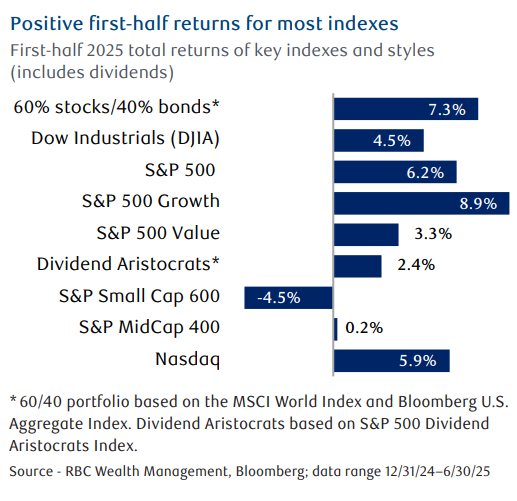

The S&P 500 ended a volatile first half of the year up 5.5 % (6.2 % including dividends), defying doom and gloom sentiments, climbing to new all-time highs in late June.

U.S. President Donald Trump’s tariff policies dominated market trends, generating significant downside and upside volatility in the spring. Investor sentiment shifted to unease as Trump rolled out high tariffs on Canada and Mexico, and then turned deeply negative after the president imposed ultra-high so-called reciprocal tariffs on the rest of America’s trading partners.

The S&P 500 tumbled 12.1 % in just four trading sessions, and declined 18.9 % from its peak level in February, nearing bear market territory.

The S&P 500 tumbled 12.1 % in just four trading sessions, and declined 18.9 % from its peak level in February, nearing bear market territory.

Following strong opposition – mainly from the U.S. Treasury bond market—the Trump team blinked.

It paused the ultra-high reciprocal tariffs and sent signals that sky-high tariff rates were unlikely to return.

The S&P 500 and Nasdaq Composite then surged 24.5 % and 33.4 %, respectively, off the April 8 bottom, and by the end of June each had climbed to new all-time highs.

As Trump’s “One Big Beautiful Bill Act” continued to work its way through Congress, the stock market was also boosted due to the legislation’s market-friendly tax and business provisions.

While the worst of Washington policy volatility has blown over the stock market, the tariffs already in place have the potential to generate economic headwinds and uncertainties.

While the worst of Washington policy volatility has blown over the stock market, the tariffs already in place have the potential to generate economic headwinds and uncertainties.

RBC Global Asset Management estimates the U.S. average effective tariff rate will likely end up roughly around the 15 % level when all is said and done, after agreements are finalized.

Tariffs are effectively a tax, and at this stage it’s unclear who will foot the bill (foreign suppliers, domestic producers , households, or some combination thereof).

While the stock and bond markets have been on inflation watch due to tariffs, both markets have rallied lately as inflation has yet to push higher.

The U.S. Consumer Price Index drifted down from 2.9 % in December 2024 to 2.4 % by May, the most recent report. The equity market looked past the 0.5 % decline in Q1 GDP. This is largely because of tariff-related noise in the data and a snapback of some economic indicators in Q2.

Nevertheless, RBC Economics currently forecasts 1.6 % GDP growth in 2025 and 1.3 % in 2026, both subpar levels, but not recessionary.

If GDP growth ends up being below average, S&P 500 profit growth will be around mid-single-digit levels this year and next - not bad and is no reason to become negative about the market’s prospects - but keep in mind that it’s below the 7.5 % and 13.0 % consensus earnings forecasts for each year.

The stock market also has been boosted by the likelihood that the U.S. Federal Reserve will resume rate cuts.

The central bank is taking cues from the bond market, which is currently assuming two 25 basis point cuts later this year, the first one potentially coming in September.

Stocks leveraged to artificial intelligence (AI) technologies started the year wobbly as “show me the money” attitudes persisted around the return on capital from billions upon billions invested in AI.

Since the April 8 market low, the performance of the AI-leveraged so-called Magnificent 7 (Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla) has been less uniformly positive than in the past two years.

During the first half of 2025, three of these stocks rose by double digits (Meta Platforms, Microsoft, and NVIDIA), whereas three declined (Tesla, Apple, and Alphabet, the first two by double digits), and Amazon was flat.

Analyzing S&P 500 returns from the first half of 2025, uncovers that the overall performance was mainly driven by just two stocks—AI-leveraged firms Microsoft and NVIDIA, which represented 42 % of the index’s total return, (chart above). Add Meta Platforms and Broadcom, to this and 62 % of the S&P 500’s total return was impacted by the emerging technology.

One could make the case that shares of financial giant JPMorgan Chase and defense and security firm Palantir benefited from AI optimism, as both are viewed by Wall Street analysts as AI leaders in their respective industries.

Investors, however, should keep in mind that the construction of the S&P 500 is one of the main reasons for this.

Five of the six stocks above are “mega-cap” stocks, meaning their capitalizations are much greater than the average S&P 500 stock.

When mega-cap stocks do well (or poorly), they have an outsized impact on the S&P 500’s return. This phenomenon is also illustrated in the poorly performing category of first-half 2025 returns.

Apple, Tesla, UnitedHealth, and Alphabet were the four biggest detractors from S&P 500 performance due to the combination of their declines (the first three dropped by double digits) and mega/large-cap status.

Leadership within the S&P 500 wasn’t as narrow as it might seem when the market-cap issue is set aside:

- Nine of 11 sectors rose during the period, and six outperformed the S&P 500 19 of 25 major industry groups (a level below sectors) rallied 60 % of S&P 500 stocks rose.

- The median and average S&P 500 stock gains were 3.9 % and 4.7 %, respectively, including dividends

- The S&P 500 Equal Weight Index rallied 4.8 %, including dividends

While the tariff saga has not yet been fully resolved and more news is likely in July and possibly later, much of the drama associated with Washington policies is in the rearview mirror.

The market’s attention in the second half of 2025 and 2026 will likely be on the impacts of tariffs already in place and the “Big Beautiful Bill” on the economy and corporate earnings.

As always, please let me know if you have any questions or comments.