Global central banks have offered something for everyone:

- The Bank of Japan continued to raise interest rates.

- The Banks of Canada and Europe both pressed forth with rate cuts.

- The Federal Reserve stood pat at this week.

The divergence in policy paths probably shouldn’t come as much of a surprise amid the global developments in recent months - nor did the Fed’s decision come as much of a surprise.

The Fed’s pause was expected by all analysts surveyed by Bloomberg, and the muted market reaction this week confirms just that.

While not much was learned from the Fed this week, questions about what the Fed does next will undoubtedly continue to hang over markets.

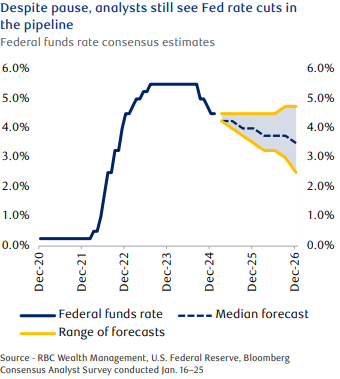

RBC Capital Markets has maintained its call that the Fed is likely done cutting rates at 4.50% and is on hold for at least all of 2025.

However, as the chart adjacen t indicates, a wide range of views amid elevated uncertainty still exist as consensus expectations as of Jan. 25—which should at least partly reflect the potential impact of policy changes from the new administration—still show further rate cuts could be forthcoming.

t indicates, a wide range of views amid elevated uncertainty still exist as consensus expectations as of Jan. 25—which should at least partly reflect the potential impact of policy changes from the new administration—still show further rate cuts could be forthcoming.

As it stands, analysts still see the Fed cutting rates at its next meeting in March, though current market pricing suggests the chances of such a move are remote at barely 20%.

As Fed Chair Jerome Powell was keen to point out during his press conference—policymakers are in no rush to cut rates at the moment.

In reality, the Fed’s rate cuts haven’t done much to actually lower interest rates.

The Fed lowered its policy rate by 1.00% over the September through December period, only to see the benchmark 10-year Treasury yield, (a much better indicator of borrowing rates for consumers), rise by over 1%.

Mortgage rates, for example, rose more than 0.50% over that stretch.

Put simply, while the Fed certainly has control over interest rates, it doesn’t have complete control and is still at the whim of market forces.

Better economic data, persistent inflation risks, and fewer rate cuts priced by markets have all worked to drive longer-term rates higher in recent months despite the Fed’s efforts.

Though the Fed skipped a 0.25% rate cut this week, there has been a reprieve on the rate front as the 10-year Treasury yield has now fallen by over 0.30% from the Jan. 14 high of nearly 4.80%.

Whether it’s just pullback amid what has been an ongoing trend higher remains to be seen, one wonders if the recent drop in longer-term yields may be reflecting the idea that tariff and trade threats pose a greater threat to the growth outlook than to the inflation backdrop ?

Powell was explicit this week that he would not comment on anything related to proposed policy plans and tariffs.

The tariff and trade threats of 2019 can provide some insight of how the Fed may weigh the risks, however.

As the chart above shows, during the previous episode of tariff threats in 2019, policymakers at the Fed grew increasingly concerned about growth risks, and less so about the upside risks to inflation.

Concerns peaked around June 2019 as steel tariffs were expanded to Canada, Mexico, and Europe, but began to fade by the end of the year as the U.S. suspended parts of later stages of tariff plans.

The ongoing discourse—and market pricing of higher inflation, higher rates, and fewer future Fed rate cuts—around the issue of tariffs and trade may be misplaced.

While it could take months for tariff plans to be put in place—if they are at all—the uncertainty alone could weigh on business investment decisions and new order activity in the meantime.

The economic slowdown seen in 2019, particularly in the manufacturing sector, partly contributed to the Fed’s decision to deliver a series of “insurance” rate cuts.

Much of the focus has seemingly been on the inflationary risks of tariffs—which are certainly material—but those upside risks may be more than offset by the downside risks to growth. For those reasons, the recent pullback in Treasury yields should be sustained.

The 10-year Treasury yield should hold a near-term 4.25%–4.75% range. While the Fed paused rate cuts this week, it’s likely not the end of rate cuts just yet.

As always, please let me know if you have any questions or comments.