The 2018–2019 U.S.-China trade conflict underscored how tariff uncertainty can dampen expectations - even if the earnings impact were modest in the end.

Given an unusually wide range of potential tariff outcomes, what approach should investors take?

Let’s break things down by asset class.

Equities Bore The Brunt:

The U.S.-China tariff war jolted equity markets in 2018, sending investors on a turbulent ride.

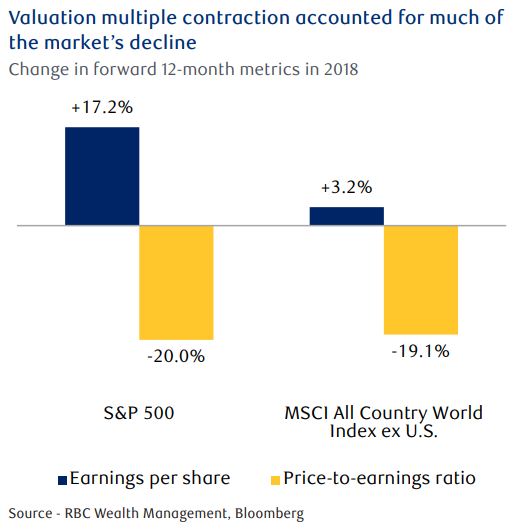

By the end of 2018, global stocks had declined by 11.2% in U.S. dollar terms, with the S&P 500 faring somewhat better, down 6.2%, while global ex.-U.S. equities slumped by 16.4%.

The correction in equities was driven less by outright corporate earnings weakness and more by deteriorating sentiment. Valuation multiples compressed sharply under the weight of mounting uncertainty, even as earnings estimates held relatively firm.

The correction in equities was driven less by outright corporate earnings weakness and more by deteriorating sentiment. Valuation multiples compressed sharply under the weight of mounting uncertainty, even as earnings estimates held relatively firm.

Fixed income: Central Bank Take Centre Stage

The impact of a tariff shock is challenging for monetary policy to address.

Central banks can’t use interest rates to simultaneously restrain inflation and support economic activity.

The typical response to a one-time price shock is to almost ignore the temporary inflation impact and focus instead on the hit to growth.

The 2018–2019 monetary policy cycle caused U.S. and global bond yields to follow the same up-and-down pattern that we noted for inflation and economic activity.

Lower yields (higher bond prices) were contingent on inflation expectations remaining stable and monetary policy having the leeway to look through temporarily higher inflation.

The Road Ahead Will Be Rocky

The Road Ahead Will Be Rocky

The Trump administration’s trade agenda is starting to take shape, yet the range of uncertainties runs wide.

Financial markets, until just recently, appeared relatively unfazed.

This may have been a function of investors experiencing “tariff fatigue,” where market participants focus on implementation rather than the steady stream of threats—or possibly some degree of complacency.

With global equities trading at 17.9x forward 12-month earnings estimates—well above their long-term average of roughly 15x—and compensation for taking credit risk in corporate bonds near historically modest levels, it appears that risk assets have been leaning into an optimistic outlook for the economy and corporate profits.

Portfolio Implications

For equity portfolios, cautious, watchful, but invested remains the appropriate stance.

Given the potential for persistently elevated trade uncertainty to weigh on the economy and corporate fundamentals, an “up-in-quality” approach to allocations as sensible.

Within equities, this can be expressed through a preference for companies with more consistent cash flows, stronger pricing power, lower debt levels, and/or growing dividends—quality and defensive attributes. These types of companies historically have enhanced resilience to weaker economic conditions.

In fixed income, high-quality bonds offer an appealing source of stability. Short and intermediate-maturity bonds offer reasonably attractive yields for stable income, with capital appreciation potential should economic growth disappoint.

For income-oriented investors, high-quality corporate bonds can typically look through periods of temporary credit spread widening. Tactical investors, however, might want to scrutinize their corporate exposure a bit more closely.

If you have any questions or comments, please feel free to let me know